Executive Summary: Intermarket Flows — Where Capital Is Flowing In and Where It Is Flowing Out

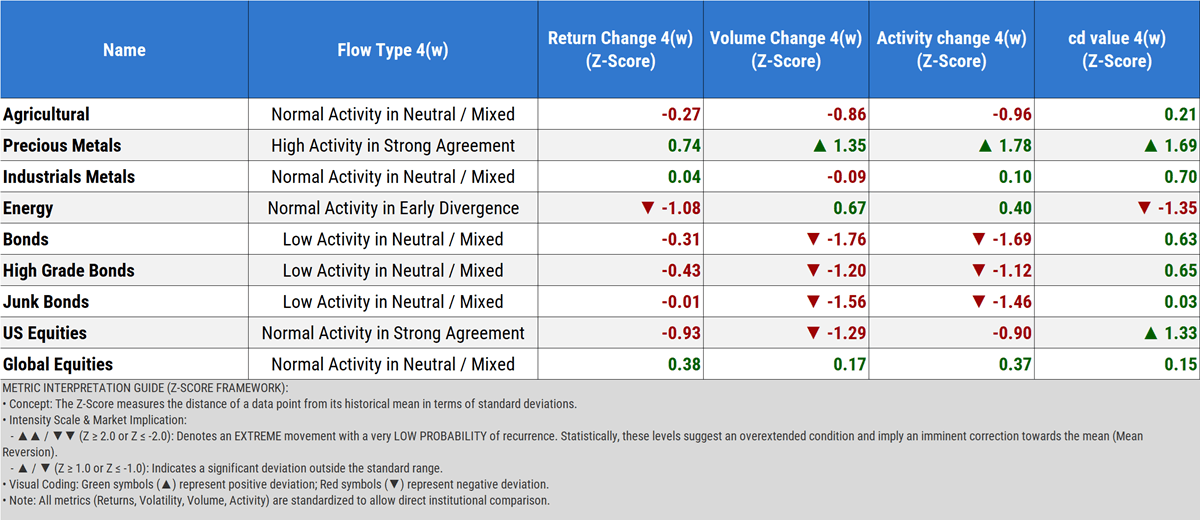

- Bonds as capital distributors and commodities as capital receivers.

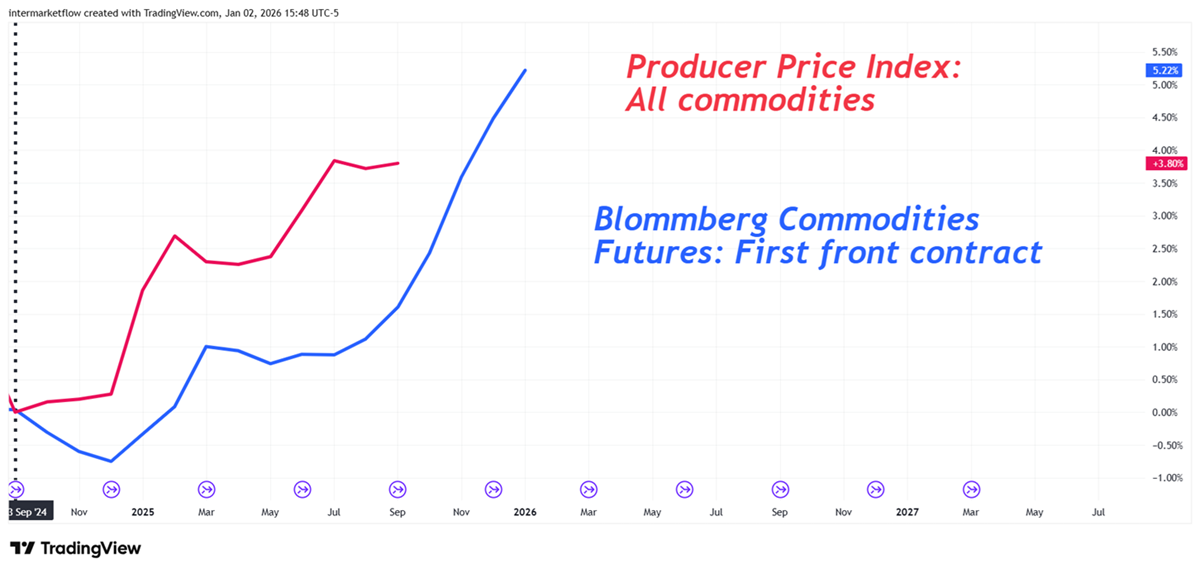

- PPI and commodity futures: inflationary pressure building?

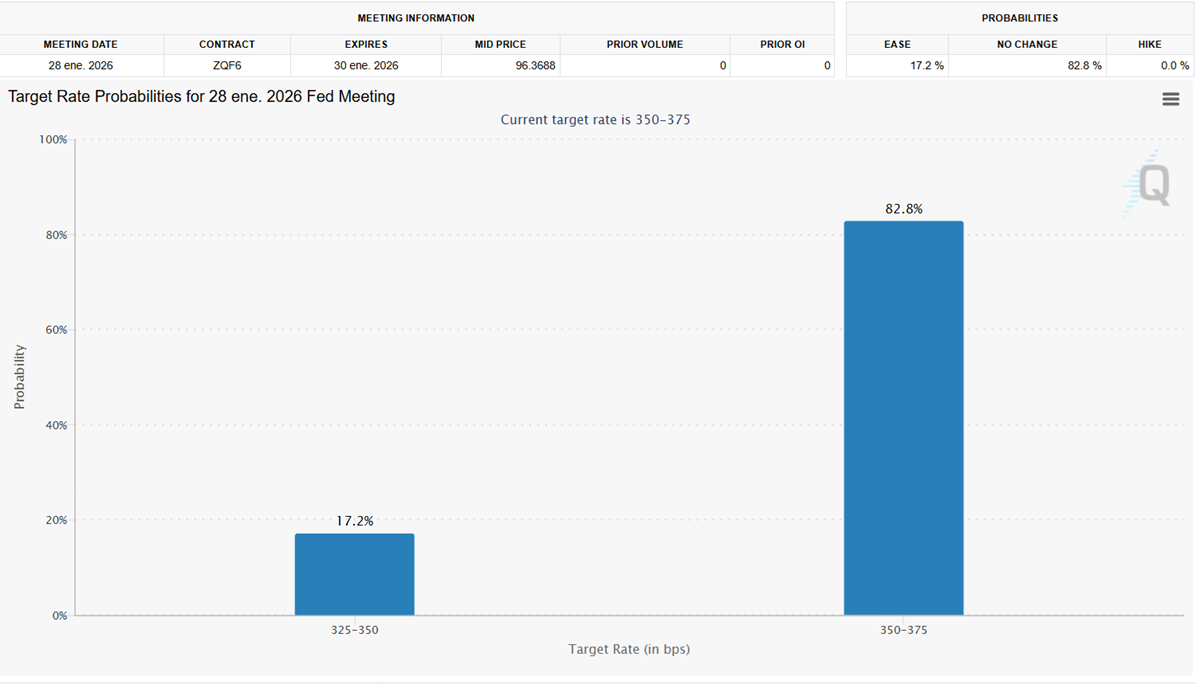

- Rate-cut probabilities for January 28.

- The crossroads: labor market exposure and asymmetric volatility risk.

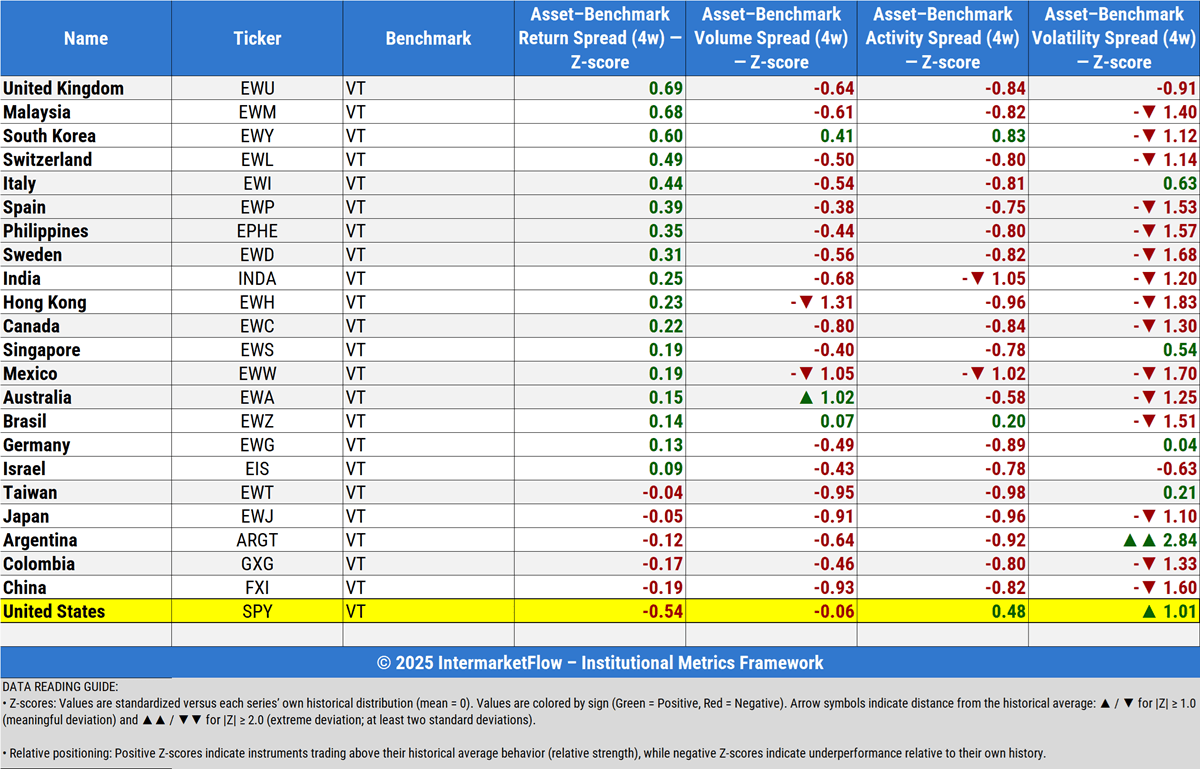

- Returns across developed, emerging, and frontier markets, with a focus on commodity-linked currencies and economies.

- Returns on Commodities and Commodities currencies.

- Crude Copper a broken relationship.

Intermarket Flows and Early-Year Market Signals

With year-end approaching, there are strong incentives of all kinds to close open positions. This is why markets become thin, moves get more stretched, and we see a higher frequency of false breakouts, disconnected price action, and noisy moves. A lack of liquidity enables these unnatural behaviors.

Naturally, the next 15 days, when positioning and portfolio construction resume, will be far more informative than the last two weeks we have just gone through.

The intermarket picture over the past month

For this reason, we step back and widen the lens to assess the broader landscape of capital flows across asset categories, in order to understand the full structure behind recent market moves.

We have been observing this clearly for quite some time now

- Bonds are acting as the primary capital-expelling center, as a category.

- This is true across all levels of credit quality.

- There has been a decline in U.S. equity volume. The time window is one month, and the magnitude of the drop is far from negligible—even acknowledging that the last few weeks are not particularly representative.

- Global equities have not experienced the same volume decline.

- Industrial metals remain relatively stable, holding close to their historical averages.

There is one category that is clearly expelling capital—bonds, and another that is absorbing it—commodities.

The connection, as always, lies in interest rate expectations, and in this particular case, the U.S. dollar.

Intermarket flows: The U.S. Dollar and Commodities

The relationship is direct. Commodities are produced and supplied globally. They are generally capital-intensive goods, priced and traded in U.S. dollars. As a result, a depreciation of the dollar directly raises their cost base and, consequently, their prices at the global level.

What does vary is production profitability, which depends on natural endowments and the structural advantages of the countries where those commodities are produced. Nevertheless, a single global price and broadly shared cost structures make the relationship with the dollar both direct and largely linear.

Intermarket picture, Commodities and PPI

The difference in maturities is explained by the deliberate use of commodity index futures, specifically to capture what the market is pricing today. Naturally, this represents inflationary pressure. The key question is how much of that pressure can ultimately be passed on to the final consumer.

This brings us back to the labor market, inflation, and interest rates.

Today—right now—the market is also telling us, via interest rate futures, that there is an 82% probability of no rate cut on January 28. From here on, good news becomes bad news for the market, because it reinforces the no-cut scenario. That said, the impact is more muted now, since that outcome is already 82% priced in.

What happens if we get a disastrous labor market report?

I think this to be a very probable scenario in fact.

The first reaction will be a spike in volatility. That is not priced into the market today. What I am less certain about is whether this scenario—which would make a rate cut more likely—would act as a bullish catalyst for equities, as it did in previous cycles. My bias is that this time it would not.

Regardless of my personal view, the operating environment in the U.S. is challenging. We are entering 2026 at all-time highs, with a complex interest-rate expectations backdrop and a setup that is highly conducive to an increase in volatility.

On top of that, there is a constant and growing injection of liquidity that continues to inflate valuations across real assets, further stretching and delaying the macroeconomic cycle.

Changing lenses, and widening the scope.

When we look at the last month, this is what we find across equity indices in developed, emerging, and even frontier markets.

This table is ordered by the returns of each country’s equity index relative to a common benchmark. In other words, it illustrates the relative strength of the assets.

The United States, highlighted in yellow, shows several relative characteristics that are not particularly attractive.

- Lower relative returns compared to the rest of the available options.

- Stable volume, but achieved at elevated activity levels, only surpassed by South Korea.

- This results in the highest relative volatility among the indices—second only to Argentina.

At this point, investing in the S&P 500 is not an efficient use of risk. This conclusion may seem obvious beforehand, but it becomes much clearer once it is grounded in the data.

What information do we have looking ahead?

- The market is expecting higher commodity prices. This is an actionable signal.

- Those expectations are likely driven by a weakening U.S. dollar. Another actionable signal.

- The S&P 500 is at all-time highs, within an interest-rate expectaitons backdrop that has clear potential to generate higher volatility.

I am going to step away from this trap. There are other options, vehicles, and markets. There is no rationale for locking into a single corner.At least not until another 15–20 days pass and we gain a clearer view of where capital flows are actually heading.

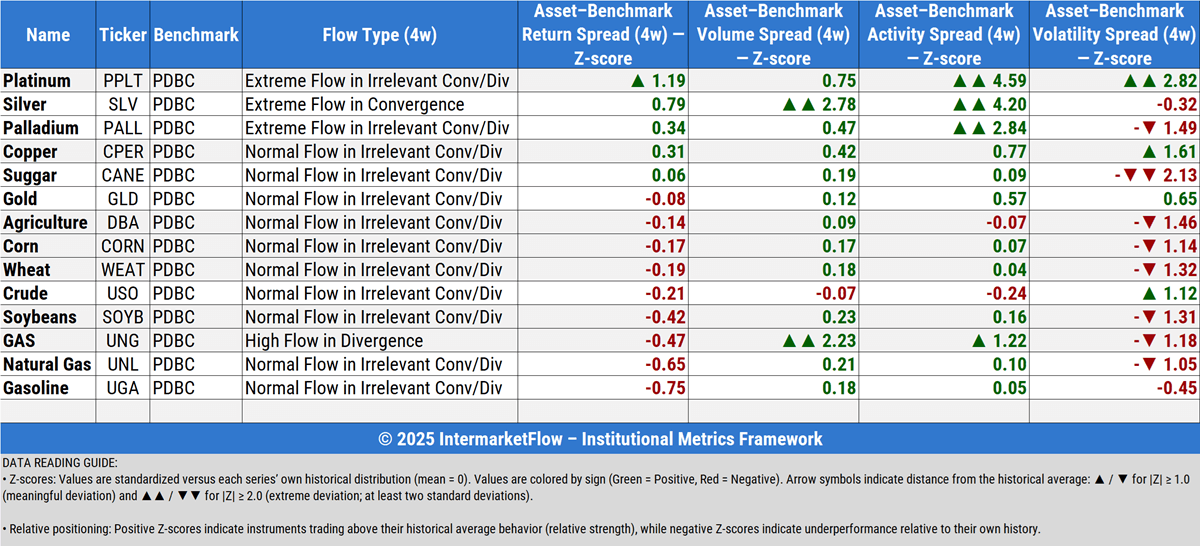

Intermarket flows: Last Month for Commodities

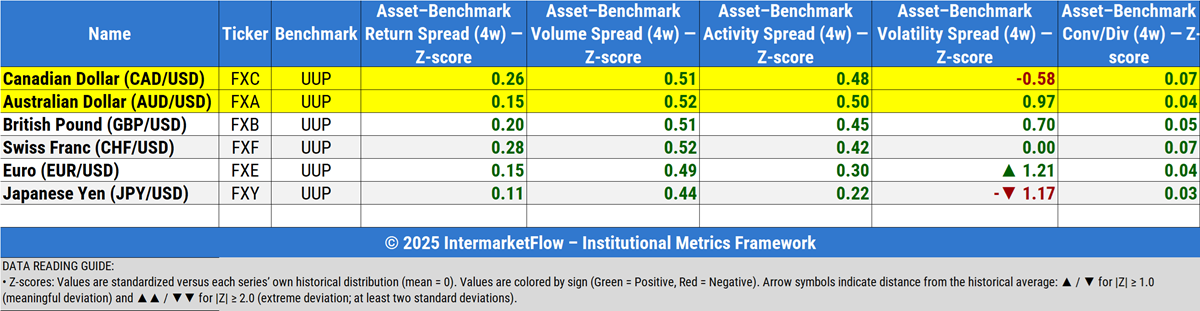

Intermarket flows: Last Month for Currencies

Crude and Copper

Martin

If you believe this is an error, please contact the administrator.

One Response