Executive Summary: New Orders: Nominal Strength, Real Weakness

- Building Permits & New Orders: Nominal data may look contradictory, but once deflated, the signal becomes unambiguous.

- Labor market under the lens: Unemployment analyzed alongside key leading indicators.

- Macro cycle positioning: Where the economy stands in the cycle—and why.

- The nominal illusion trap: How inflation distorts perception and decision-making.

- Inter-market flows: Capital movements from the first full week of the year—where the money is actually going.

- Intra-market flows: A sector-by-sector breakdown to pinpoint where capital is concentrating.

- The gamblers: Weekly positioning of leveraged ETF traders and how 3x players are set for the week ahead.

- From sectors to stocks: The individual names selected for Wednesday’s technical analysis.

New Orders: Nominal Strength, Real Weakness

In the Sunday report, we focus on Intermarket and Macro dynamics. New orders and building permits, two high-quality leading indicators that, at first glance, appear to be contradicting each other — or at least that is what the media, financial communities, and virtually every free and politicized information source out there would like us to believe.

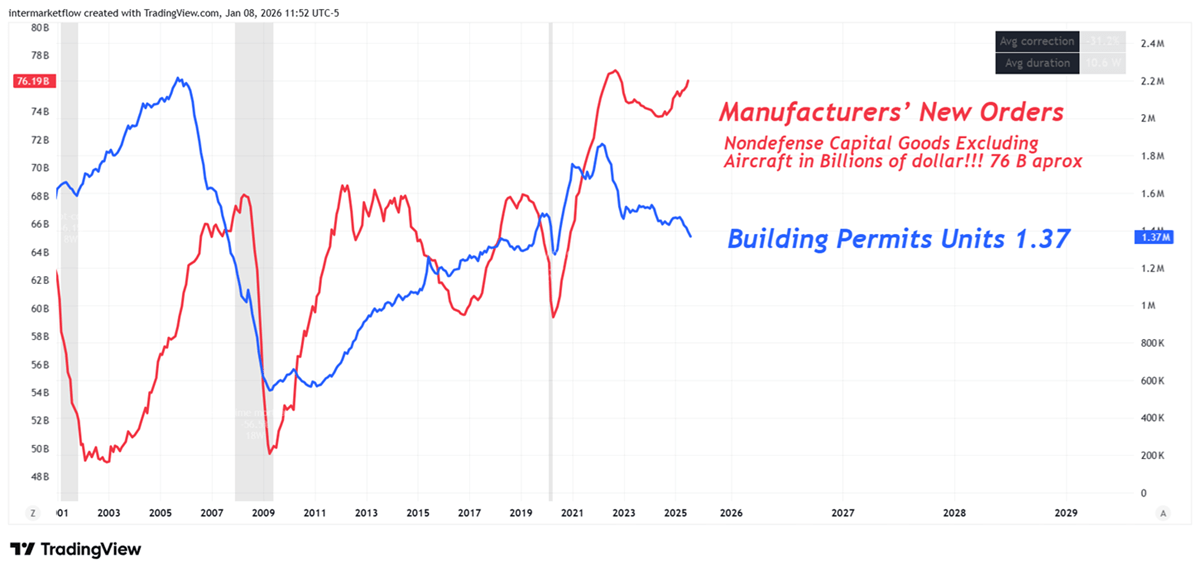

Building permits and manufacturing new orders for capital goods, excluding defense and aircraft.

This chart is plotted using two different scales, for a simple reason. One series is measured in units — building permits — while the other is measured in billions of dollars, new orders.. At first glance, they appear to tell contradictory stories.

Building permits have been collapsing since July 2022, precisely when the yield curve inverted. Meanwhile, new orders are sitting at all-time highs, which would suggest that business owners are anticipating a flourishing future. In that scenario, they would need more capital goods and higher levels of investment to meet expected demand. More inversion would make new orders grow so as to meet forward looking demand.

In concrete terms, this is directly linked to AI.

The problem, however, is that these figures are measured in nominal dollars.

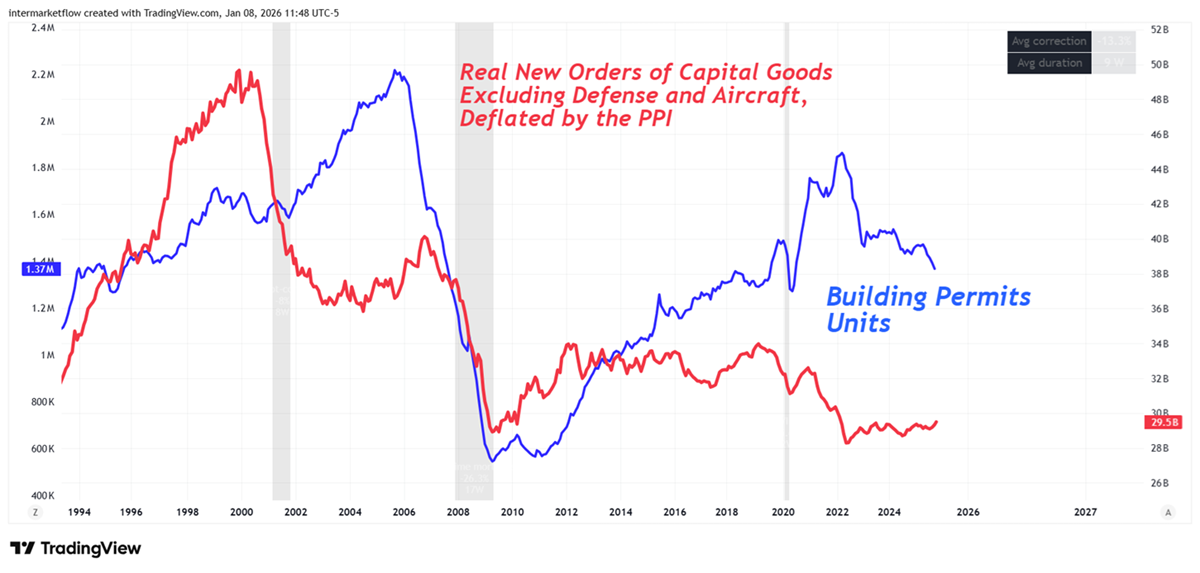

Deflating manufacturing new orders for capital goods, excluding defense and aircraft.

When we deflate new orders using the P.P.I.(Producer Price Index, All commodities), we realize that real new orders are stagnating and lower levels than during the G.F.C.

Manufacturing new orders, unemployment, and recessions

Unemployment is a coincident indicator while permits and new orders are probably the best available leading indicators.

New orders and the Economy

This is the description of an economy that is stagnating with a clear recessionary bias, transitioning toward the end of the expansion cycle.

Why?

- The Nominal Illusion Trap

When capital goods orders (Non-defense Capital Goods ex-aircraft) rise in nominal terms but stall once deflated, this signals a lack of real productive investment.

Companies are spending more, but acquiring the same or fewer machines and technologies. This reflects costly maintenance of existing capacity, not expansion.In spite of A.I. boom.

- The Signal from Building Permits

Building permits are a key leading indicator. A sharp decline reflects high sensitivity to interest rates as monetary tightening hits housing. Remember, yield curve inverts on July 22.

- Negative multiplier effects across construction-related industries and inversion in the sector.

- Labor Market Deterioration

As employment growth and job openings weaken, consumption begins to cool.

New orders and the Macro Cycle.

I believe we are in the Late-Cycle moving towards a cyclical recession. The economy shows clear signs of exhaustion. Once inflation is stripped out, the apparent contradiction between strong nominal data and weak real activity disappears. Housing, industry, and labor are all pointing in the same direction: a recession in real income and real investment.

That said, it is evident that both fiscal and monetary policy are powerful tools that distort the natural progression of a sideways economy. The real signal will come through corporate earnings and credit spreads.

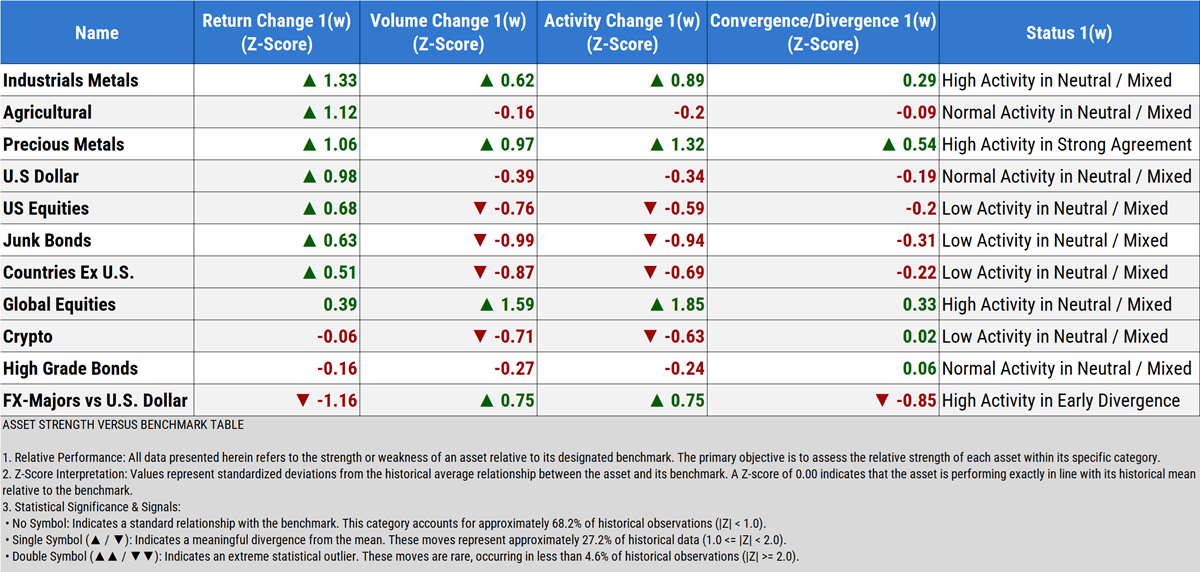

Intermarket Flows for the week

Strong week for the dollar, U.S. equities, but especially , as has been the case for some time now, commodities. It increasingly appears that correlations are starting to shift, pushing flows and dispersing them across different commodity groups.

Intra Market Flows for the week

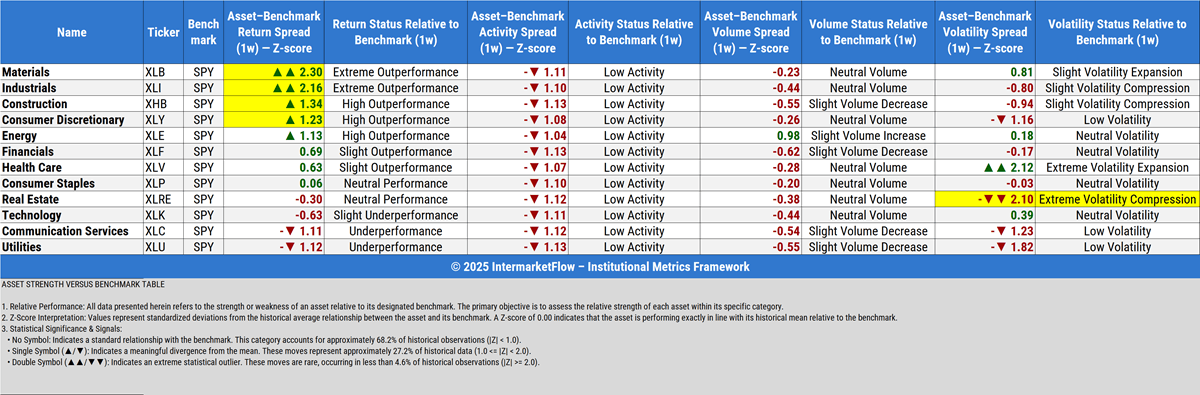

We begin to break down the intermarket dynamics to sharpen the analysis. This is a snapshot of each sector’s performance within the economy, relative to the S&P 500. What it illustrates is the relative strength of each sector over the past week.

Materials, Industrials, Construction, and Consumer Discretionary were the strongest returns for the week. Not confirmed by volume though.

The first two are likely tied to tariffs the nominal data we have been seeing, while Construction is closely linked to two very clear policy signals from the administration: the decision to halt fund purchases of new homes and the de facto intervention on the long end of the yield curve. In practical terms, this amounts to yield curve control—similar to what Japan, China, and several other countries have already experienced.

Volatility compression in real estate is also extreme. That is why I highlighted it in yellow in the lower right corner.

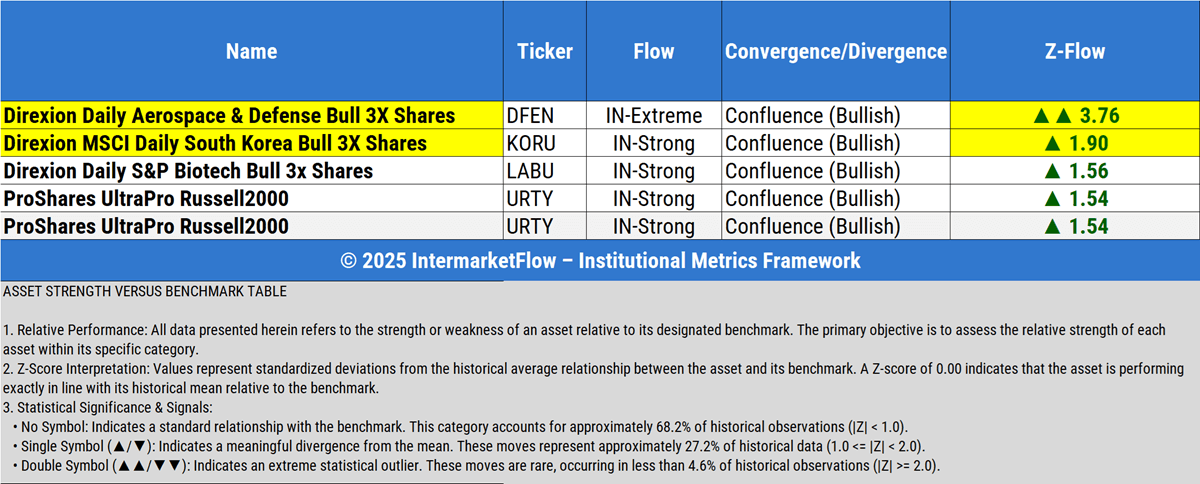

The gamblers flows for the week

A snapshot of where the speculators are positioned heading into the week. It always provides a useful sense of short-term expectations. Besides, I happen to like this crowd in particular.

Bulls

Defense Bull 3x is experiencing a near–black swan probability event. A Z-score close to 4 is entirely abnormal, regardless of the data distribution used for the sample.

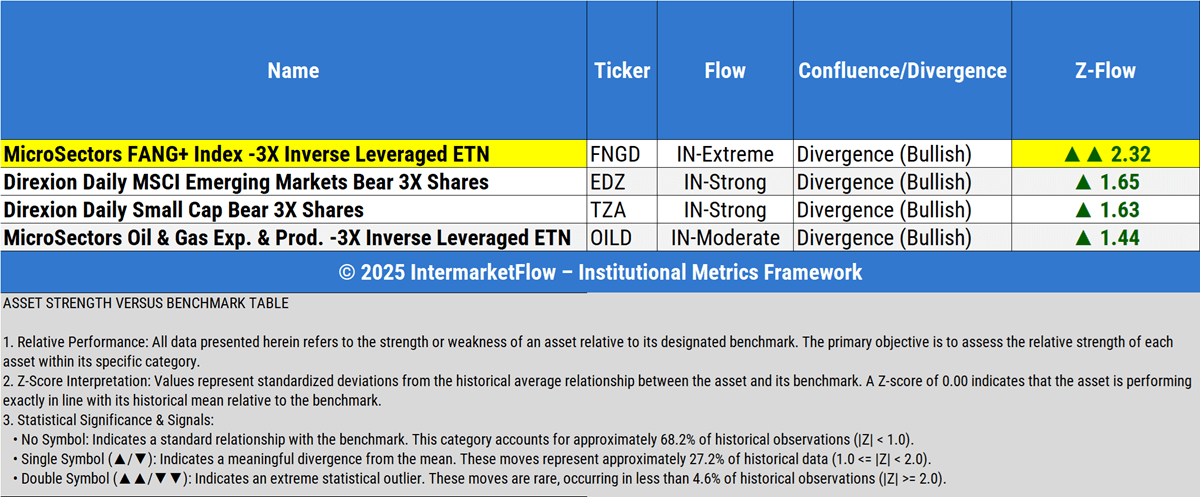

Bears

Be careful: bears buy ETFs like TZA, which is a -3x small-cap product. They are buyers, but their view is not bullish on the economy.

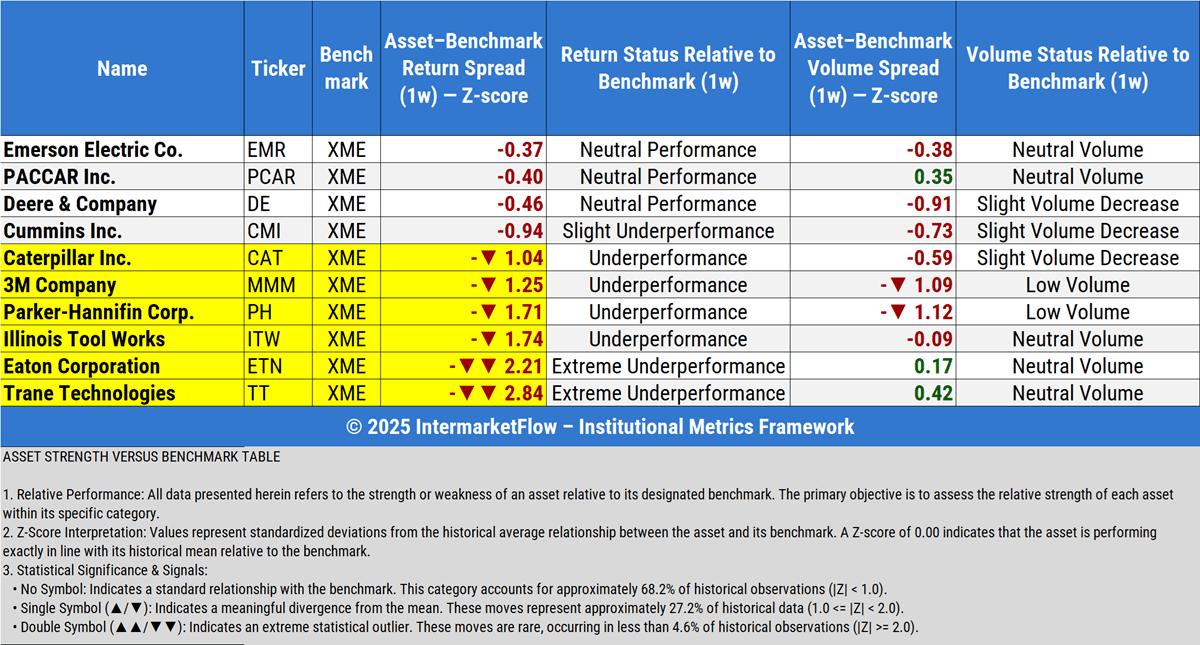

Manufacturing companies. Relative strength and a key focus for Wednesday’s technical analysis.

Martin

If you believe this is an error, please contact the administrator.