#39 Trading reversion to the mean.

The process of assembling a setup derived from the above analysis, from the perspective of technical analysis. From theory and research to real trading.

We are in the third state of the macro narrative. We expect and trade volatility or reversion to the mean.

How do you manage exposures in the small bank industry in this context?

– Knowing that we are in stage 3 of the macro narrative (we saw it here).

– Knowing the reaction function of the Federal Reserve.

– With a new administration taking over.

Despite our macro and intermarket view, the concept to trade these days is mean reversion. It is the characteristic that we believe will prevail for some time to come.

For a number of reasons.

1.Stage 3 of the macro narrative(here). We know that a new macro narrative is entering the market and the main characteristic of this stage is volatility. We do not expect directionality to prevail in the short term.

2.The current political situation, with the advent of a new administration, will contribute to this volatility. For the simple reason that it creates uncertainty.

In this context, the search for tops and bottoms is most likely to succeed. What we expect is, indecision, noise and risk-off, all components of volatility.

The choice of vehicle in this context is the search for the greatest overextension.

V.I.X

The expected volatility for the Sp500 will trigger our trade when it reaches what we consider to be the value zone.

We want to short the Spy. Yep.

We just need to wait for the VIX to enter the value zone.

We add two more charts, which come from the inter market and reinforce our hypothesis.

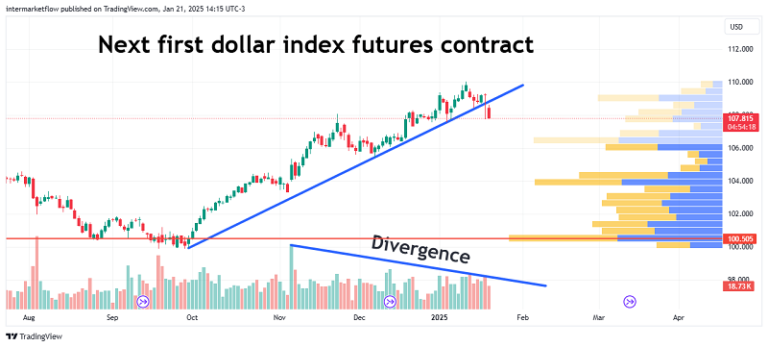

Dollar futures.

Gold Spot.

‘Equity capital can be assumed to be stable. Its destinations or exits are limited.

The inter-market is a powerful tool for reading the markets. Precisely because it analyzes the state of one of these stops and sees where the capital is flowing to and from where it is flowing out. This, of course, is decisive in the choice of vehicle.

As always and for the 1000th time, these are not trading recommendations. It is our procedure for putting together a technical setup, which we make public for marketing purposes.

See you soon. As always, you can find us at X

We will be in touch.

Martin