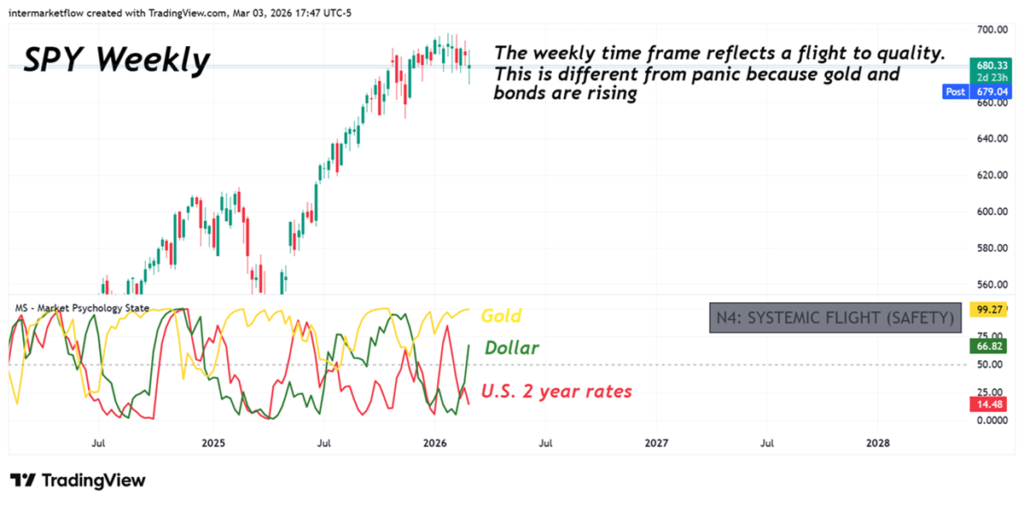

#99 Intermarket Flows: The Thin Line Between Flight to Quality and Panic

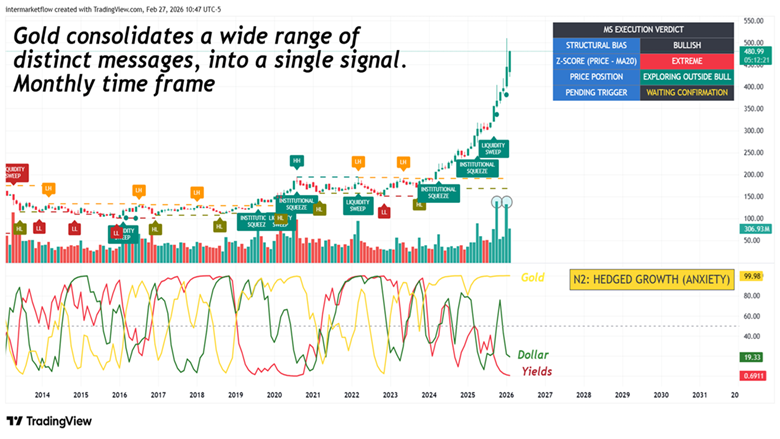

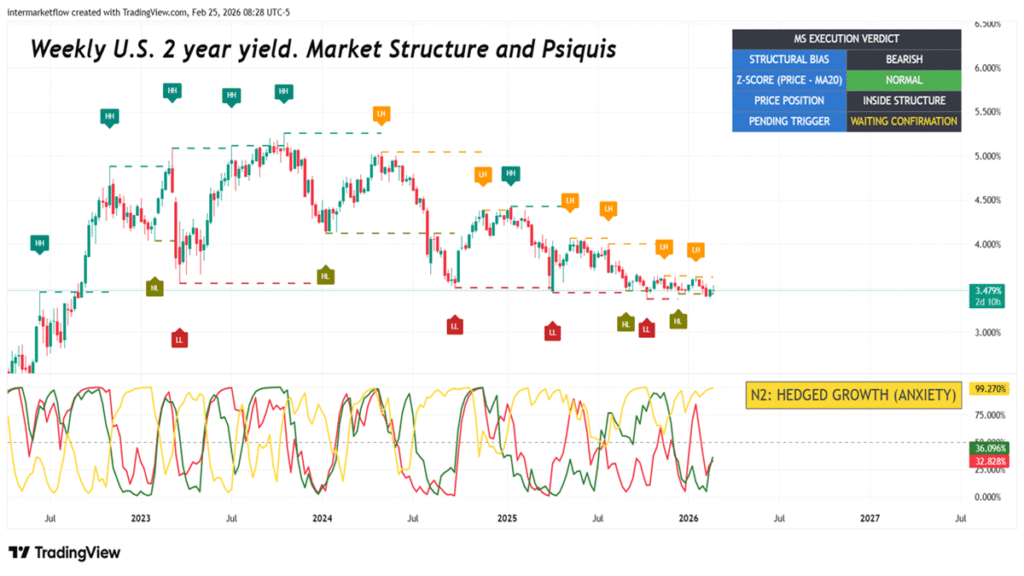

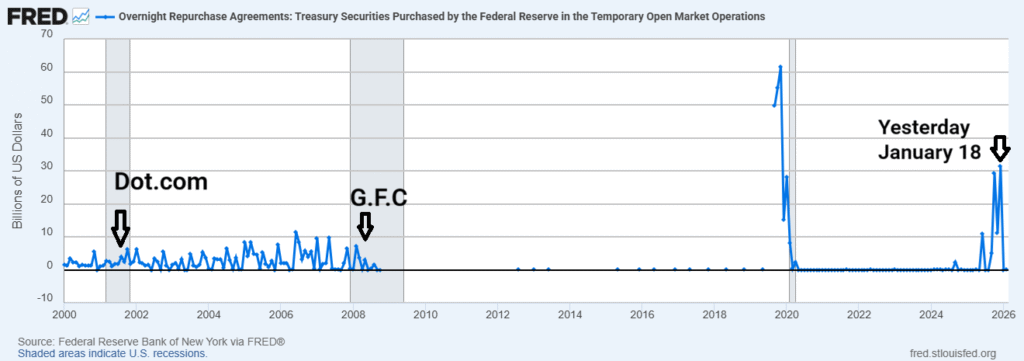

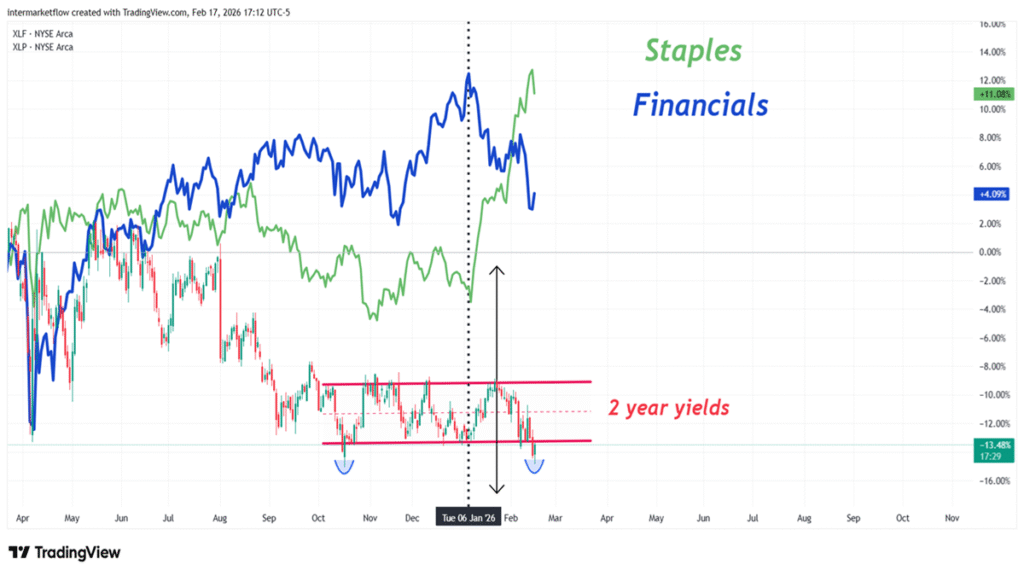

Intermarket Flow data reveals a violent shift from an orderly flight to quality into a pure liquidity squeeze. Here is the institutional playbook for a Hard Landing and the exact credit trigger to watch.