#6 QT, Liquidity and capital flows around the world

We analyze QT from different time perspectives. We dive into the concept of liquidity as applied to different sectors. What it can solve and what it cannot. A complete intermarket capital flow tracking, sub-categorized to refine the analysis. We look at the weekly positions of risk takers.

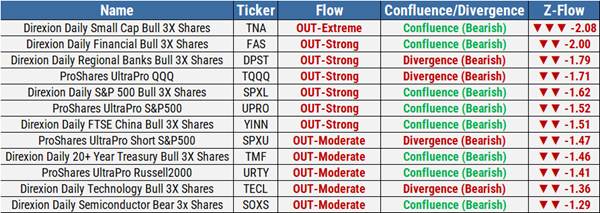

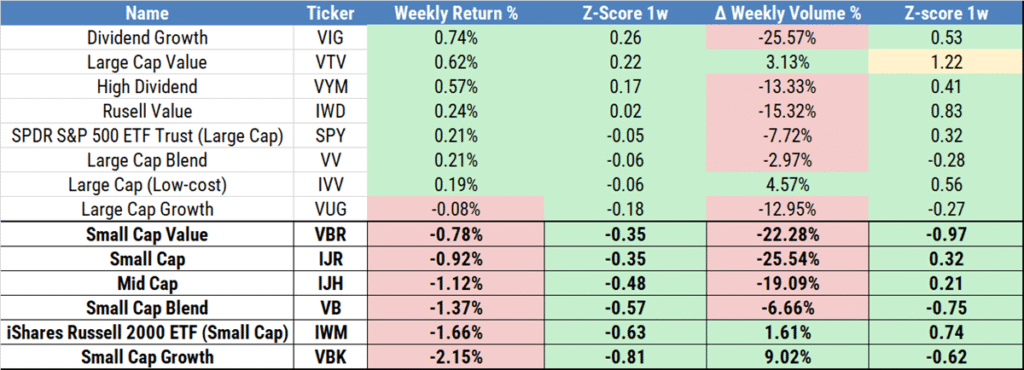

#79 Equity Assets: A global paralysis

Equity assets Across the world, they’ve gone into hibernation. There isn’t a single asset class that has received inflows as a sign of confidence ahead of the upcoming rate cut. Volume — the only real confirmation — signals paralysis. And in that context, returns are irrelevant. Equity Assets: To kick off this piece, the first […]

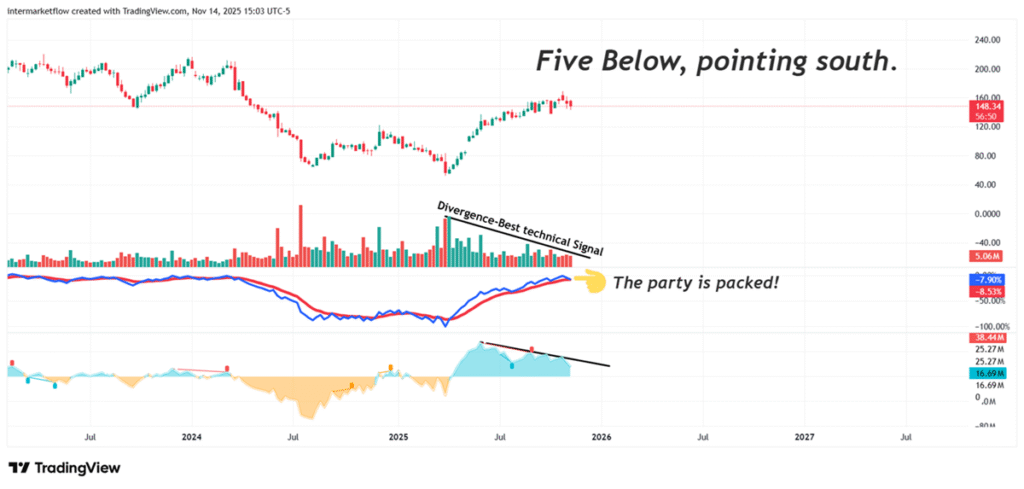

#5 Mid-Week Technical Analysis: Stagflation Captured in Two Charts

We describe how a stagflationary process hits different sectors at different moments. With two charts, we show an economy in stagflation. We also break down the SP500 and the six largest fast-food chains from a purely technical perspective.

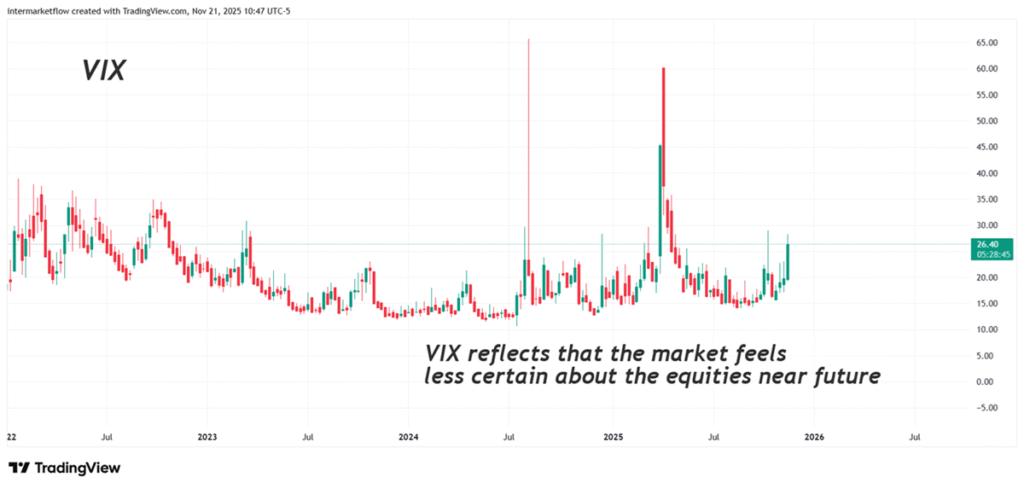

#78 Cross-Asset Signals Hint at a Valuation Regime Shift

Last week we saw that there’s one variable that can truly destabilize markets: uncertainty. Here You can’t touch it or see it—but you can feel it. And even though it’s intangible, the market expresses it in many ways, across different assets. Uncertainty can encompass everything—when the whole system trembles—or focus on a single category. It […]

#4 Technical Analysis: Sector Profile, the Methodology for Trading an Emerging Correction

The technical methodology for trading pullbacks. Selecting the right sector, beta profile, and company size in line with a macro hypothesis.

#77 The Macro Split: Why Recession and Stagflation Trade Nothing Alike

Recession and Stagflation require distinct trading methods. The recession methodology is clear; however, Stagflation is far more confusing. Here are our options for trading both stages.

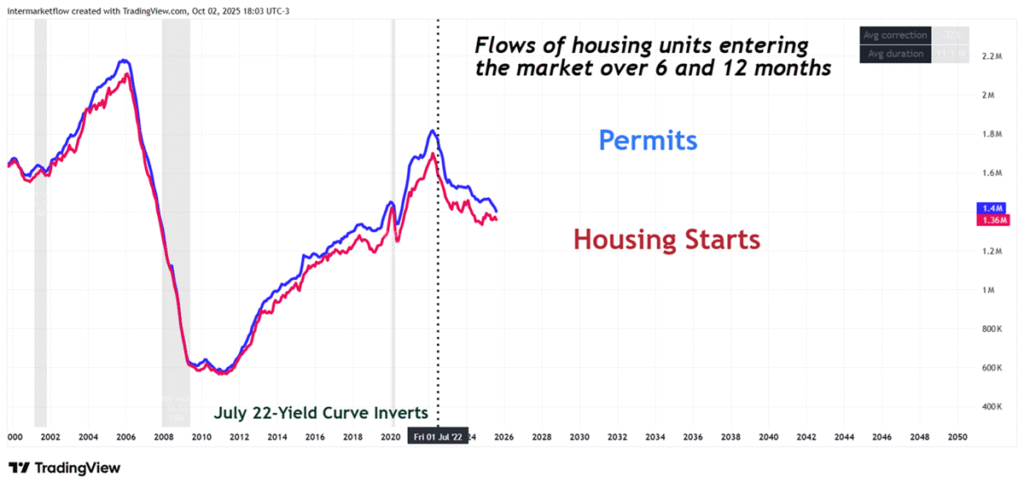

#3 Technical Analysis: Homebuilding vs Real Estate: the Divergence No One’s Talking About

Here you’ll find: How Homebuilder and Real Estate sectors diverged since the yield curve inversion, relative to the S&P 500 Equal Weight The evolution of U.S. housing starts over the same period Market data showing the imbalance between supply, demand, and existing inventory Sector statistics highlighting the companies with the sharpest capital outflows Technical snapshots […]

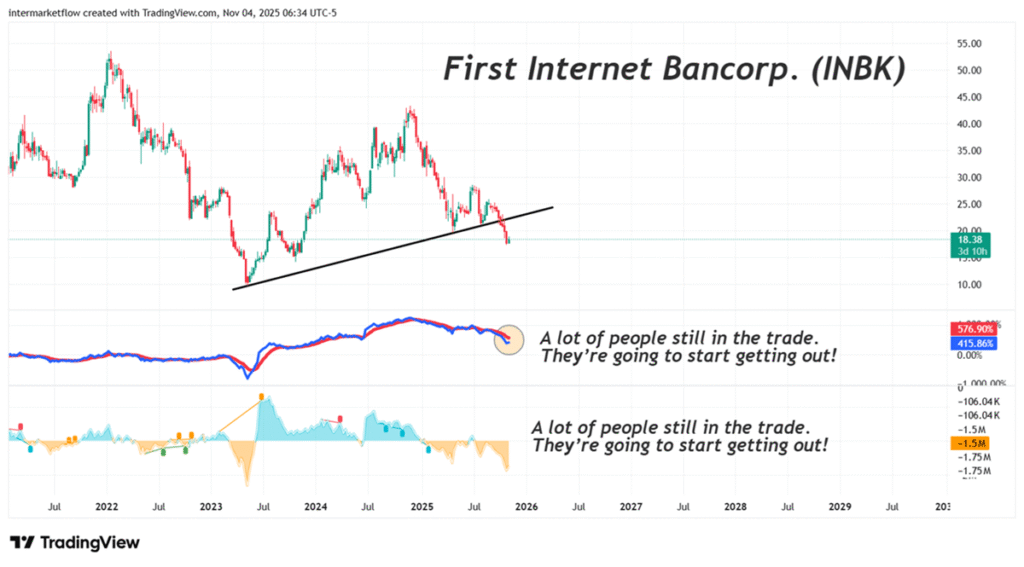

#2 T.A: XLF, the financial sector, midweek pure technical and complete set up for INBK

A purely technical analysis of the financial sector as a whole, with a focus on INBK and NWBI in particular.

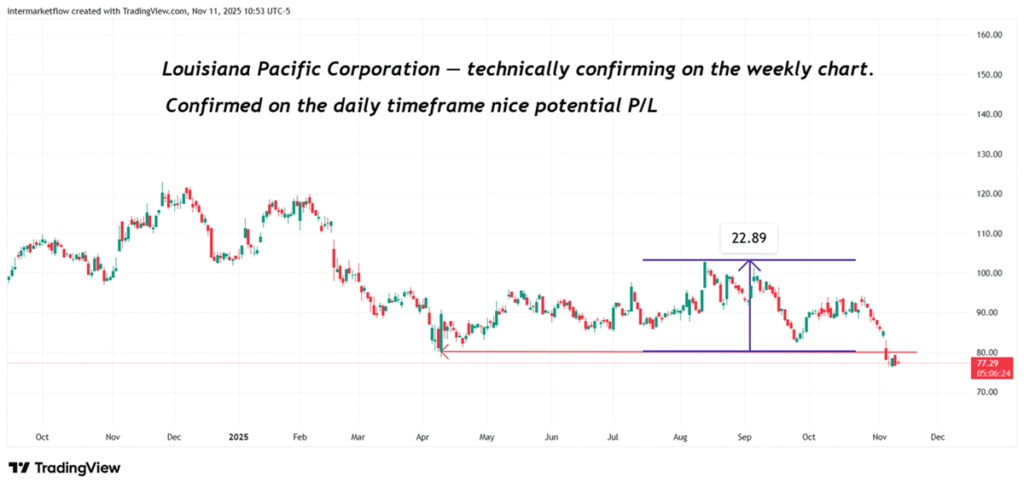

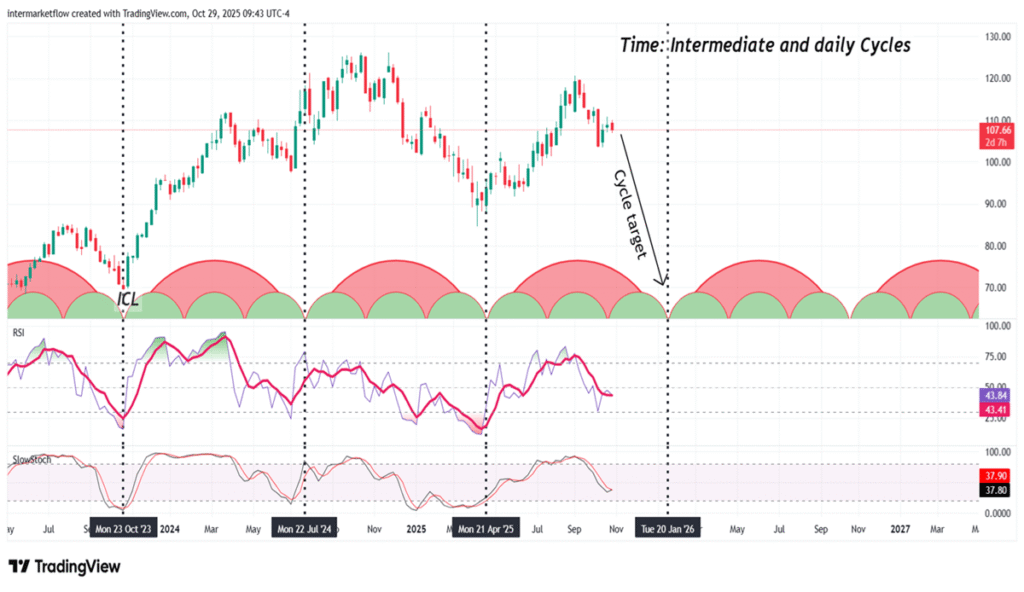

#74 Complete Technical Set Up for the Home Builders Sector-Nov 26

A complete technical analysis covering all branches of technical study: trend, time, volume, mean reversion, and charting.

#70 The Residential Market

We seek to understand the relationship between the new and the existing home market—the different flows and inventories that shape both. We analyze how imbalances in one market affect the other.