#58 Causality between the yield curve and leading indicators.

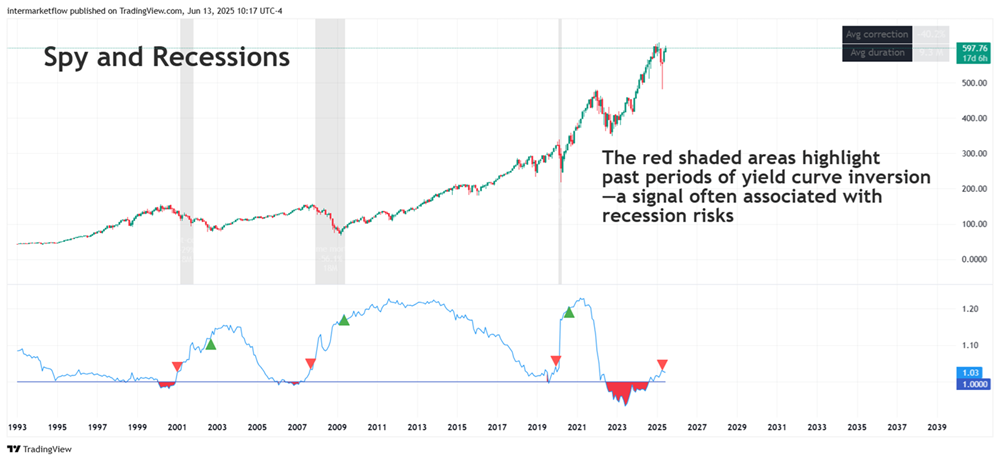

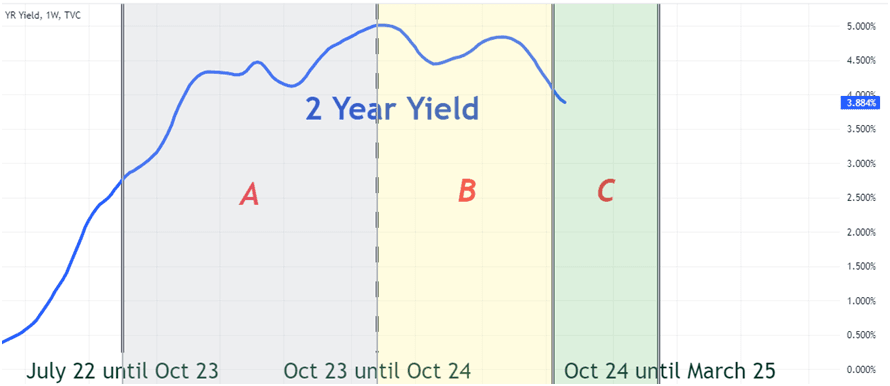

We covered two different interpretations of the yield curve: the inversion and the first Fed rate cut. We analyzed the last four recessions and measured the lead times to estimate the window until the next recession.

#57 A deep dive into the current state of the dollar

This article explores the U.S. dollar’s status as the world’s reserve currency—its role as a safe haven, as a reserve held by both private investors and central banks, and as the dominant currency in global trade.

#56 Global equities—time to open our minds. Trading has become a global game.

U.S. markets are facing high uncertainty. They’ve just gone through the deepest and longest yield curve inversion in history. With valuations stretched and prices at all-time highs, it’s time to open your mind and consider other options.

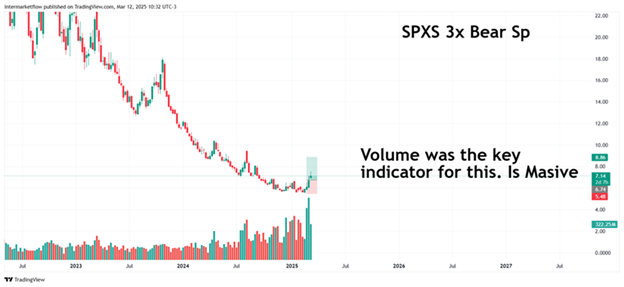

#49 A volume-based system to trade macro narratives

A deep dive into the different ways volume can be read We’re in a market where macro reports have taken a back seat— daily news is driving prices. It’s a time for weekly and daily trading, and in this context, it’s technical analysis that guides us. We already know we’re in a volatile price environment, […]

#41b) Technical Setup: Trading a Macro Narrative in Stage 3.

Here you’ll find:

The reaction to the earnings announcements of Google, Amazon, and NVIDIA.

The similarities and differences between them.

The charts that, from a technical perspective, indicate the sector is very close to a correction.

#40b)SETUPS: Trading in a Risk-off Environment.

Here you will find:

1. A brief description of the Pension Fund’s way of thinking.

2. Mainly a trade originated in the Intermarket Analysis.

3. The process of choosing a vehicle

4. Complete technical setup for NVIDIA shorting.

#39 Trading reversion to the mean.

Here you’ll find a complete technical setup: volume, trend, momentum, and mean reversion. Entry and exit zones are clearly defined. This aligns with or is a consequence of the macroeconomic analysis presented in the previous article.

# 37 Complete Technical Setup: Looking for weaknesses.

Here you’ll find a complete technical setup: volume, trend, momentum, and mean reversion. Entry and exit zones are clearly defined. This aligns with or is a consequence of the macroeconomic analysis presented in the previous article.

#36 Effects on the real economy and generation of incorrect incentives by the lender of last resort.

In this article, we explore how the revelation of the Fed’s reaction function—essentially, “we saved everyone”—not only presents a moral hazard but also creates incentives for greater risk-taking, particularly by small banks. An industry that is, in fact, overcrowded.

#35 Setup: Setting up a strategy and macro narratives.

This is a complete technical setup to trade the DAX on the short side. It includes liquidity, long-, mid-, and short-term trends, momentum, mean reversion, and alternative vehicles to execute this macro view.