#25 Trading Real Rates.

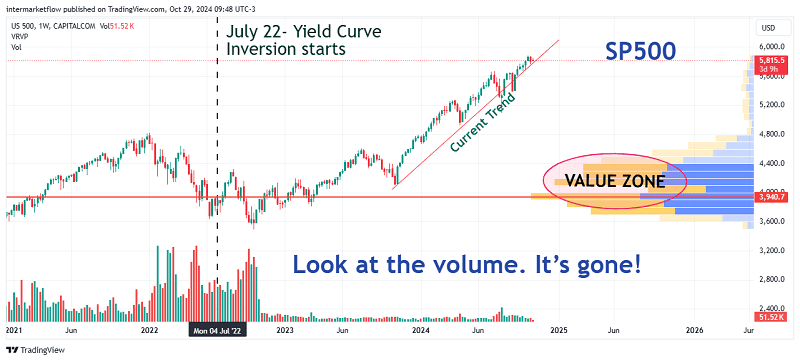

This is an article calculating current real interest rates for developed economies, primarily in Europe. It analyzes the strength of their currencies and major stock indices. A common pattern emerges across all of them: currencies are weak, and there’s a total lack of volume in the latest rally in their indices, making a correction imminent.

#7 Macro and Technical Set up. Arguments for targeting the Real State Sector

Targeting Real Estate

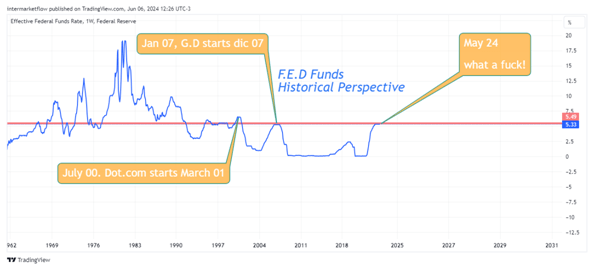

#4 Set ups. From the FED

Intermarket Analysis Throught Macro and Technical Methods The 30-year rate. Technical and Macroeconomic Perspective Anticipating the Recession Those who cannot remember the past are condemned to repeat it.” – George Santayana The Life of reason 1905. The Reaction Function of the FED and Any Central Bank with the Same Mandate The reaction function of the […]

#3 Commodities Breakout Signals and Long-term Rate Trends. Searching for Set-ups.

Intermarket Analysis Throught Macro and Technical Methods [gtranslate] #3 Commodities Breakout Signals and Long-term Rate Trends Looking for Setups Through Intermarket Analysis Continuing with the analysis publish last Wednesday, 05-22, commodities and long term rates , we will attempt to delve deeper into the conclusions we reached. Remember that in that analysis, we examined stock […]