#58 Causality between the yield curve and leading indicators.

We covered two different interpretations of the yield curve: the inversion and the first Fed rate cut. We analyzed the last four recessions and measured the lead times to estimate the window until the next recession.

#57 A deep dive into the current state of the dollar

This article explores the U.S. dollar’s status as the world’s reserve currency—its role as a safe haven, as a reserve held by both private investors and central banks, and as the dominant currency in global trade.

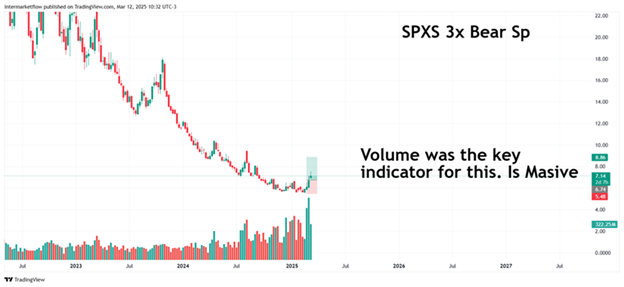

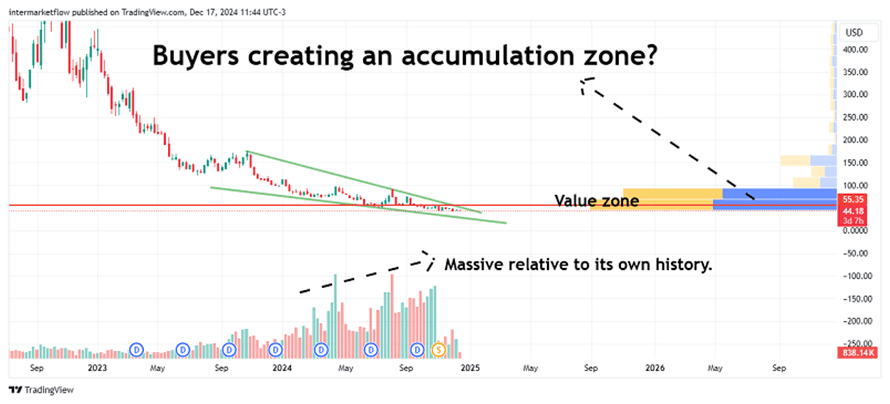

#49 A volume-based system to trade macro narratives

A deep dive into the different ways volume can be read We’re in a market where macro reports have taken a back seat— daily news is driving prices. It’s a time for weekly and daily trading, and in this context, it’s technical analysis that guides us. We already know we’re in a volatile price environment, […]

#33 Technical Setup for shorting Tecs

This chart caught our attention due to the divergence we observed in volume. It aligns with our macro view, and we have chosen it as the vehicle for an aggressively defensive trade, targeting what we believe to be a point of weakness: the S&P 500.

#31 Trading sectors in a bubble environment

In this article, you’ll find:

The relationship between momentum and mean reversion.

The importance of tracking momentum at extreme or overextended price levels.

Relative ratios between sectors.

Where we see opportunities and where we don’t.

A general view for portfolio positioning today.

#28-C Point and Figure Basics: Charting Objectives Explained

In this article, you’ll find a detailed description of the Point and Figure charting method. Its primary function (trend identification across different time frames), the method for plotting it, its pros and cons, and an example to clarify its use. I hope you enjoy it and find it useful, as it’s a fundamental tool in technical analysi