#29- B Trading the 10 year real rate.

Double trigger operation depending on condition A. Here

Here you will find:

- The complete technical analysis that frames a setup.

The setup that derives from a micro, macro, and intermarket analysis we discussed here.

The Vehicle:

We are being aggressive. If we expect a correction in the S&P 500, the most exposed assets are those with higher β. They are the most vulnerable. If we see weakness in the S&P 500, these are the sick animals, the old ones, or simply the smallest.

Important, this is only viable once condition 1 is confirmed.

Direxion Daily S&P 500® High Beta Bear 3X Shares

Ticker: HIBS

When trading leveraged ETFs, especially those leveraged by 3x, timing is everything. These are instruments that, just by the passage of time, lose value. They have very high daily rebalancing costs that “eat away” the value of the asset.

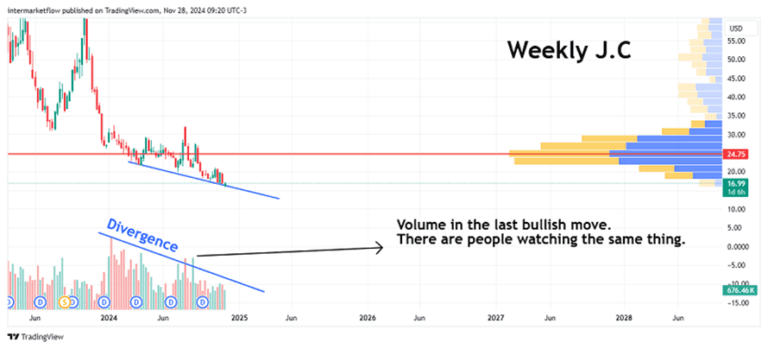

At the lower part of the channel. Current bearish trend on the weekly chart.

The current daily trend is bearish.

Weekly Oscillators

Now, notice that the price is increasingly struggling to go lower, failing to make new lows on either of the two oscillators. On the contrary, it has already created an additional divergence.

This is a high-risk setup. Keep this in mind when trading it, especially when sizing the position.

I hope you enjoyed this as much as I did writing it. Opinions and constructive criticism are valued. That’s all for now. The subscription won’t cost you anything and it makes our day.

You can find us at our site intermarketflow.com or on X @intermarketflow

See you soon,

Martin

Intermarketflow.com

- Intermarketflow