#97 Intermarket Signals: Capital Flight from US Beta to Global Alpha

Intermarket Signals point to a structural capital flight from US beta. While Fed liquidity masks a cyclical collapse and creates a bull trap in the S&P 500, smart money is aggressively repositioning into Swiss Franc safety, Korean semiconductor alpha, and Brazilian real yield. Read the full Sunday Verdict to map the rotation.

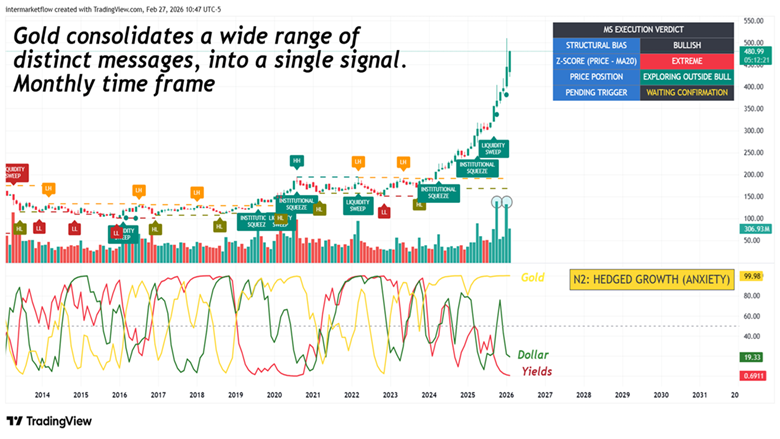

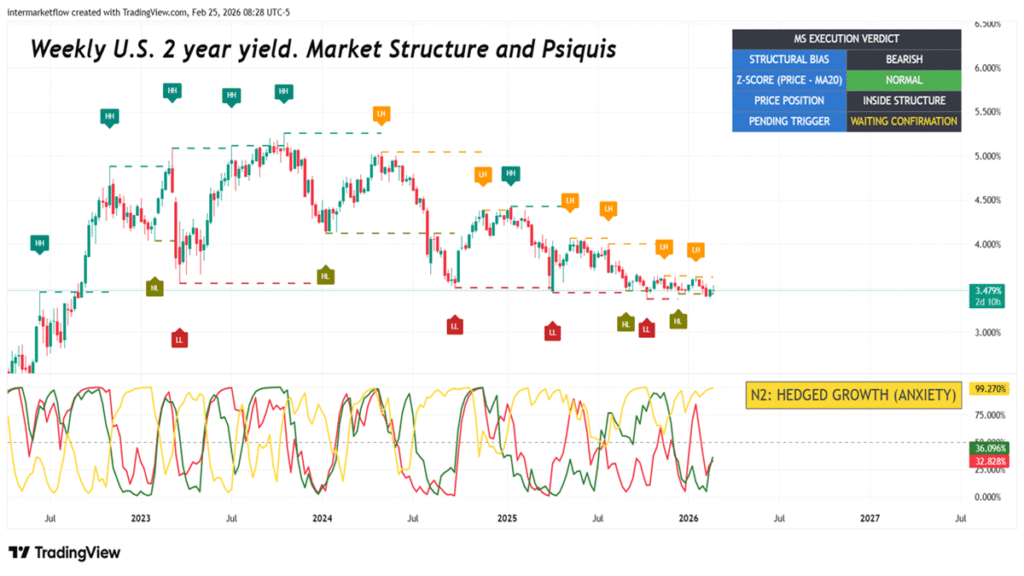

#95 Intermarket Trading Strategy: Risk-Off and the US02Y Correlation Breakdown.

We use intermarket analysis to describe, anticipate, and trade. The Dollar, Gold, the 2-year yield, and the sectors that test our hypothesis.

#94 The SOFR Breaking Point: Navigating the Dollar’s Structural Squeeze

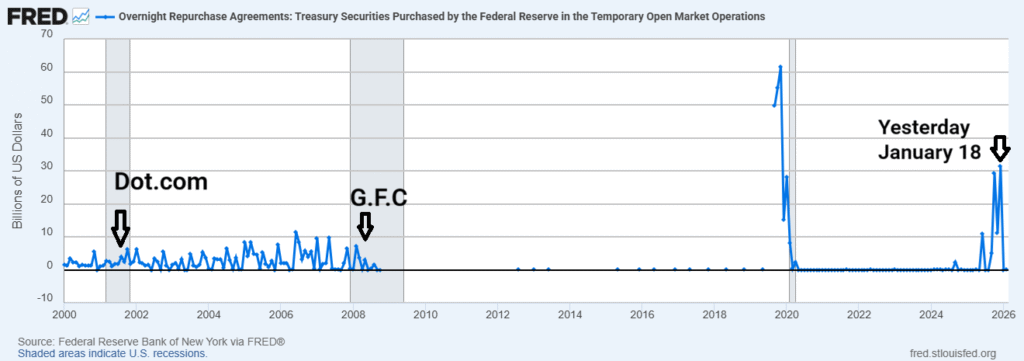

Liquidity has not vanished; it has been relocated. While the market is distracted by the “soft landing” narrative, the system’s plumbing is undergoing a structural stress that most are choosing to ignore. This report analyzes the critical transition from the Reverse Repo (RRP) facility into captive bank reserves and explains why the current growth model has officially entered a solvency trap.

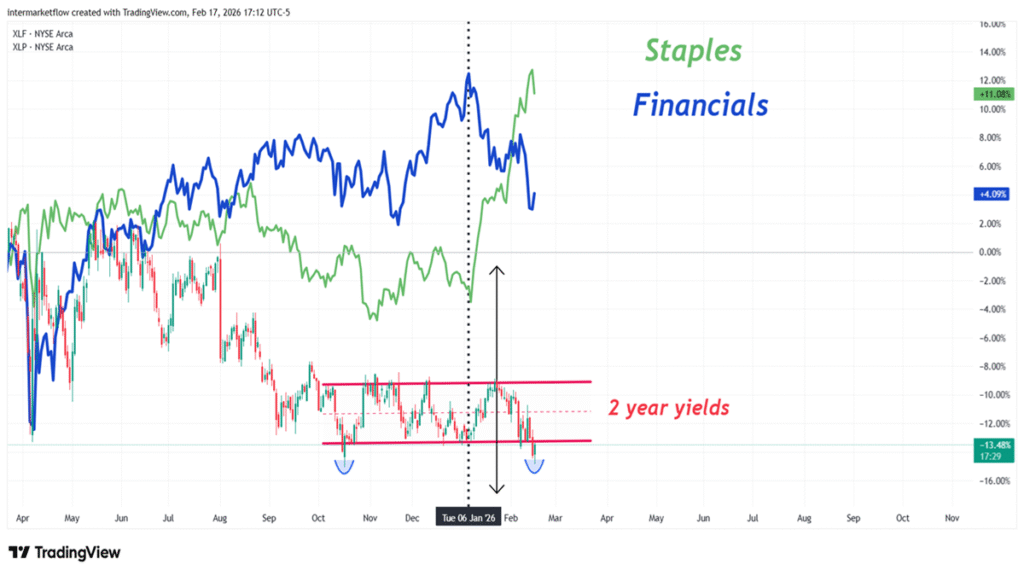

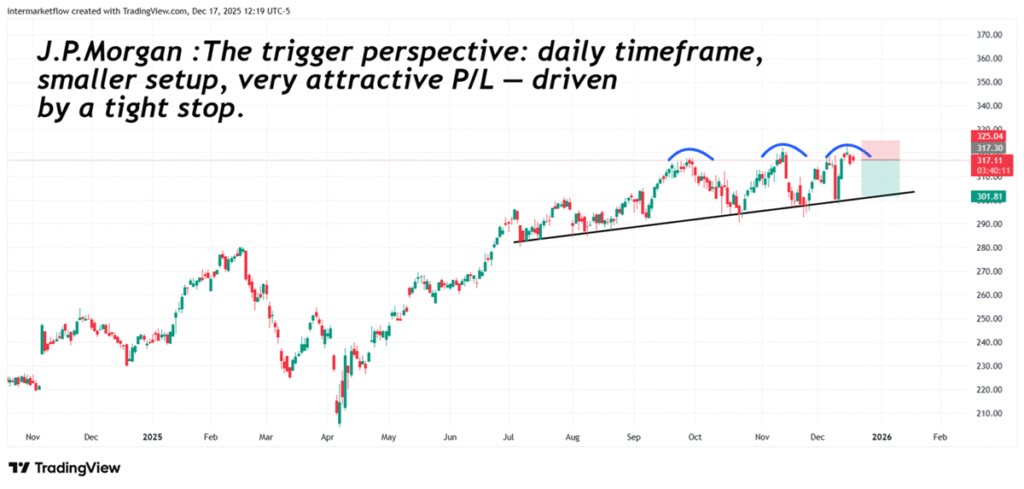

#93 FINANCIALS DEFENSIVE REGIME: THE MATH IS BROKEN

Lower rates are signaling distress, not stimulus. Discover why the Jan 7 pivot redefined the XLF regime and get the full WFC trade box setup (Target: 76.5).

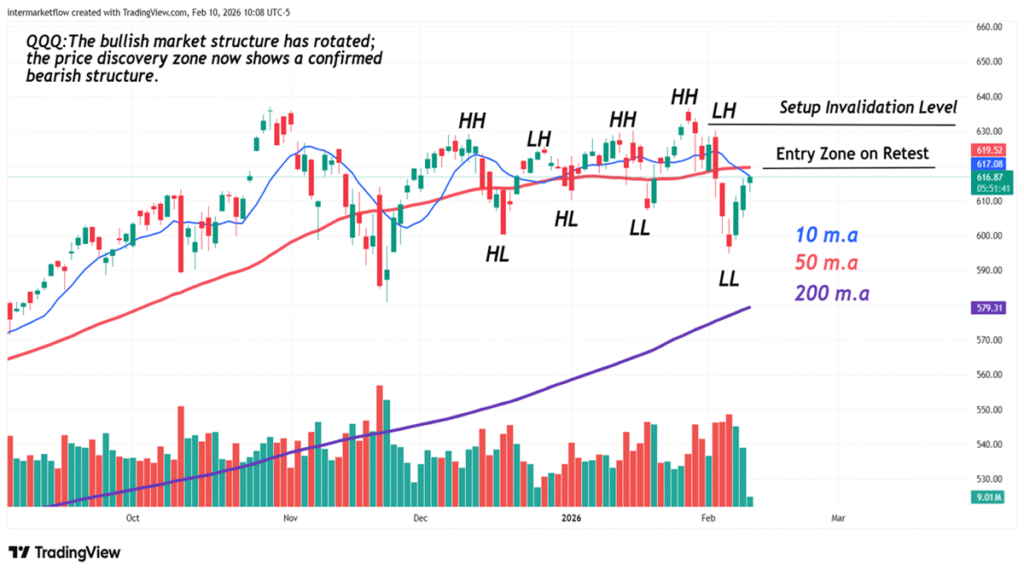

#91 Context and Follow-Up: QQQ & IWM — From Sunday to Today

We analyzed which correlations shifted over the past month—and in which part of the curve.

What we found in Small Caps, Tech, and the 2-year yield was striking.

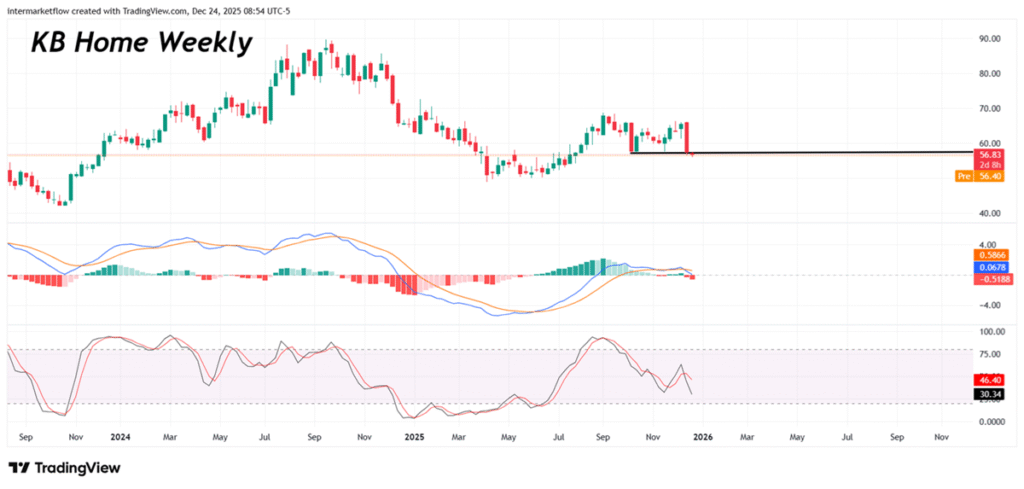

#85 The Real Economy: Winners, Losers, and Injured Players

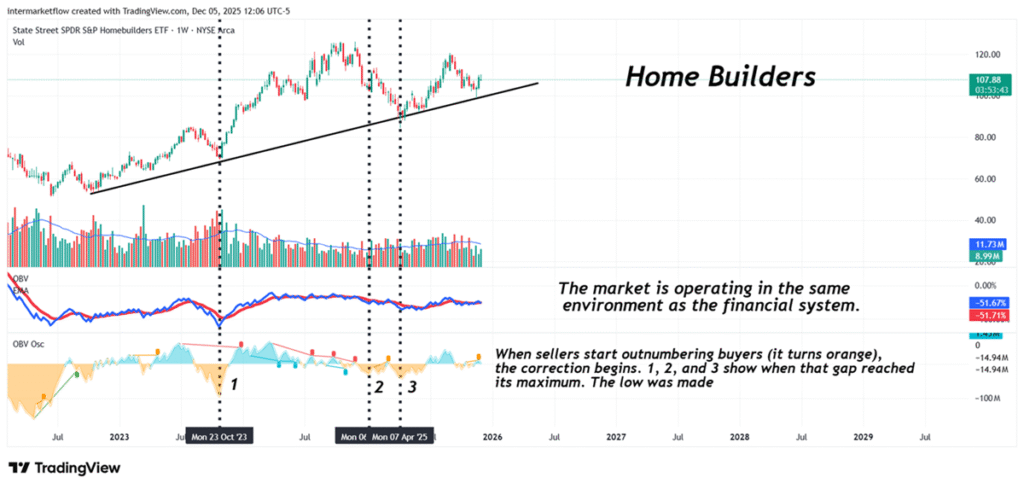

The real economy and the context we are trading today.The VIX: a historical perspective on current levels, with a specific comparison to the Dot-com and GFC recessions.The real economy and divergent reactions within the financial and homebuilding sectors.

Intermarket flows: the same winners remain in control.Intra-market analysis: segmentation to see what headline data hides.The health of the AI trade.

Sector-by-sector relative performance versus the S&P 500.

Relative strength within the homebuilding sector, identifying specific vehicles.

Home Depot and KB Home: wounded prey on the open plain.

#84 The discretionary delusion and the market’s stance. Three vehicles to track.

We break down retail sales and why Consumer Discretionary is completely detached from reality. We picked three vehicles to go deeper, while tracking how risk-takers positioned themselves this week.

#83 Unemployment, Macro Cycles and Sectors

A historical perspective on unemployment—its levels and the current trend relative to past cycles. Its connection to sectors, and how sector leadership evolves as the cycle matures. We then zoom in on two sectors in search of vehicles to trade.

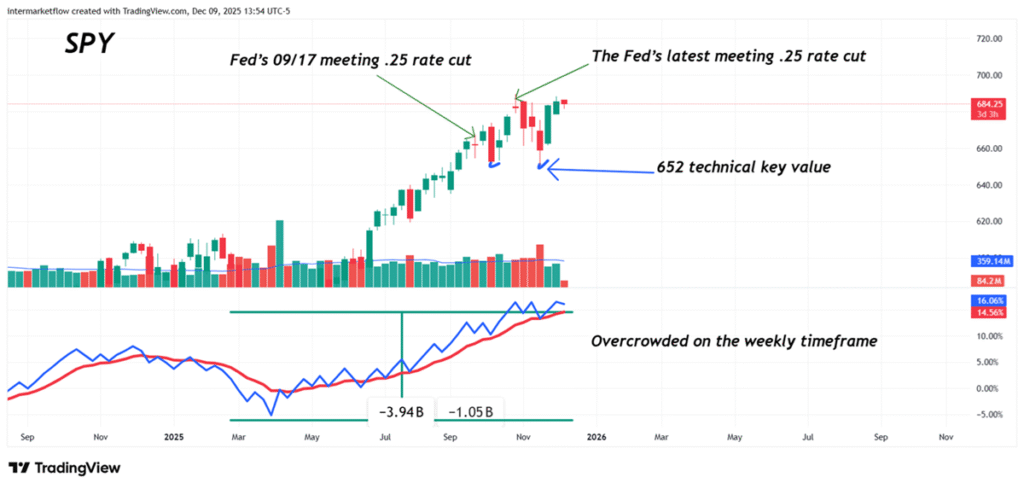

#81 Feed meeting: On your marks, get set… go

The Fed meeting is acting as the catalyst. Here, I read the messages the S&P 500 is sending across different timeframes. Too clear not to hear.

#80 End of QT ≠ QE.

We analyze the end of QT and the rate cut scheduled for next December 10. Which mechanisms must reactivate for it to transmit into the real economy, and the scenarios ahead. Why we believe we could see a “buy the rumor, sell the news” into Wednesday, and the three stages of a correction scenario.