#39 b ) SETUPS: Trading in a Risk-off Environment.

Here you will find:

1. A brief description of the Pension Fund’s way of thinking.

2. Mainly a trade originated in the Intermarket Analysis.

3. The process of choosing a vehicle

4. Complete technical setup for NVIDIA shorting.

Operating in a risk-off ecosystem.

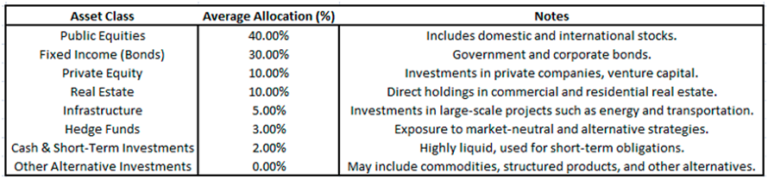

Of course, operating in this ecosystem depends on the type of market participant. A pension fund does not attack this situation. It hedges against it.

Also, it is important to remember, these types of funds are limited in the types of assets they can hold. The limitations are not as deep as those of the big Banks post-GFC banks, but they are limited.

This portfolio has one main characteristic. Liquidity. Where are these birds today?

Cash, treasury notes and the illiquid parts of their portfolio. These guys do not do active traiding. They are like an ocean liner that needs miles and miles to turn around. The less trouble the better, but they need to ensure a certain minimum profitability.

Today, with rates at 4.5%, this capital is in the money markets collateralized by Treasury bonds. The next destination for these guys is the 3 to 10-year curve. These are markets that, as we have seen, are not so unbalanced and offer a good opportunity to add some duration. We will come back to this.point in the episodes to come.

Setup #2: Shorting NVIDIA Corp.

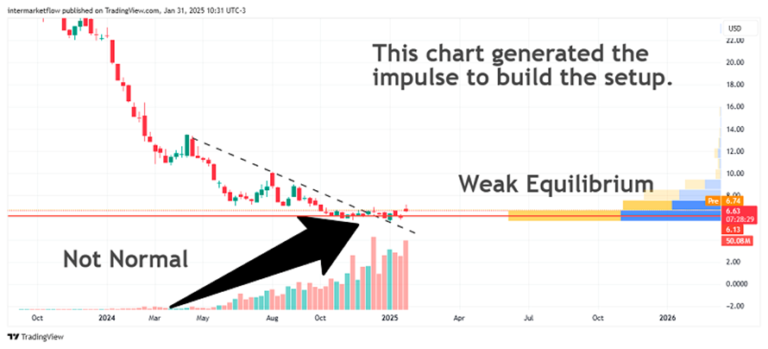

Going back to this chart, this is the market structure that we consider the weakest of the entire inter market.

We’ve argued why. Now we just want to see how. This index has the value it has exclusively because of the big technology companies.

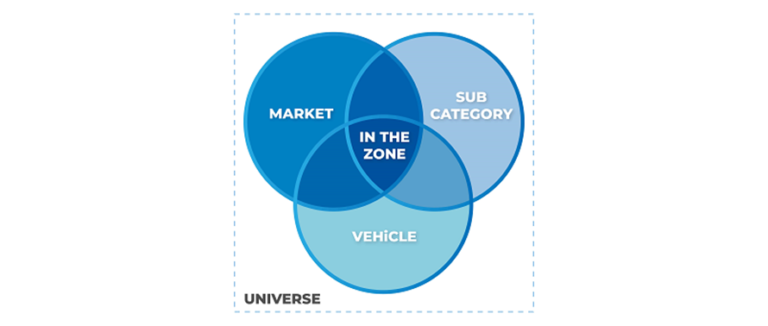

The vehicle selection process.

Do we want to short the index? Do we want to short the technology companies?

None of these options is a macro trade. We are not trading our hypothesis. We are trading inter-market. It is important to understand this, because triggers, stops and control vehicles vary.

Compliance.

Over the course of this week Compliance received 8 set ups from the desk. Of course at the portfolio level it is a delicate time. Of the 8 setups, 6 are what we call “guerilla setups” and two focused on the opportunity to take duration. All of them bounced. In other words, they are on standby, which in practice means that they went to sleep in the archive drawer.

It hurts to admit it, but he is right. If we are going to attack, we cannot be the first. We have to wait for the market to give the signal.

Of the 6 guerrilla setups we analyzed this week, this is the one we looked at with the most love.

SETUP: Attacking Big TEC

Why? Monthly time frame

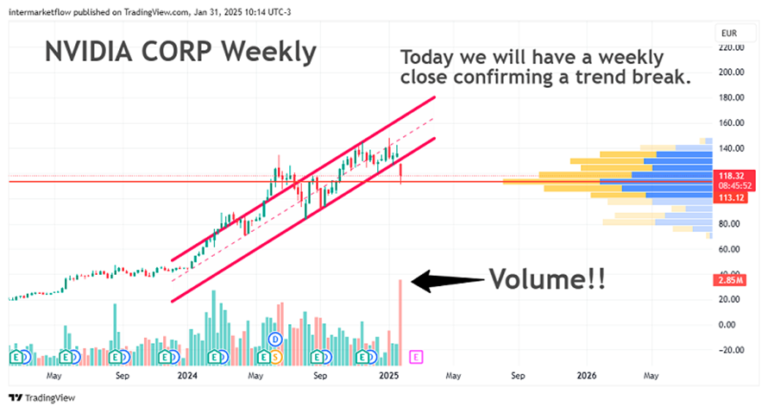

Of course today NVIDIA is big tech. Technically the monthly close today confirms the trend breakout. Look at the volume for the month, but more importantly the market structure.

Weekly Time Frame.

This setup is assembled while waiting for technical confirmations. We share it, with the warnings of the case.

Short NVDA x 1 ETF Vehicle: NVDD

Weekly.

Daily

Trigger

Compliance’s argument was that, expecting higher volatility and with the natural stop being so short, he was assuming stop hunting on the part of the market. He is right but this is a spectacular technical setup.

Well, that was it. Remember, this is what we do. These are not recommendations. We make it public for marketing purposes.

Before I say goodbye, I wanted to share with you some news that we are very excited about.

Starting on March 25, Inter Market Flow will be launching a paid version of the service. The reasons are many.

– We need a bigger research team.

– Information technology, in particular access to real time prices.

– Data presentation tools.

To solve all this new structure and become profitable.

The only way to improve quality and guarantee sustainability over time.

It is perfectly clear to us that among our subscribers there are fellow travelers since page 1. We will take care of you in some way. Everything is in process and a lot of details are still to be defined.

As we have more news, we will comment on it here and on x.

I trust you will understand.

Thank you in advance and we will be in touch.

Martin