The Great Liquidity Blackout

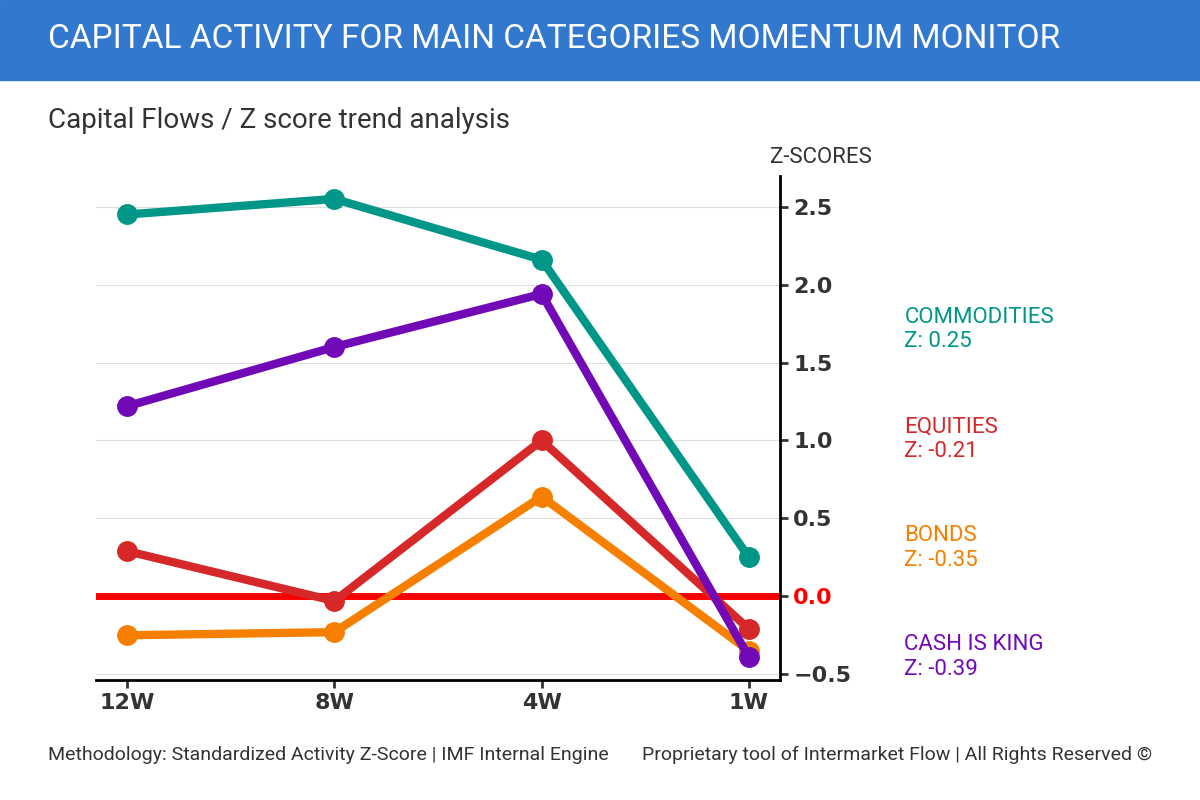

Market capital has gone on strike. Activity (price x volume) has collapsed across every category — including the traditional safe haven, we call, “Cash is King”. There was no action anywhere.

The macro data didn’t just invite caution; it triggered a systemic exit. A logical situation, considering the reports released this week — Non-Farm Payrolls, CPI, Existing Home Sales, Retail Sales, and others.

Where did market capital go?

Money doesn’t disappear — it steps aside.It has moved into the system’s plumbing:

- Fed Reverse Repo (RRP): Institutions are parking liquidity at the Fed, avoiding counterparty exposure.

- Idle Cash: Proceeds from bank and tech sell-offs remain in cash, waiting for clarity.

- De-leveraging: Capital is being used to meet margins and reduce debt, compressing overall liquidity.

- The Curve: Massive flight to T-Bills and Treasury Notes.

Liquidity hasn’t vanished. It has retreated

Even so, a broad decision has been made — one that breaks a prevailing narrative or signals a shift in market expectations. And therefore, a new trading regime.

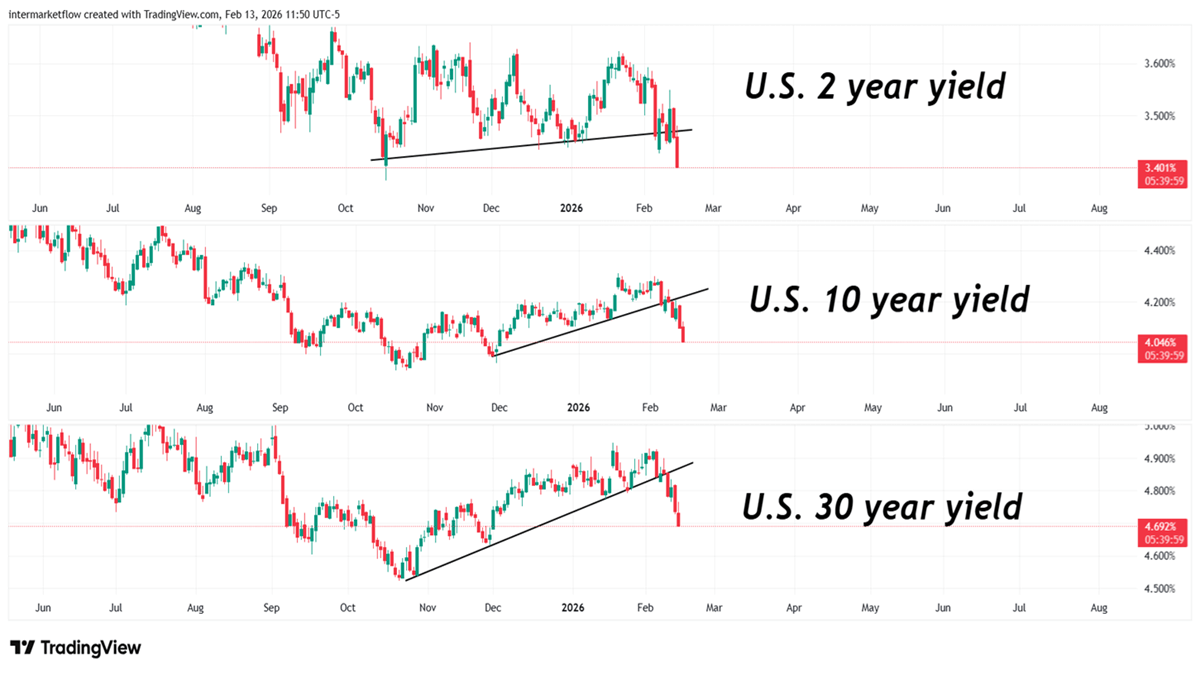

The Yield Curve Collapse: A Recessionary Regime

This is the core of the framework: the entire U.S. yield curve — from the 3-month bill to the 30-year bond — is in technical capitulation. This is not a routine pullback in rates. It is a synchronized repricing.

In a scenario like this, with yields collapsing, one would expect a strong rally in equities.

That is not what we are seeing.This divergence suggests the collapse in rates is masking a different narrative — one the bond market is already pricing in. A hard landing!

Bonds set the rules of the game

We could speculate and label these narratives, but that’s unproductive. We don’t need to name it. We need to understand what it implies and position accordingly.

The Arithmetic Paradox

All cash flows, discounted at lower rates across every segment of the curve, should mathematically imply higher equity valuations.

The lower the discount rate applied to cash flows, the higher the present value — and therefore, the higher the implied valuations.

Mathematics is exact and honest — when it’s done correctly.

Yet the market is not behaving that way. And with activity collapsing the way it is, the situation becomes highly vulnerable to violent moves.

There’s no one in the markets. Any large player stepping in can trigger an outsized move.

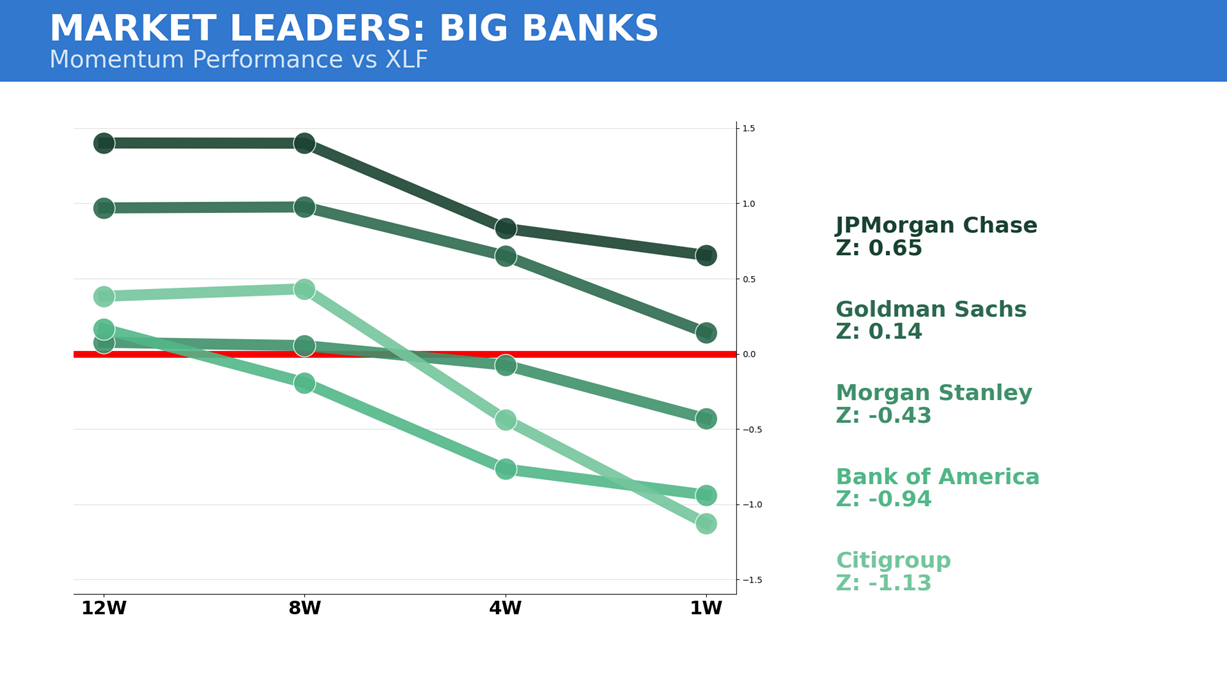

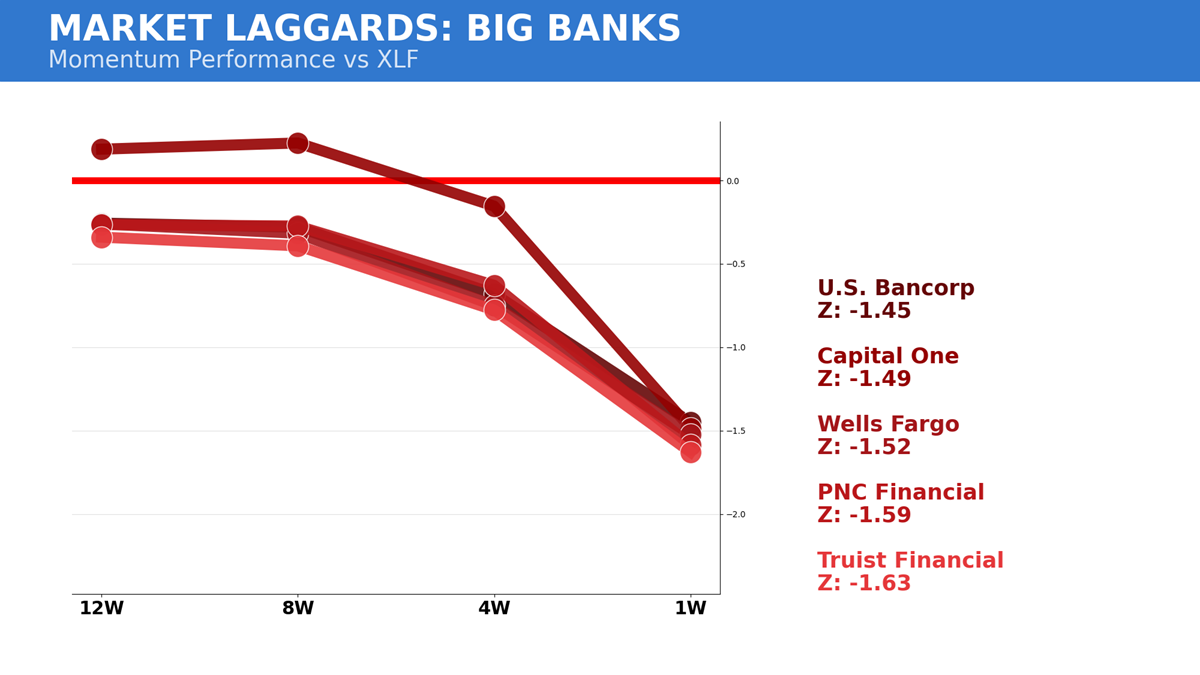

Financials: The heart of the economy

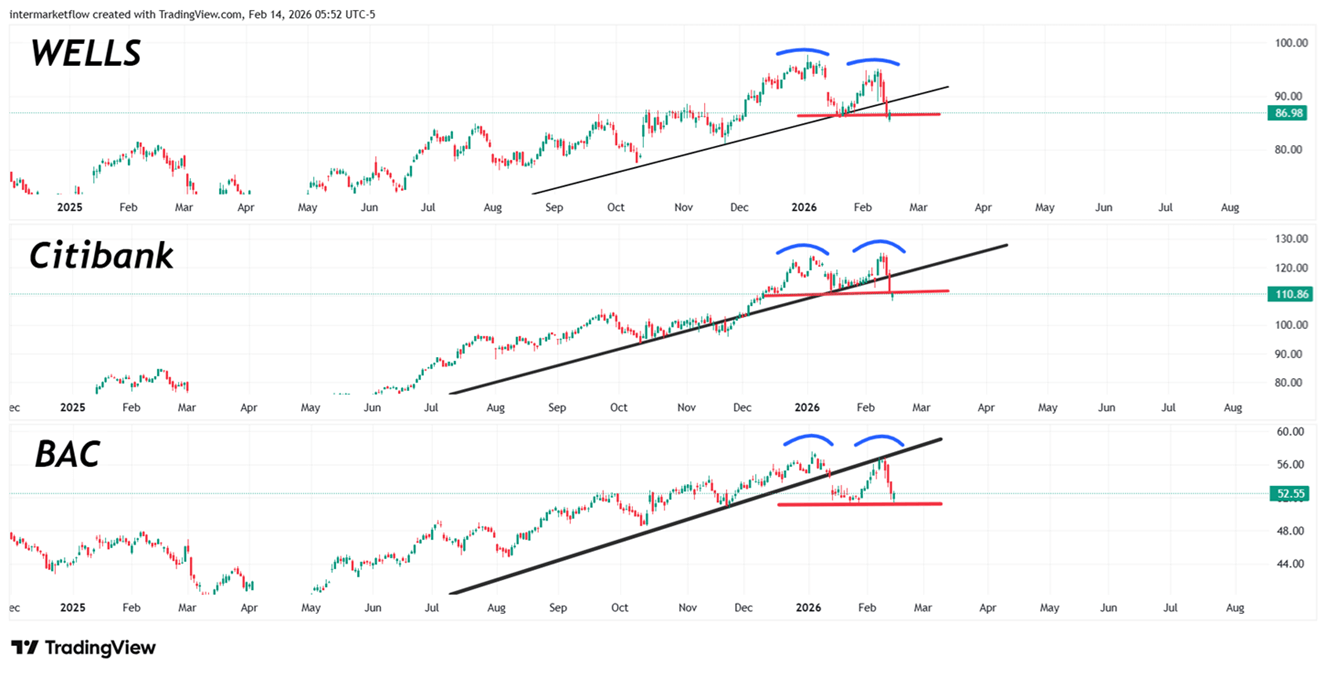

What we are seeing here is a collapse in activity across the major bank tickers — the very names that led the financial sector this week.

In this chart, we see the financial laggards of the sector and how their activity has declined.

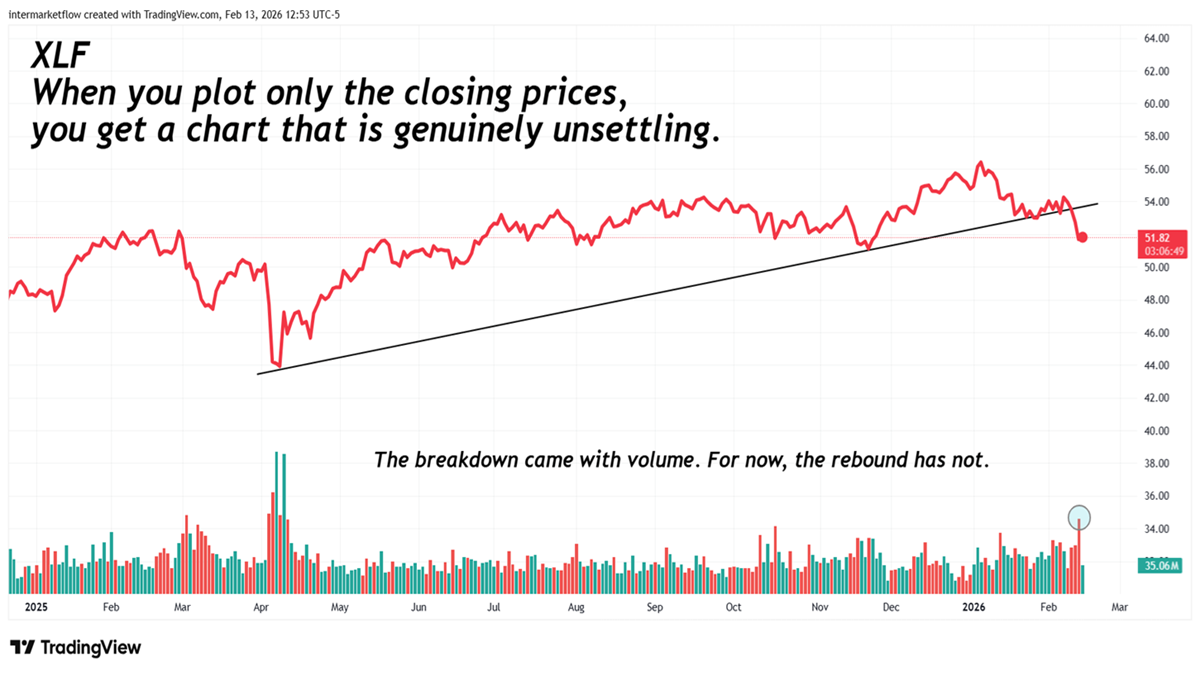

XLF: When you aggregate the sector

For nearly a year, we’ve been discussing rising delinquencies across credit segments, the different banking business models, and which institutions are most exposed. (Delinquencies in consumer credit, commercial and residential mortgages, personal loans, and the different banking business models).

Now we are witnessing a broad repricing across assets.

Market Capital: Mid-Week Report — Direction

This is a moment of extreme risk. Competing narratives are colliding. As a result, we should expect elevated volatility — even if the directional decision has already been made.

Patience is not optional. It is an edge.

Martin

If you believe this is an error, please contact the administrator.