Based on the macro fundamentals analysis we conducted articules #5 and #6 in our blog we have we reached several conclusions that will determine the direction of our trades.

Stock Market Trends and Defensive Strategies

Despite the grandiose news about new highs in the stock market, beneath the surface, a defensive stance is on the move. The market is reflecting this situation in several variables, most notably the trading volume in the long end of the yield curve and the price of gold. Both assets serve as safe havens. This is happening at a time when there is an all-time historical record of available funds in money markets. This capital, parked at 5%, will eventually change destination. The current market information indicates that it is positioning itself defensively in risk-off mode.

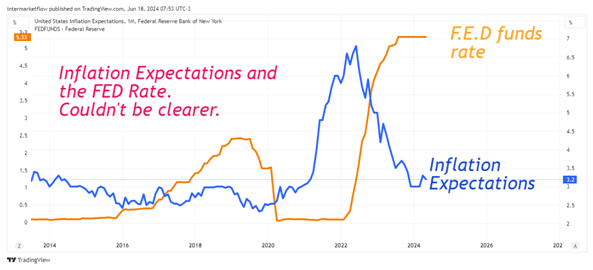

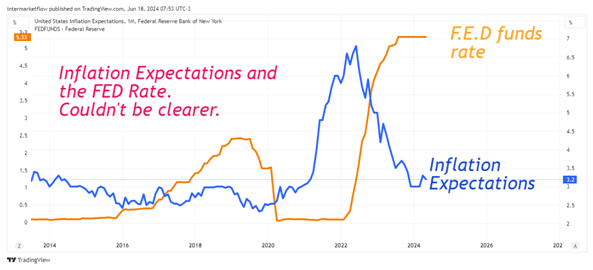

Probability of Interest Rate Cuts: Declining Inflation Expectations

Según la información actual proporcionada por la FED, las expectativas de inflación están cayendo en picado. Excelente indicador adelantado de la tasa de los fondos federales, como vemos aquí. El mercado asigna hoy una probabilidad del 56%(June 2024) de un recorte de la tasa en la reunión de septiembre.

Average Timing of Upcoming Recession

Tools

The average time from the start of rate cuts to the next recession is 9 months. The sample extremes range between 15 and 4 months. Rate cuts haven’t started yet, but it’s good to keep these parameters in mind.

- Yield Curve Inversion

To date, we have had an inverted yield curve for 24 months. It seems like a lot, but if we look at history, we haven’t reached the average yet, which is 27 months. The extremes of the last four recessions ranged between 26 and 33 months.

- Importance of the 30-Year vs. FED Funds Rate Spread

The spread between the 30-year rate and the F.E.D funds rate is a powerful indicator with a stellar track record. When the difference between them reaches its maximum negative point and begins to recompose, a recession is very near—100% effectiveness. As we saw here, this scenario doesn’t seem far off.

Historical Data and Projections

Spread 30-Fed

It’s important to note that all these indicators come from the core of the market. They don’t involve data collection or data entry, and they aren’t subject to sampling errors or human error. They are market prices—visible, transparent, and available to all agents. These prices, like all prices, reflect all the information available to date and are adjusted as new information enters the market.

Correlation of the 10-2 Year Spread with F.E.D Rate

Correlation Spread-10/2

This is the most closely watched spread in the market. It directly influences the expectations of all agents. Notably, its correlation with the F.E.D funds rate is at historic highs. This is simply unsustainable. The breakdown of this correlation will signal the entry of a new macro narrative into the market that does not align with the F.E.D’s.

In real life, the one that happens in homes and streets.

Real Income vs. Real Disposable Income Trends are two trains heading in opposite directions. The severity of the situation lies not only in their direction but also in the fact that the growth rates of both variables are opposite. Real income is growing at a constant rate, while real disposable income is decreasing at a higher but negative rate. It’s as if one of the trains is accelerating toward the collision.

New Job Positions and Consumption Impact

The most real-time reports indicate that while job creation is positive, its current growth rate is slower than in the recent past. This also imposes a deadline on consumption growth rate.

Private Sector Credit Slowdown

The F.E.D is doing its job. Monetary tightening is slowing down the creation of private credit and so, slowing down future consumption and production. This will result in reduced consumption, production, and future investment.

Credit Card and Consumer Loan Debt

If we analyze aggregate consumption, it continues to grow at constant rates. However, this is being achieved by pushing consumers toward the worst type of credit: credit cards and consumer loans. These are the most expensive types of credit.

Stagnation of Non-Durable Goods Consumption

Despite all this, the consumption of non-durable goods has stopped growing. This reflects an initial stage of the real consumer because government spending does not influence this demand.

Government Spending and Stable Consumption

Government spending, in an election year, is undoubtedly supporting aggregate consumption. This is reflected in the current data.

Government Spending as a Risk Factor

This factor is quite easy to anticipate. After all, politics has this bias, especially in an election year. It can certainly sustain and delay the economic cycle. It’s not free and has both internal and external, present and future, economic implications for the United States.

A.I

This factor is difficult to measure. Like the internet in 2000-2001, the future implications of this technology are simply incalculable. As happened back then, everything reacted so quickly that the explosion was inevitable. Predicting these things seems easy in hindsight, but ex ante, right now, it’s not so straightforward

Given all this, as we've seen here and here, we believe we are in this part of the cycle.

Not all sectors perform equally. The elasticities of each particular good interact. Some sectors are more exposed to a slowdown, and some collapse in a recession. Others, however, serve as safe havens. This is considering equity, but as we saw here, there are several more issues to analyze.

M.M and M (Money Markets Mountains)

Additionally, we are starting from an initial stage with capital highly concentrated in money markets. This asset is primarily dependent on interest rates. We know that it won’t be long before rates drop. We know the economy is slowing down, and therefore we know where to look. Whether in the equity spectrum, bonds, currencies, or commodities, the butterfly effect will be felt, as we have seen here.

Portfolio Management

- Rotation of assets in their main categories: stocks, bonds, currencies, and commodities. Including geography en economic perfil of each case

- Within the American economy, it determines the rotation towards more suitable and profitable sectors in an economic slowdown.

- Outside the United States, rotation to other types of economies and currencys.

- The defensive situation seen in the market also determines rotations towards other assets and sectors more suitable in recession scenarios.

We are targeting the sectors of:

Real Estate

- Discretionary Consumption

- Financial

- Technology

In that order, with varying levels of aggressiveness. Not everything is the same. Volatility varies, and more importantly, the current market craze for some tech stocks makes them practically unviable to attack for now. We will wait attentively, but we are keen on shorting them.

Defensive Moves

Some of these moves have already been made, generally involving the long end of the curve. In addition, we are looking at the typical defensive sectors:

- Health

- Staples

- Utilities

This is a summary of the fundamentals we’ve discussed. I hope you enjoyed it. Subscriptions and sharing are very welcome.

It won’t cost you anything, and it makes our day. Stay in touch.

Martin

Intermarketflow.com

- Intermarketflow

Intermarket Analysis LLC

703 Waterford Way - Suite 805 - Miami, Fl 33126

Unlock Full Access

We create professional content for traders, based on intermarket, macro, technical, quant, and flow analysis.

Welcome aboard — enjoy the ride.

If you have already registered before, please enter your email again to recover your session.

7 Responses