Envisioning capital flows

We integrate Intermarket, Technical and Macroeconomic Analysis to generate trades in the financial markets

Love your work!!

I have been in the markets for 30+ years, and rarely have I seen a strategist who thinks as clearly as you do.

Have a great week ahead, and I’ll be looking forward to your next email.

Best,

Amazing

You’ve written something that feels not just like knowledge, but like a quiet form of wisdom.

Knowledge and reliability.

This site offers a lot of captivating and helpful information.

On this platform, you can find a wide range of subjects that cover many important themes.

All materials is written with care to detail.

The content is frequently renewed to keep it current.

Users can gain useful insights every time they come here.

It’s a great place for those who enjoy informative reading.

A lot of visitors say this website to be trustworthy.

If you’re looking for well-written articles, you’ll certainly find it here.

Fantastic!

Thanks for another fantastic post. The place else may anyone get that

kind of information in such an ideal manner of writing?

I’ve a presentation subsequent week, and I’m on the look for such info.

Good tip!

That is a good tip especially to those new to the blogosphere.

Simple but very accurate information… Thank you for sharing this one.

A must read post!

Intermarket, technical and macroeconomic analysis

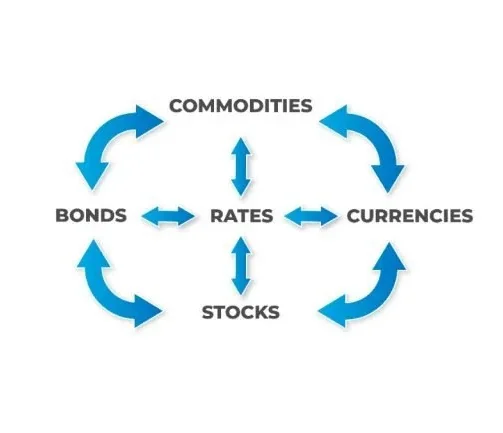

Capital is constantly in motion. In this dynamic scenario, nothing operates in isolation; everything is interconnected. We may not always comprehend what the market is doing, but it is crucial to understand what it should be doing, or even better, anticipate what is to come. Intermarket awareness guides us in the direction toward the next destination.

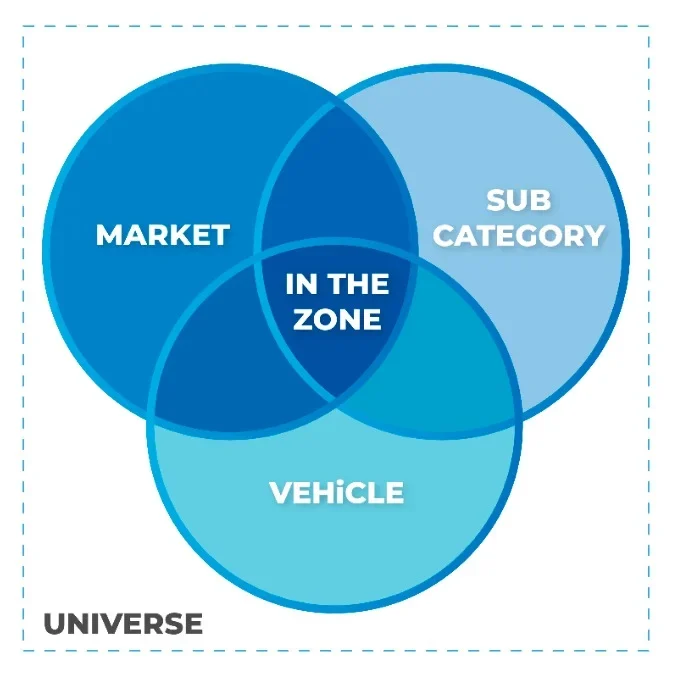

Operating in the Zone

These are set-ups and trades. They will be posted on the Blog or sent via email. We will publish the analyses conducted, the conclusions drawn, and the process followed to reach them.

The best traders in the world don’t exceed 50-55% of correct trades. The difference is made in the profit/loss ratio. This relationship is defined by your work discipline and your personal psychology.

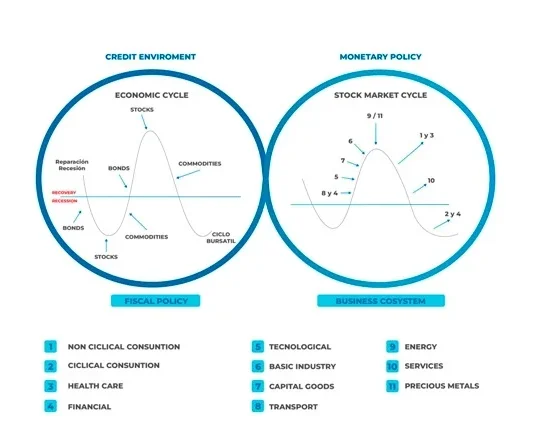

Macro

The key is to have an accurate diagnosis of the macro cycle. This helps anticipate the stage that is about to begin and select assets consistent with it.

Understanding the current predominant macro narrative and identifying the one forming, based on market information, provides context and helps understand market reactions.

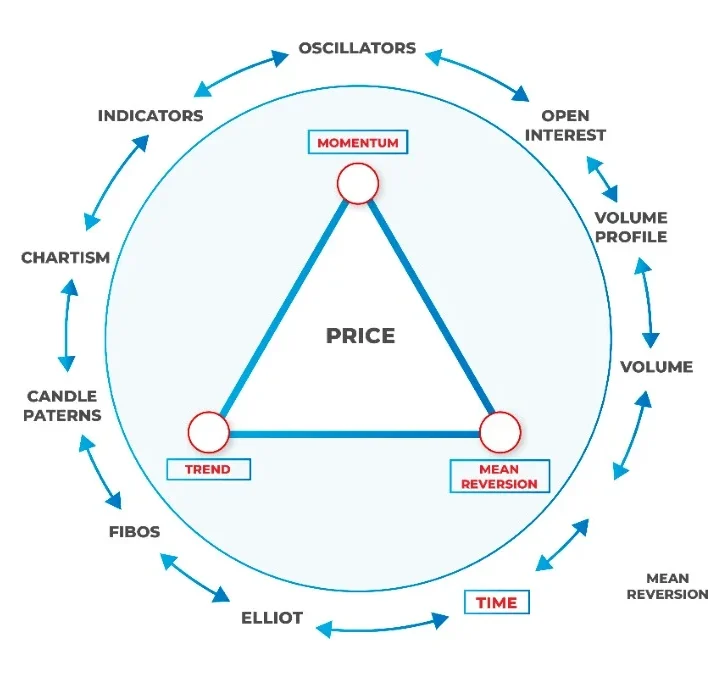

Technical analysis

The price of an asset is influenced by three forces simultaneously: Trend, Momentum, and Mean Reversion. Alongside these forces, time progresses, influencing all three aspects and occasionally establishing temporal cycles. Our analysis covers all aspects, both individually and collectively.

Price

Price+Time

Time+Volume+Volatility