#27 Two Year Real Rate Trends and Analysis

We broke down the 2-year real rates to understand their evolution. We used the nominal rates, inflation expectations, and the 2-year term premium. The conclusions are clear.

#24 Exploring the world of Currencies

In this article, we are attempting to infer the state of currencies and the global economy by conducting a sectoral analysis of supply and demand across commodity sectors.

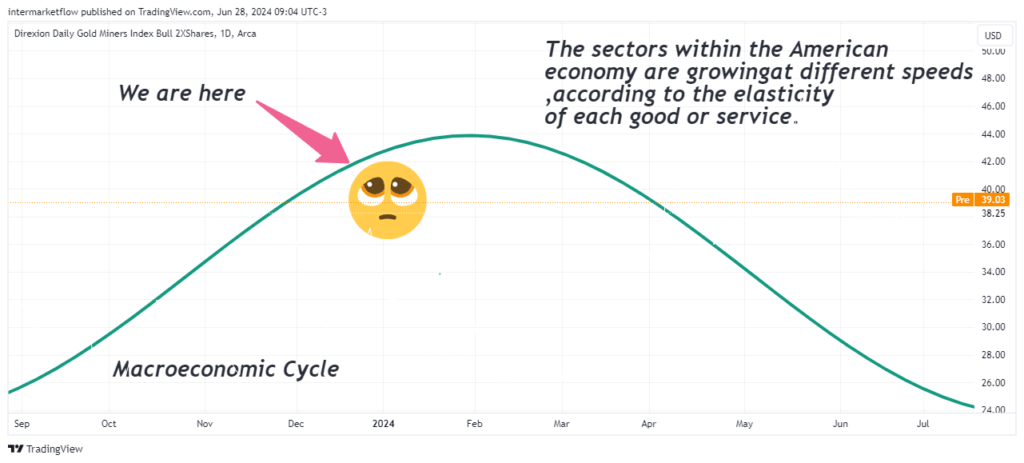

#6 Current Stage of the U.S. Economic Cycle

Macro Arguments for a near recession in the american economy aprox jun-jul 2025

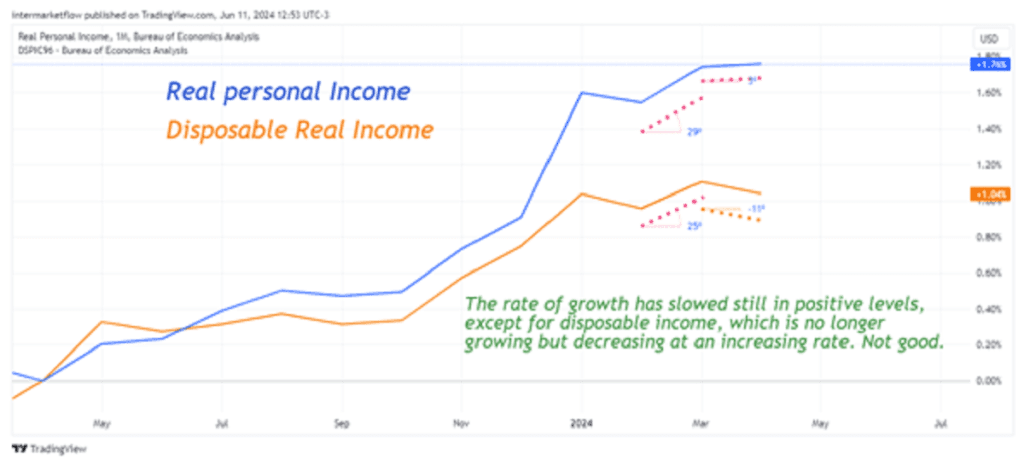

#5 Macro View and the American Consumer

Intermarket Analysis Throught Macro and Technical Methods #5 Macro View: Brief Introduction to Get Everyone on the Same Page Generating a macro view through fundamental analysis. This analysis will guide our trades. Let’s start with the basics. An economy can be summarized by the following identity: GDP=C+I+S+G+(X−M) C = Aggregate Consumption I = Investment S=Savings […]

#2 Rates and Market trends-Intermarket Analysis

Understand how interest rates, especially American rates and the yield curve they form, determine the trends of all types of assets: stocks, bonds, currencies, and commodities.