#5 Macro View: Brief Introduction to Get Everyone on the Same Page

Generating a macro view through fundamental analysis. This analysis will guide our trades.

Let’s start with the basics. An economy can be summarized by the following identity:

GDP=C+I+S+G+(X−M)

- C = Aggregate Consumption

- I = Investment

- S=Savings

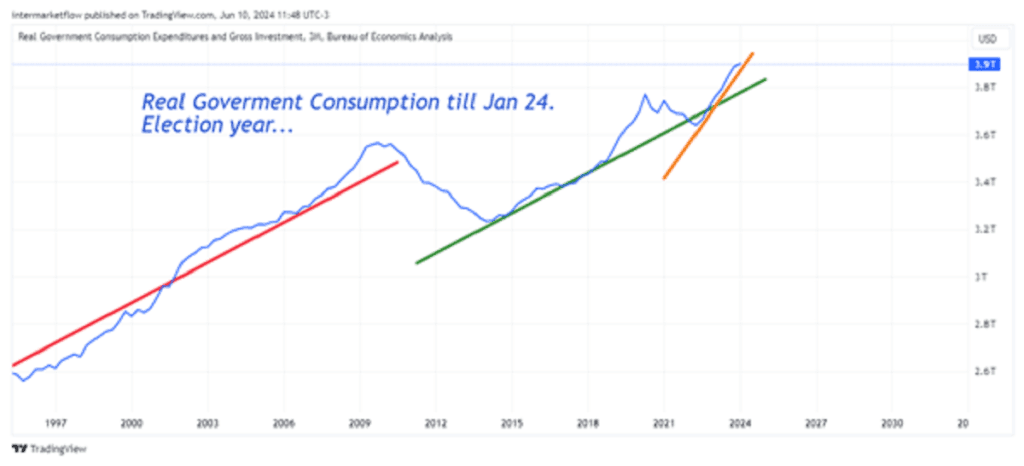

- G = Government Spending

- X – M = Current Account

The current account is like a storage account that measures: Everything that comes into a country minus everything that goes out, in all types of goods and services that exist, both real and financial.

Every three months, GDP data is reported to see how the economy and each of its variables are doing. Think of it like a company presenting annual reports, except the government presents these data quarterly.

Economic Ecosystem

This economy is exposed to different types of policies: monetary (determined by the FED), fiscal (determined by the government), and is also framed within a legal system. All of this creates an economic ecosystem that leans more to the left or right depending on the government in power.

The F.E.D.

The FED has a dual mandate:

- Keep inflation below 2%

- Maximize employment

To achieve these two objectives, it has several monetary policy tools, but the foundational one is the interest rate.

Who Decides?

The interest rate is determined by 12 economists in a room known as the F.O.M.C. This team of economists comes from various organizations, each one is selected differently, generally from academia, and they know a lot about economics, at least “on paper.” They are basically the geeks we met in university.

Interest Rate

A developed economy consists of:

- Consumption: 70%-75%

- Investment: 15%-20%

- Government Spending (depends on the country, but tends to grow everywhere because it generates votes)

- X – M: Less than 5% in the USA

If you want to know where a developed economy is heading, you have to analyze the consumer. They define 75% of the situation.

The Consumer

We want to see levels, but what interests us most is the rate of change, what mathematicians know as the first derivative.

- Viewed from the perspective of their income

- Viewed from the perspective of their consumption

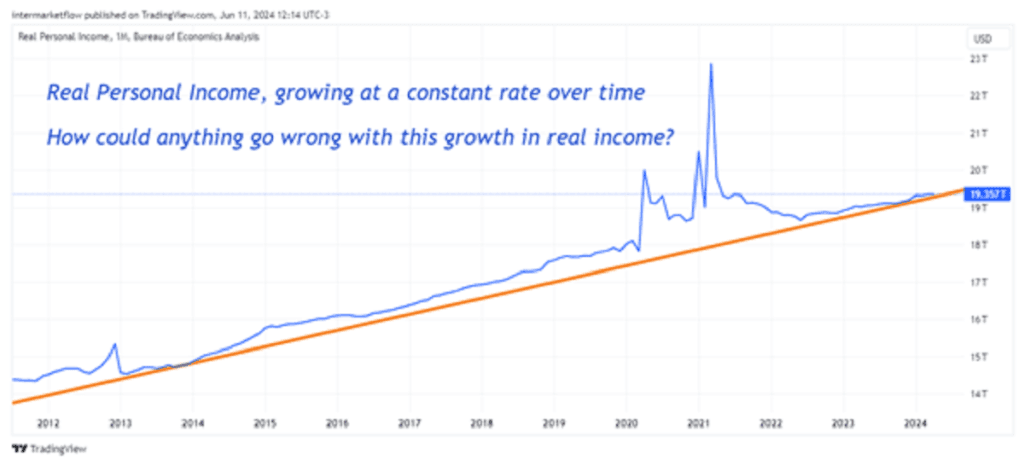

Real Income

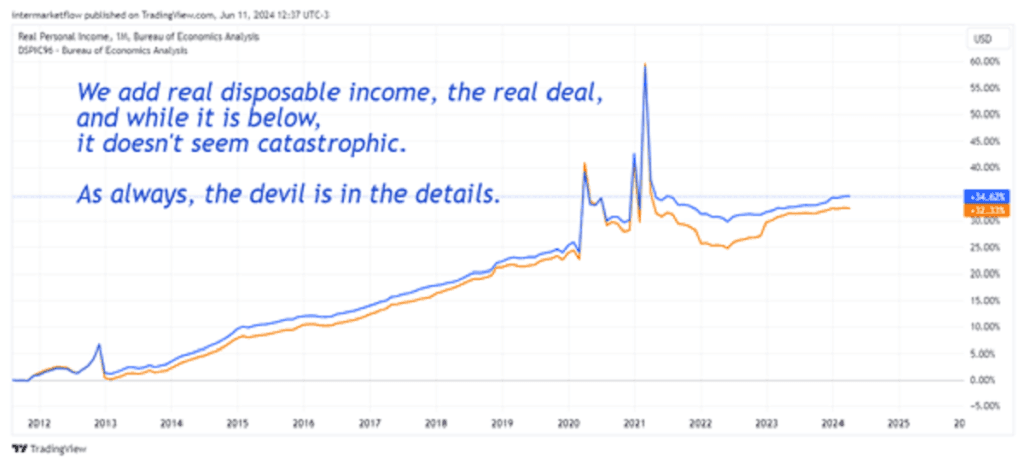

Overlapping Real Disposable Income, the real deal

Both series come with a three-month lag. Keep this in mind, as these are not actionable data but rather data for portfolio management.

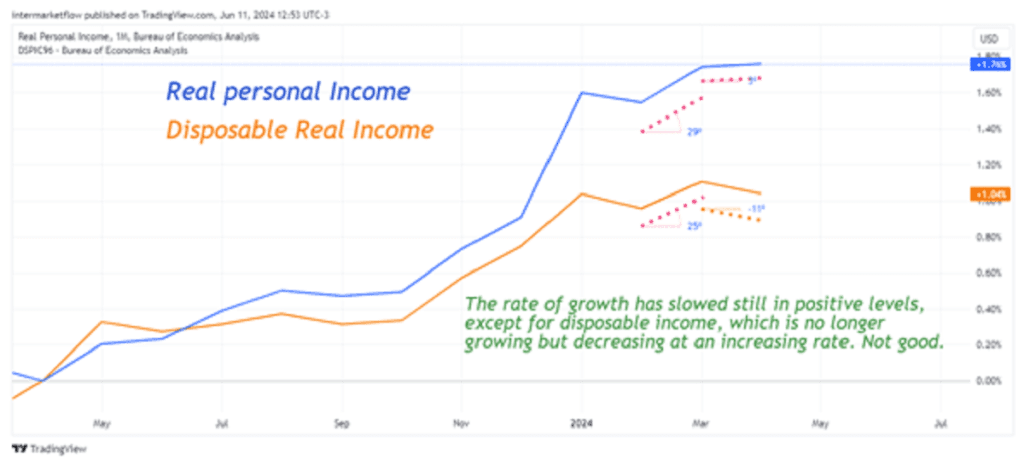

Zoom In

These are three-month-old data, but conclusions can still be drawn. In terms of levels and rates of change, this is our main focus, here lies the predictive engine of macro analysis.

Monthly data In French

Well, there’s not much to say. The graph speaks for itself. The rate of change for both has slowed, but in the case of disposable income, it is now negative. And this was happening three months ago.

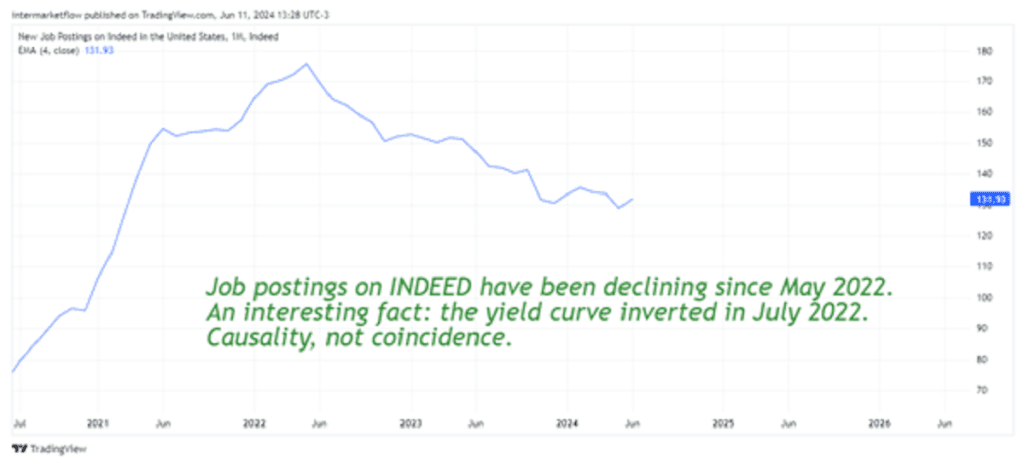

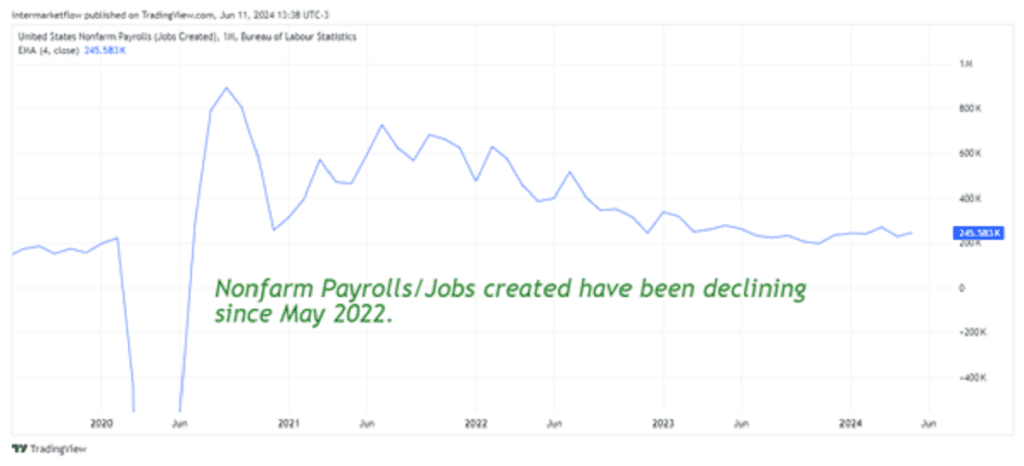

Employment

Monthly Data

Non-Farm Job Creation

Job creation is falling, but the rate of change in this decline is decreasing

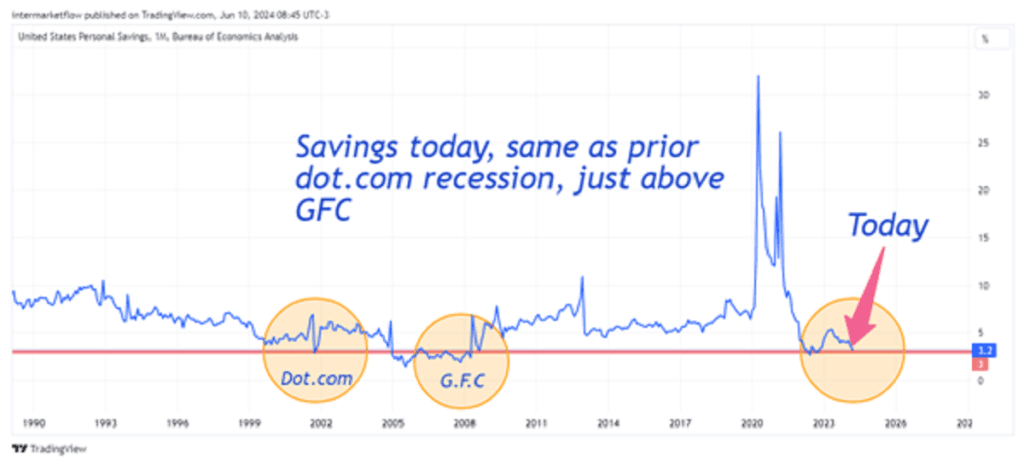

Savings?

The ultimate consumer

I love these guys. They spend at increasing rates, and their accounts don’t balance. You see this in the fiscal deficit of the U.S. and generally in all countries. Understand this, giving away primoney that isn’t there generates votes.

Back to the Individual Consumer

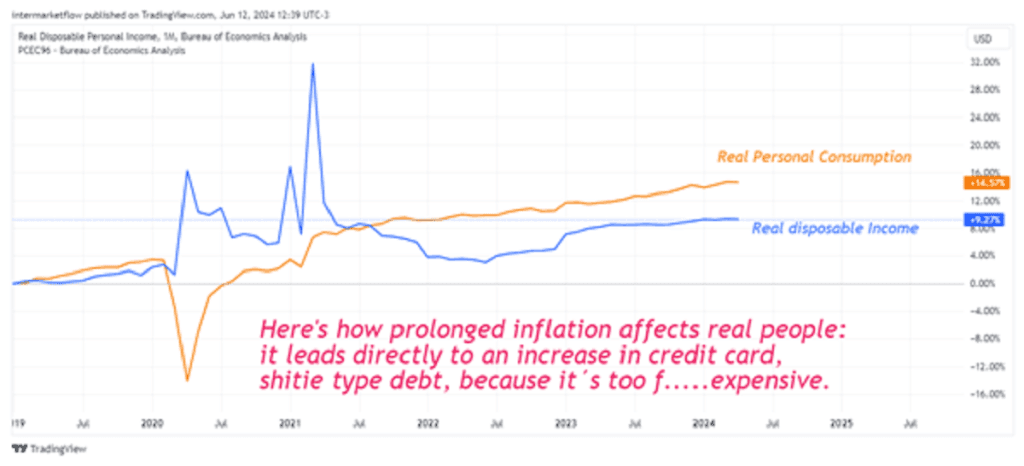

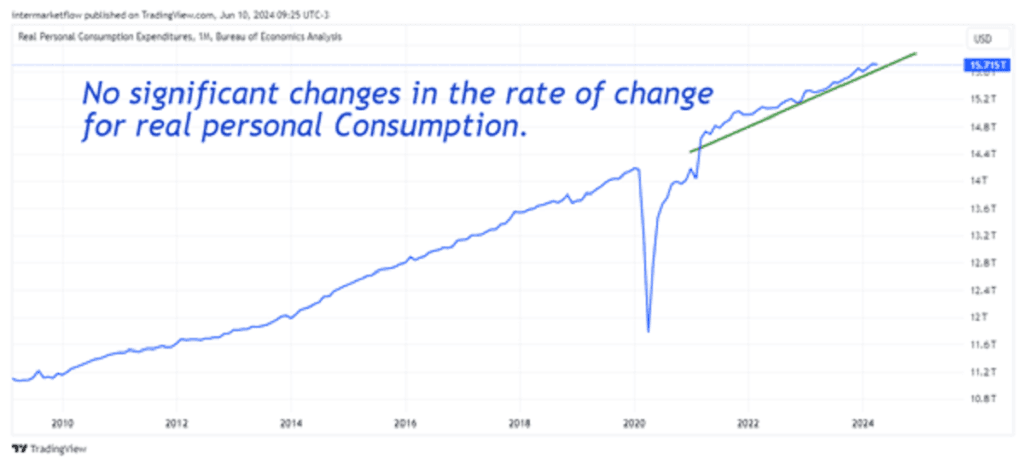

Real Consumption

At very high levels, growing at constant rates since 2010, and not even flinching despite the change in disposable income. Something is wrong. These people, the common folk, have a disadvantage compared to the government—they don’t have the money-printing machine. To sustain this, they have to go into debt.

Deeper

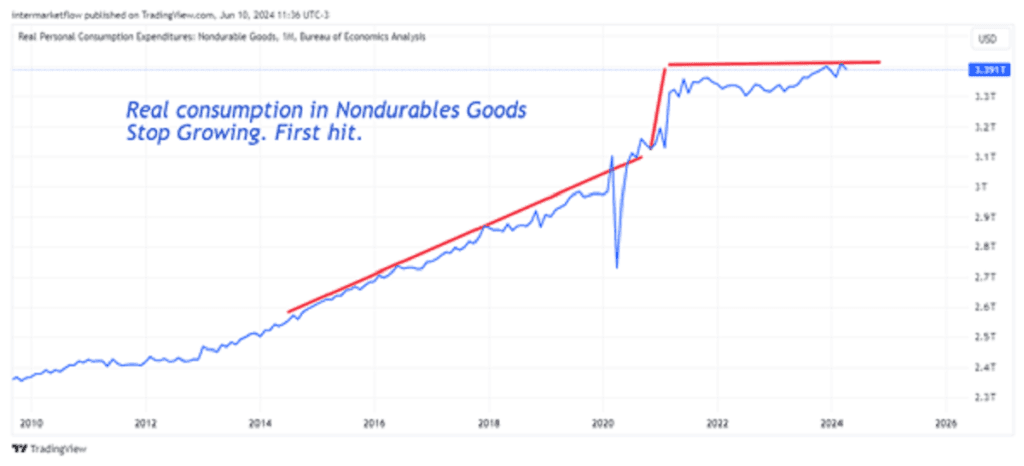

Real NonDurables Consupmtion

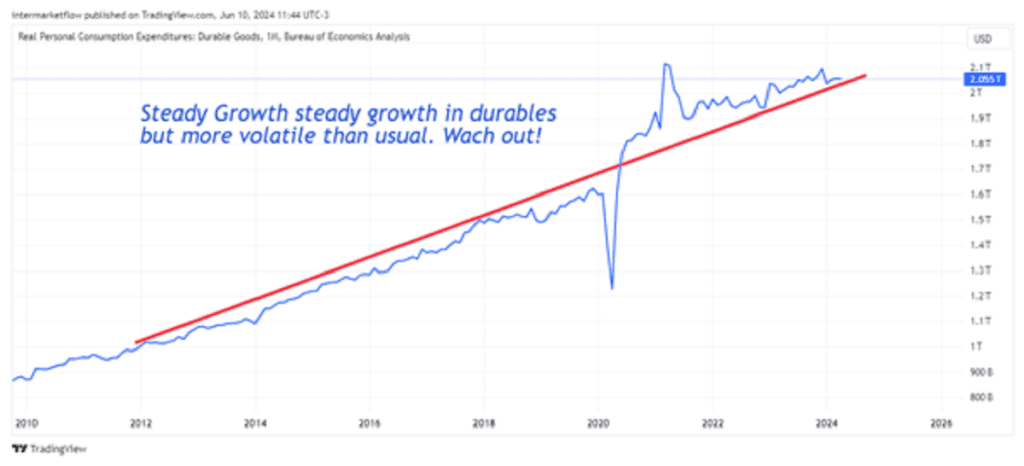

Real Durable Consumption

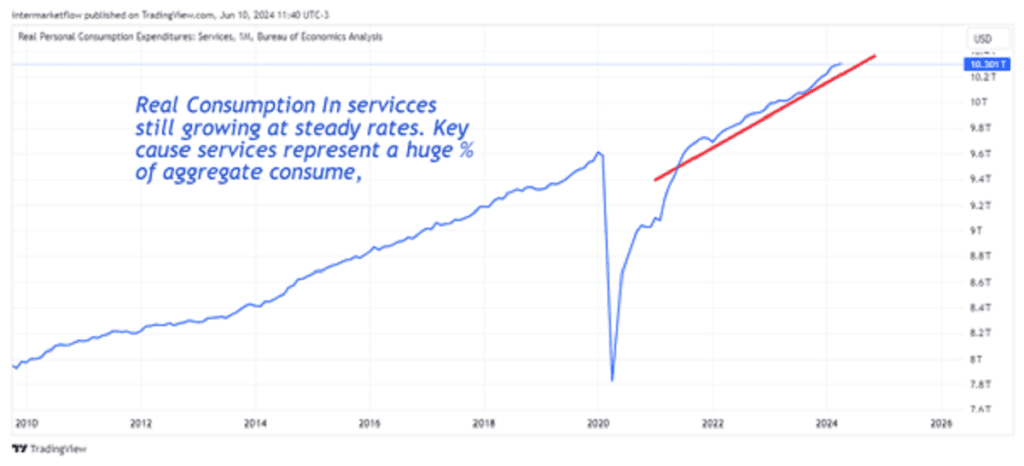

Real Services Consumption

Credits and Delinquency Rates

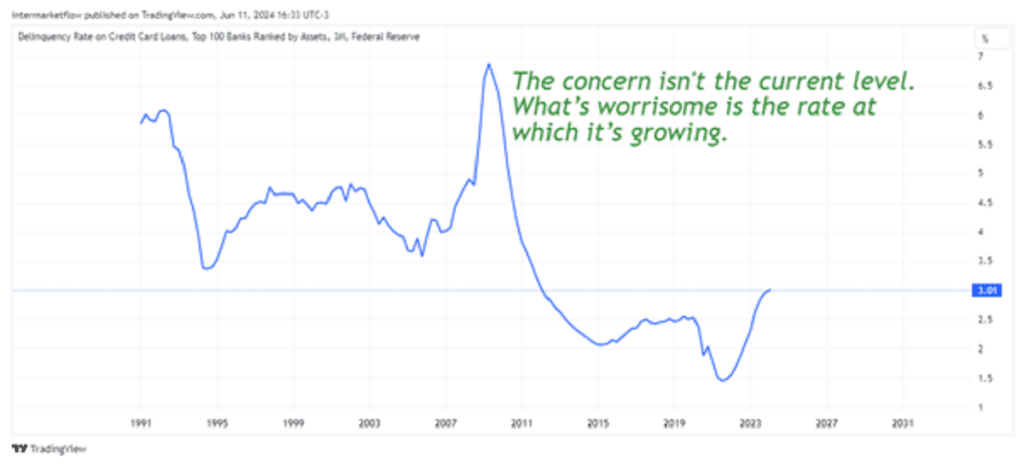

Credit Cards

Credit Card Delinquency

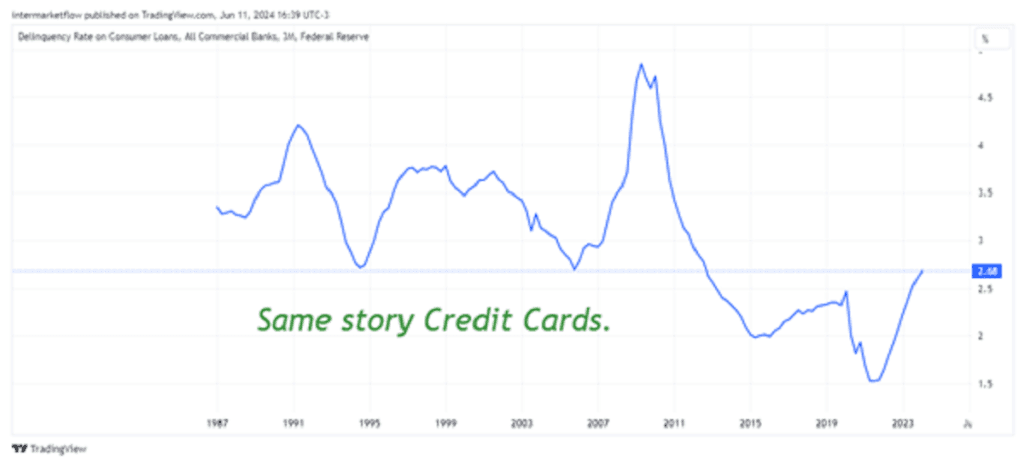

Consumer Loan Delinquency

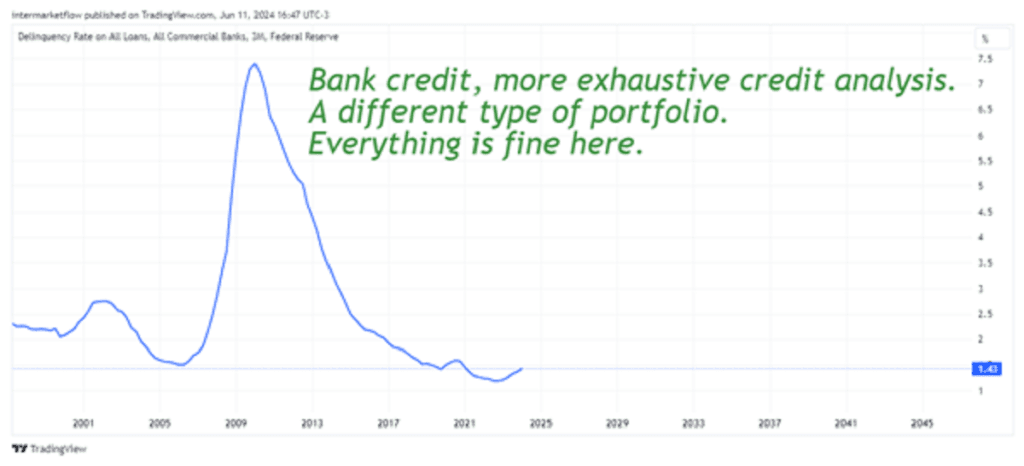

Private Credit

Private Credit Delinquency

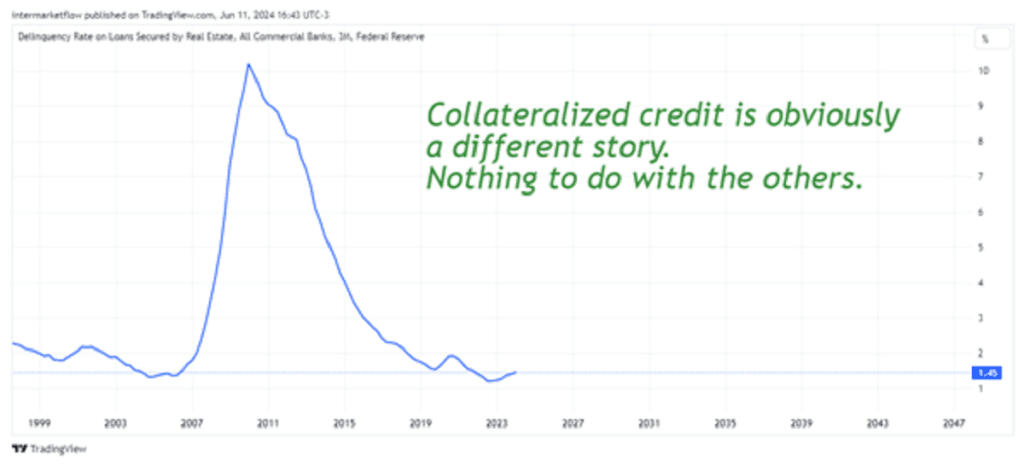

Collateralized Credit

All types of credit are growing at different rates with different delinquency rates. We see that the FED’s work is reducing the generation of private, banking, and collateralized credits without changing delinquency rates.

The Problem

Consumers are compensating for the drop in disposable income with the worst type of credit—consumer credit. These are the worst because they refinance at unpayable rates. In the case of credit cards, these rates can reach up to 28%.

Conclusions

- The FED is doing its job and it’s working.

- However, it’s also creating distressed or desperate consumers who finance themselves with the worst type of credit.

- Consumption on nondurable goods is not growing, which is a significant hit to the real economy. Nondurable goods account for 20%-25% of the 75% aggregate consumption in the GDP equation.

- Consumption on durable goods is showing unusual volatility, a clear sign of weakness.

- Delinquency rates are generally low, except for credit card debt, which has a delinquency rate of 3.16% of the total portfolio and growing at a scaring rate of change

- For historical context, we had delinquiency rates of 4.86% and 4.3% at the onset of the dot.com and GFC recessions.

- While we are not at the inflection point in terms of levels, the growth rate of delinquency in this type of credit is alarming.

- The rate of change in disposable income is negative, and consumption continues at the usual rates.

It’s like two trains coming from afar, on opposite tracks but on the same on

Rolling Stones on the road ahead

- The Crisis of Regional Banks: It’s only going to get worse because the value of the collateral for their loans is plummeting. This includes commercial real estate such as offices and retail spaces.

- Unpredictable Crisis Unfolding: The speed at which a crisis unfolds is unpredictable.

- Productivity Increases from AI: The productivity gains generated by AI.

Generating a macro view

Based on all the above, I believe the macroeconomic cycle is still growing, at decreasing rates. We are at the part of the wave where we need to start paddling to catch it. As in the ocean, the ones who catch the wave are always the same. They have more strength, arm power, and collective experience.

This defines asset categories and subcategories within those categories to trade. This info is sent via email to subscribers.

On Doomsday Economists

- The deficit is unsustainable, and everything will explode.

- The dollar will stop being the world’s reserve currency.

- The debt is unpayable.

- Interest on the debt is becoming increasingly problematic.

All these points, which I share to some extent, are data for portfolio management decisions. They are not trading data. These are interconnected issues where you need to look at levels and especially rates of change.

Could they happen tomorrow? YES. Could they happen in 20 years? YES.

What is clear is that with these rates of change, some of them will happen. Again, this is not info for individual trades. It’s info for portfolio management.

I hope you enjoyed it. We loved writing it. Thanks for reading this far. If you liked it and enjoyed it, you can follow us on @intermarketflow or at www.intermarketflow.com. Even better, you can subscribe. It won’t cost you anything, and it makes our day.

Stay in touch. Take care. The markets are full of sharks!

Martin

Intermarketflow.com

- Intermarketflow

Intermarket Analysis LLC

703 Waterford Way - Suite 805 - Miami, Fl 33126

Unlock Full Access

We create professional content for traders, based on intermarket, macro, technical, quant, and flow analysis.

Welcome aboard — enjoy the ride.

If you have already registered before, please enter your email again to recover your session.

Hello colleagues, its impressive piece of writing concerning tutoringand fully defined,

keep it up all the time.

ss

Very shortly this web page will be famous amid all blogging viewers, due to it’s good

posts

ss

Hi friends, how is the whole thing, and what you desire to

say about this paragraph, in my view its truly awesome designed for me.

https://www.telestar.fr/culture/casinos-quels-effets-sur-la-production-cinematographique-851729

Hello this is somewhat of off topic but I was wanting to know if blogs use WYSIWYG editors or if

you have to manually code with HTML. I’m starting a blog soon but have

no coding knowledge so I wanted to get advice from someone with experience.

Any help would be enormously appreciated!

http://www.sports.fr/bien-etre/comment-lutter-contre-le-stress-822909.html

If you want to improve your know-how only keep visiting this website and be

updated with the most recent news posted here.

https://www.thisdaylive.com/index.php/2023/03/31/how-do-you-know-if-a-casino-is-safe/

Everything is very open with a precise clarification of the challenges.

It was truly informative. Your site is very helpful. Many thanks for sharing!

Website https://www.playpilot.com/fr/blog/les-nouveaux-jeux-de-casino-inspires-par-la-cultur/

That is a good tip especially to those new to the blogosphere.

Simple but very accurate information… Thank you for sharing this one.

A must read post!

https://efdeportes.com/efdeportes/index.php/EFDeportes/article/view/7078/1873

It’s a pity you don’t have a donate button! I’d certainly donate to this superb blog!

I suppose for now i’ll settle for bookmarking and adding your RSS feed to my Google

account. I look forward to brand new updates and will talk about this site with my Facebook group.

Chat soon!

https://www.directvelo.com/actualite/110710/publi-lequation-de-la-victoire-les-secrets-de-la-reussite-inspires-du-cyclisme-et-plus-encore

Hi, Neat post. There is a problem together with your website in web explorer, might check this?

IE nonetheless is the market chief and a large component of other

folks will miss your great writing because of this problem.

close

Thanks for another fantastic post. The place else may anyone get that

kind of information in such an ideal manner of writing?

I’ve a presentation subsequent week, and I’m on the look for such info.

https://cidadeverde.com/noticias/391059/guia-definitivo-para-escolher-o-cassino-online-perfeito