#94 The SOFR Breaking Point: Navigating the Dollar’s Structural Squeeze

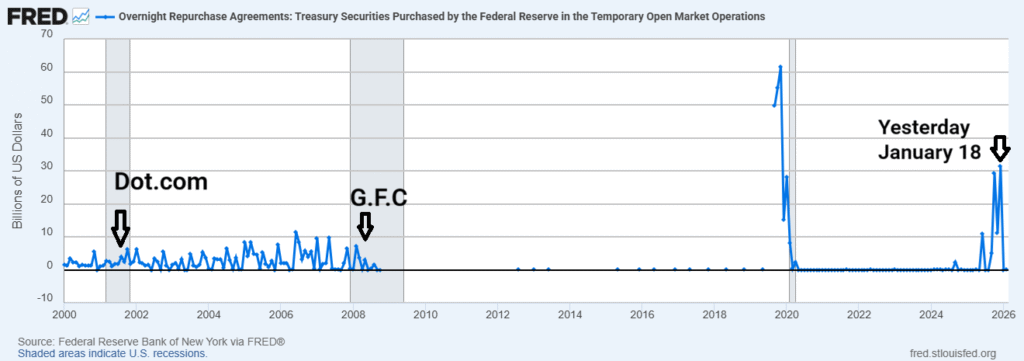

Liquidity has not vanished; it has been relocated. While the market is distracted by the “soft landing” narrative, the system’s plumbing is undergoing a structural stress that most are choosing to ignore. This report analyzes the critical transition from the Reverse Repo (RRP) facility into captive bank reserves and explains why the current growth model has officially entered a solvency trap.

#84 The discretionary delusion and the market’s stance. Three vehicles to track.

We break down retail sales and why Consumer Discretionary is completely detached from reality. We picked three vehicles to go deeper, while tracking how risk-takers positioned themselves this week.

#79 Equity Assets: A global paralysis

Equity assets Across the world, they’ve gone into hibernation. There isn’t a single asset class that has received inflows as a sign of confidence ahead of the upcoming rate cut. Volume — the only real confirmation — signals paralysis. And in that context, returns are irrelevant. Equity Assets: To kick off this piece, the first […]

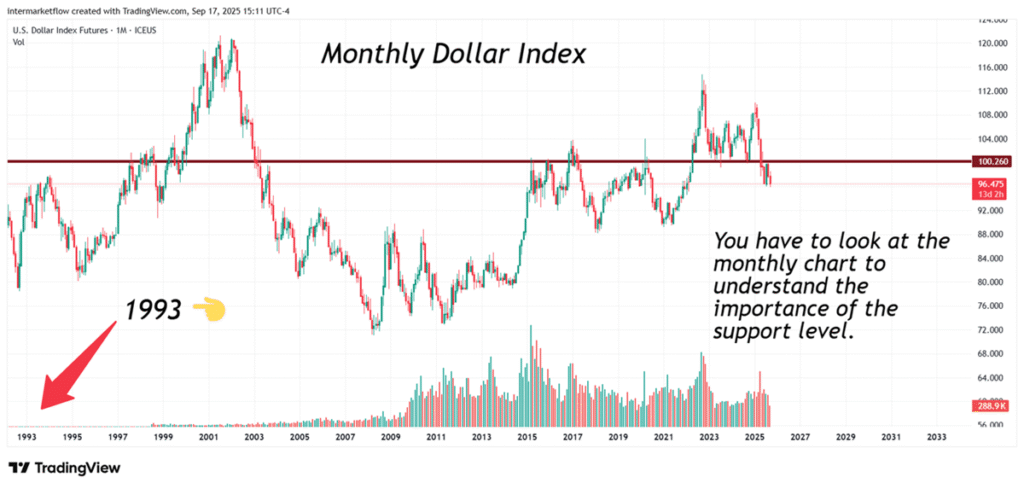

#5 Mid-Week Technical Analysis: Stagflation Captured in Two Charts

We describe how a stagflationary process hits different sectors at different moments. With two charts, we show an economy in stagflation. We also break down the SP500 and the six largest fast-food chains from a purely technical perspective.

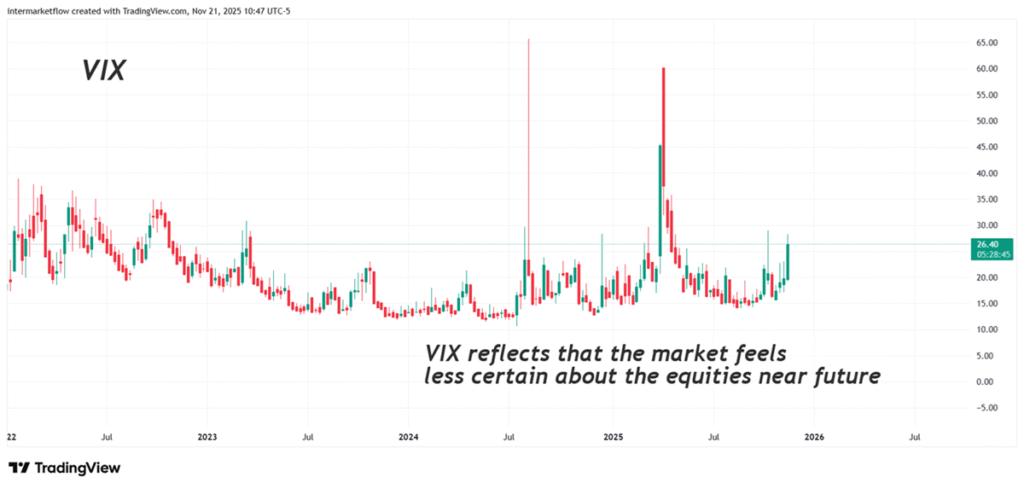

#78 Cross-Asset Signals Hint at a Valuation Regime Shift

Last week we saw that there’s one variable that can truly destabilize markets: uncertainty. Here You can’t touch it or see it—but you can feel it. And even though it’s intangible, the market expresses it in many ways, across different assets. Uncertainty can encompass everything—when the whole system trembles—or focus on a single category. It […]

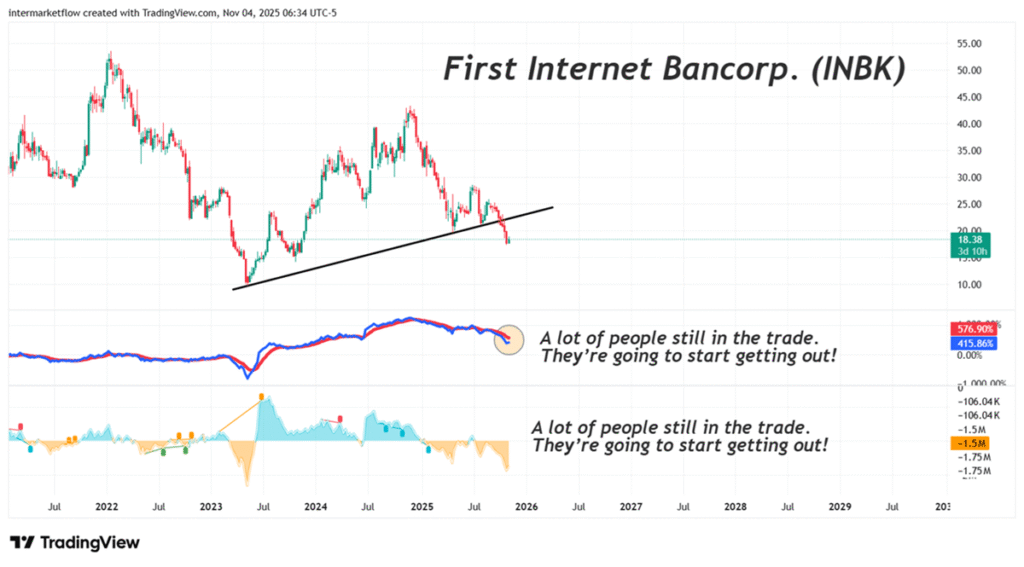

#2 T.A: XLF, the financial sector, midweek pure technical and complete set up for INBK

A purely technical analysis of the financial sector as a whole, with a focus on INBK and NWBI in particular.

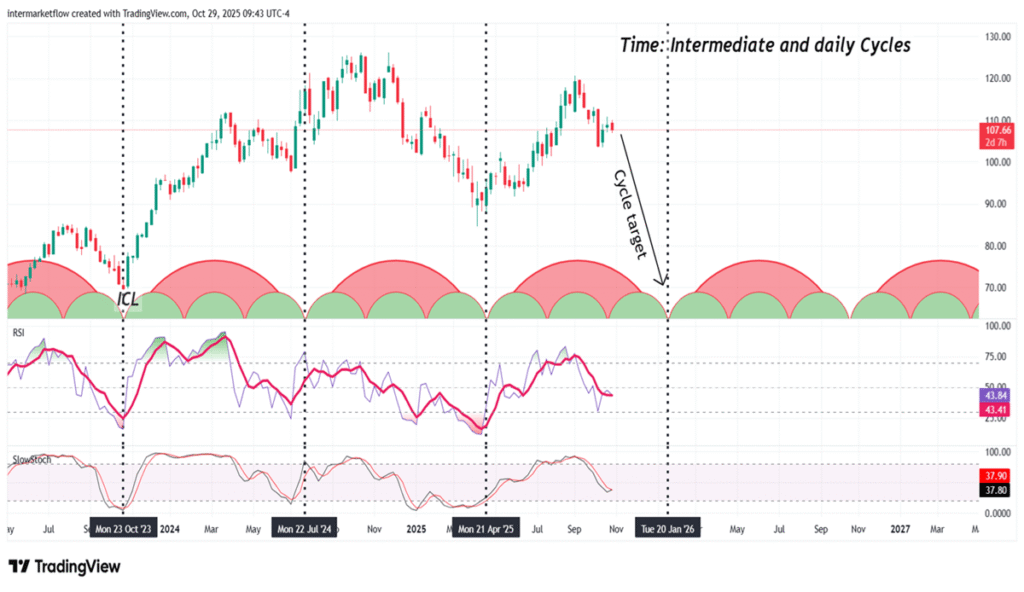

#74 Complete Technical Set Up for the Home Builders Sector-Nov 26

A complete technical analysis covering all branches of technical study: trend, time, volume, mean reversion, and charting.

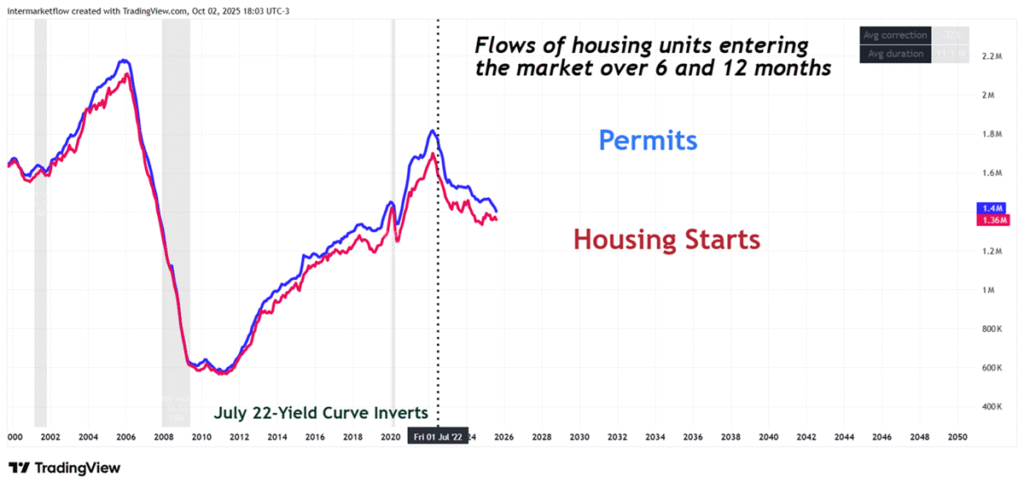

#70 The Residential Market

We seek to understand the relationship between the new and the existing home market—the different flows and inventories that shape both. We analyze how imbalances in one market affect the other.

#68 Spot federal rate spread vs. PCE inflation rate

We analyzed the intermarket capital flows that took place in the week of September 17, following the rate cut. We looked at the effects they generated, where they occurred, and with what volume. We searched and found where the volume moved that week.

#67 Labor Market and Consumption

The connection between consumption and the market may seem direct. It isn’t quite so since the state has also intervened in this market. Here we explain the market’s causalities. We break down Nonfarm Payroll to show why it fails as a true measure of employment, and finally, we lay out a concrete technical setup.