Executive Summary

- QT ended — an analysis of what it achieved from different time perspectives.

- Why can’t the economy support lower liquidity levels than before?

- Liquidity: myths and legends.

- What it solves and what it cannot solve.

- Its effects on the construction sector and the financial sector, plus a metaphor of its importance for small businesses.

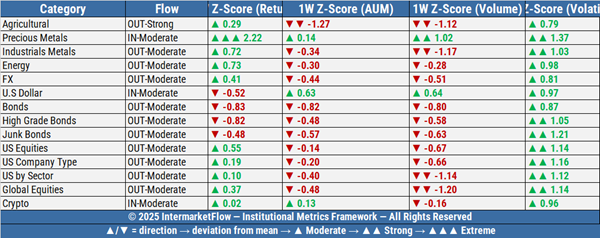

- Intermarket Analysis: where capital flows went this past week, across all asset categories, segmented into sub-categories to refine the analysis.

- The intermarket message: which assets are moving and the implicit message behind them.

- The weekly activity of risk takers: which assets they bought and what their weekly attitude was.

QT is over. No glory, no tragedy — let’s say goodbye, because it’s not coming back

QT: Before we dive into the more technical sections of Wednesday’s report, we can’t ignore what just happened: the end of the QT phase and the beginning of a “QE-lite” phase. It’s not the same thing as standard QE, but it plays a few similar roles.

QT: Success or failure?

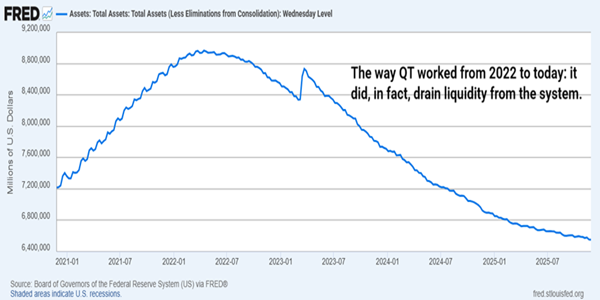

Let’s break it down with charts across different timeframes so we can answer that question properly. In the short term, this is what QT achieved — this is the liquidity it pulled out of the system.

If I stopped my analysis here, it would look like QT actually worked. In other words, it did manage to pull liquidity out of the system.

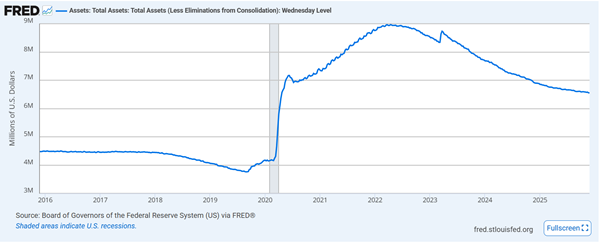

QT: medium-term perspective

Once we change the lens — and extend the timeframe — the story starts to look very different.

Well, at face value the goal was to get back to pre-COVID levels. If we look at what was actually achieved — roughly 33% of what needed to be done — then QT didn’t deliver.

Of course, that’s a simplistic way to put it. The reality is that the real economy didn’t allow it. It couldn’t sustain lower liquidity levels, even when those levels were still far above pre-COVID.

Once you strip out all the noise that muddies the analysis, the only question that matters is this: Why didn’t the economy allow QT to finish — or put differently, why did the economy become so liquidity-dependent?

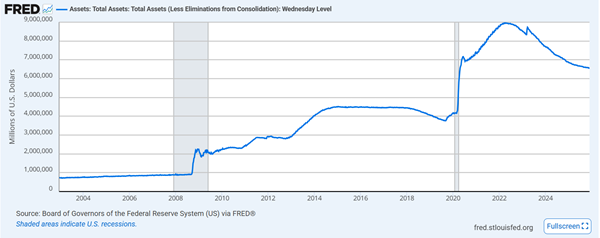

QT: The really big picture

If we zoom out, it gets even more overwhelming: liquidity has been flowing into the system since 2002 through different channels, but mainly via fiscal deficits.

A fiscal deficit is basically printing money and pushing it into the economy. Call it debt-backed or not — the mechanism is the same: money shows up and enters the system.

That’s why it shouldn’t surprise anyone that everything sits near all-time highs — stocks, gold, housing, crypto, even some inventories.

Basic economics: more money chasing a relatively stable supply of goods means each dollar buys less in real terms, so everything rises in nominal terms.

Liquidity and the real economy: what it can and can’t solve

What liquidity can solve

- I think it’s fairly likely that no relevant economic agent will face a true liquidity problem again in the future. The Fed is effectively guaranteeing that through different “windows” where agents can go and get cash against Treasuries and/or MBS, the last ones at par value, which is an enormous moral hazard as we saw here.

- This is not a small detail. In the past, prior crises were either triggered or amplified by liquidity problems.

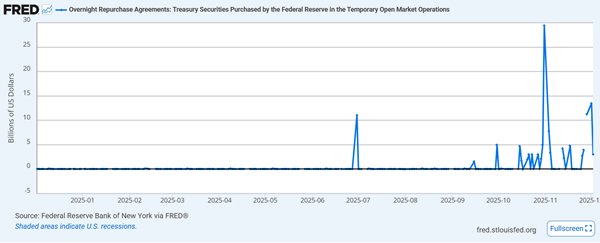

In fact, over the last few days we’ve seen some players tap the Fed’s discount windows. Nothing alarming, but it’s becoming more frequent.

Another moral hazard is that the Fed keeps their names secret, so nobody panics. It might very well be your bank asking for an emergency rescue, but the federal government won´t let you know.

Liquidity: what it can’t solve

Let’s think together! Common sense will get us out of here soon enough.

Let’s assume we own a factory, a business, a small company, or a kiosk. Our business stops being profitable in an inflationary economy with rising unemployment because something changes in the economic ecosystem..basically, we lose money every month. We fight it, we look for alternatives. We burned the ships.

There’s been too much effort — and probably too much emotion — poured into this business for us to let it die without a fight.

One way out was always credit. And with fixed 3% rates, even an ice factory in the North Pole works. Today rates are not that — and to make it worse, the real economy isn’t either.

What do I gain by investing money into a business model that isn’t profitable?

I amplify my economic losses.

Liquidity and the homebuilders

These are players that have been exposed to illiquidity risk. But even if that problem is “solved,” does the business change?

They’re still sitting on high inventories, high rates, and home prices at all-time highs. Does liquidity fix margins? Do they sell more?

Keep injecting liquidity nonstop and you can keep propping things up — but along the way, home prices will keep rising, inflation will stay hotter, and the dollar will keep getting devalued.

And that loops back into the real economy like throwing more wood into the fire: it creates a vicious cycle, with an eventual exit that becomes more and more painful each time.

Liquidity and risk assets

Liquidity has clearly acted as support for risk assets in the past. Back then, risk assets were pricing a healthy, mildly growing economy — with a positive expected return. Liquidity is so powerful it can even pump memecoins… whatever that thing is.

I believe this scenario is gonna change. Risky businesses need a positive expectancy for returns like everyone else.

Liquidity and Banks

For a bank, liquidity is literally a life insurance policy. The historical problem in the banking business model is when everyone shows up at the same time to withdraw their money — money that obviously isn’t there, or isn’t enough.

But again, we’ve already looked at the state of banks’ loan books (here and here) — the delinquencies that are there, the direction they’re trending, and the losses that still haven’t been recognized.

Can liquidity change that situation?

Sure — it buys them time. But the unavoidable inflationary consequences — on interest rates and on the value of the dollar — eventually re-emerge down the road, worsening margins, pushing everyone to take more risk, and growing the snowball that is already huge today.

What’s coming: Nominal vs Real

You start seeing surprising numbers: growth, investment, consumption. But if you deflate them — meaning, you subtract reported inflation — in many cases there isn’t growth at all. In some cases, there are losses.

This is the fight that’s coming.

The battle happens every day in markets, but in the real economy you can see it in corporate results — at least for the companies that report publicly.

And that matters because the U.S. has roughly 8 million businesses, while only about 4,000 trade on the stock market — around 0.1%. That’s the technical reason why stock indices are not “the real economy,” and why the real economy eventually ends up dominating the narrative.

Hunting global capital. Where did the little birds fly?

One must understand that this migration is taking place with an 89% probability (you should follow this probability on a daily basis here), of a rate cut on December 10th and with QT just ending. We should be entering into a lavish party — and yet…

Only Categories with weekly inflows, across all asset classes are Precious metals and the US dollar. Yes, you read that right

This lines up with what we saw here last Sunday. The market is frozen — but the only assets actually receiving flows are the dollar and precious metals. Intermarket, once again, pointing the way.

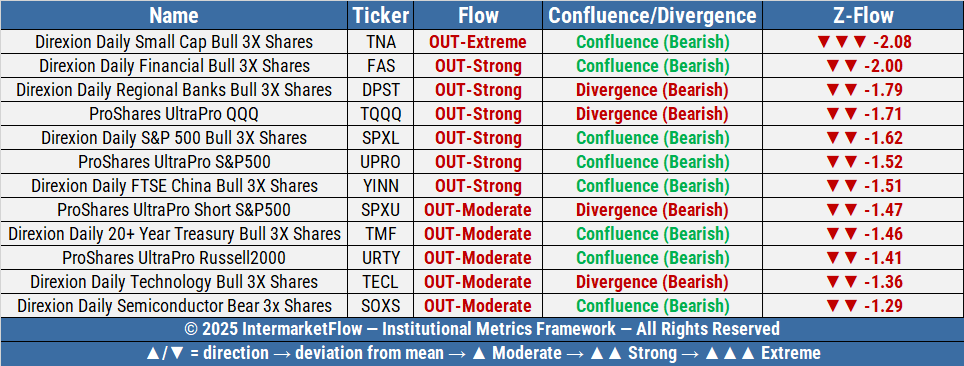

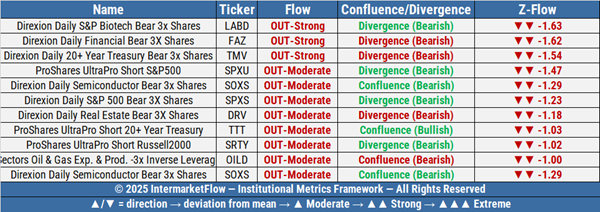

Hunting Global Capital: What are the risk-seekers doing? It’s always useful to know what they’re up to. Their bets carry a message

Bulls

And bears

All assets are seeing strong outflows. How strong? Looking at the Z-scores, most of these moves are sitting around two standard deviations away from their typical behavior. In other words: these are really strong moves for them.

Wrap up

- All asset classes are experiencing outflows except two: the dollar and precious metals.

- Risk-takers — both bulls and bears — are in escape mode, moving away from the highest-risk assets.

And yet

There are moments when it’s better to go fishing. The context is crystal clear — and so is our bias.

Now we wait.

See you.

Martin

If you believe this is an error, please contact the administrator.