Technical Setup: Trading a Macro Narrative in Stage 3.

Technical indicators in the technology sector.

Here you’ll find:

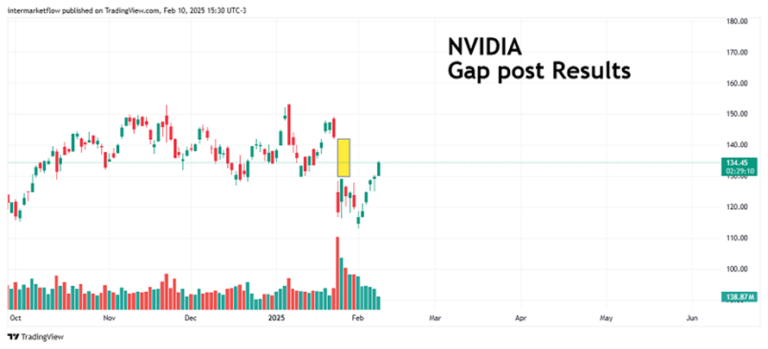

The reaction to the earnings announcements of Google, Amazon, and NVIDIA.

The similarities and differences between them.

The charts that, from a technical perspective, indicate the sector is very close to a correction.

We know it’s a volatile stage, and we’re going to trade the vehicles where we see the most overvaluation or weakness—depending on how you look at it.

In the previous article, we saw the earnings reports of 3 of the big tech companies.

Reality has drifted too far from the narrative and is expressing itself in prices. We’ve been arguing that the S&P 500 is in the process of marking a top. We believe it’s overvalued and needs a correction that reflects the stage of the macroeconomic cycle it’s in.

DeepSeek and Capex

Why would anyone make such a significant investment in Capex when the role of each of the big players is somewhat predefined.

Why?

We’ve thought a lot about this, and of course, there are countless hypotheses. We believe they all stem from fear. That this overinvestment in Capex is an overreaction driven by fear. It’s not a competition among them; it’s a competition against something that we, or the general public, don’t yet understand.

It’s a sector-wide issue. NVIDIA is the cornerstone the sector relies on today.

Microsoft

In the monthly time frame, it broke the first holding speed, it broke the second….

Technically speaking, that is a double top, almost confirmed.

A correction is coming soon.

Only the trigger is not given yet.

Well, that’s all for today. For the 10,000th time, this is what we’re seeing and sharing for marketing purposes. THESE ARE NOT TRADING RECOMMENDATIONS.

Remember that starting in March, we’ll be launching a paid version of the service. The reasons for this were already explained in the last episode, so I don’t want to be repetitive. I hope you’ll join us because we need you.

You can find us at intermarketflow.com and on X @intermarketflow.

See you soon,

Martin