#59 Macro reading of the S&P 500 and its sub-indices

Each sub-index of the S&P 500 reflects the situation of different types of companies.

When analyzing the S&P 500 from a macro perspective, it’s essential to go beyond the index level and dive into its underlying sectors. Each sub-index reflects different parts of the economy—cyclical, defensive, interest-rate sensitive, etc.—and reading their relative performance helps anticipate where capital is rotating, how macro expectations are evolving, and what stage of the cycle we’re likely in.

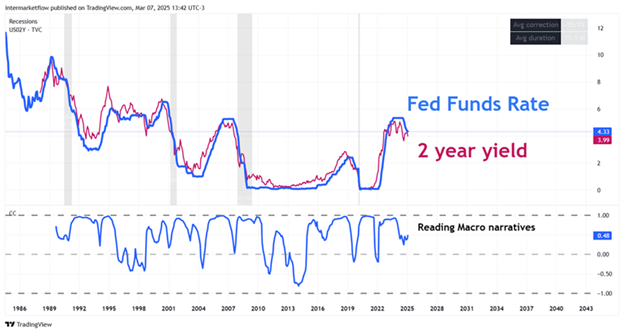

#58 Causality between the yield curve and leading indicators.

We covered two different interpretations of the yield curve: the inversion and the first Fed rate cut. We analyzed the last four recessions and measured the lead times to estimate the window until the next recession.

#57 A deep dive into the current state of the dollar

This article explores the U.S. dollar’s status as the world’s reserve currency—its role as a safe haven, as a reserve held by both private investors and central banks, and as the dominant currency in global trade.

#56 Global equities—time to open our minds. Trading has become a global game.

U.S. markets are facing high uncertainty. They’ve just gone through the deepest and longest yield curve inversion in history. With valuations stretched and prices at all-time highs, it’s time to open your mind and consider other options.

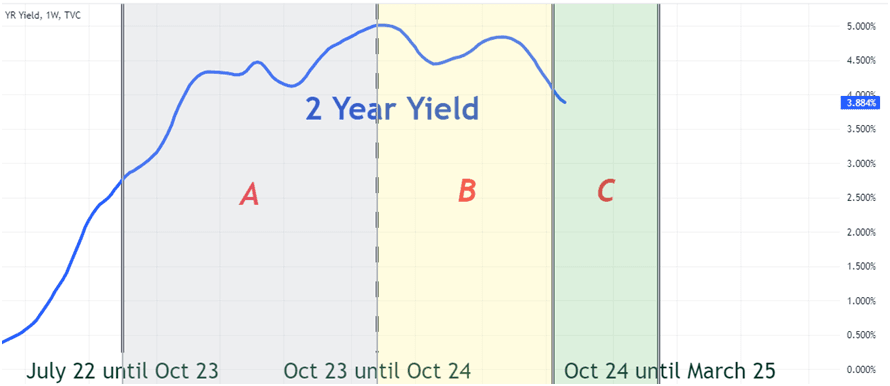

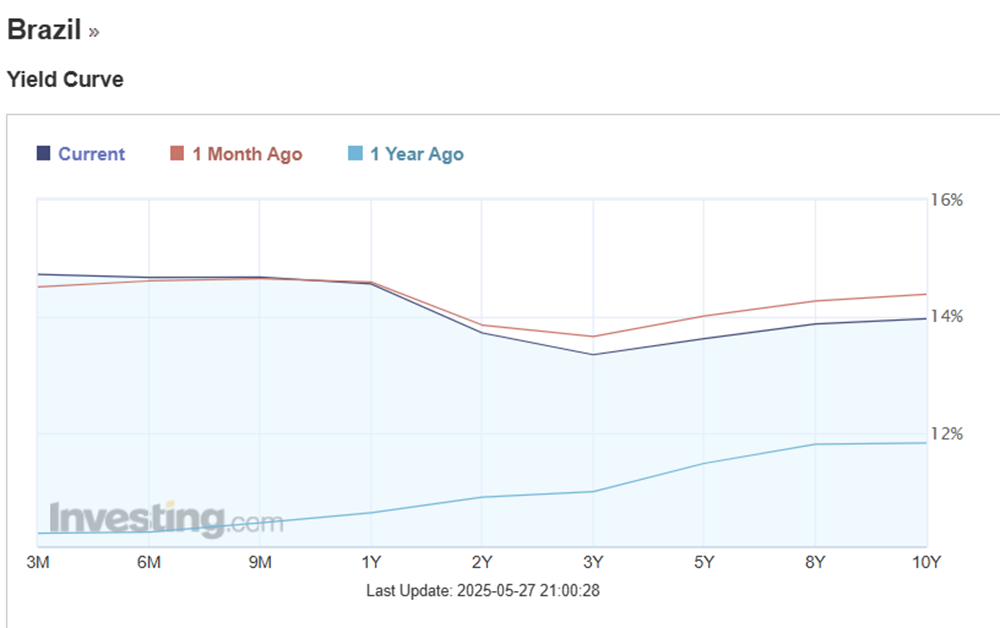

#55 Episode 2- Decoding the Yield Curve Messages

This is the second step to strengthen your understanding of the yield curve—decoding the messages it sends and the effects it has on the real economy.

#54 Episode 1- Yield Curve: Basic Concepts Behind Its Formation

This is your first step toward understanding the yield curve from scratch.

Simple, clear, and concise. Enjoy it.

#52 Micro and Small Caps: valuations across and within sectors

In this article, we analyze the capital rotation into defensive sectors of the economy, while also examining intra-sector valuations between small-cap and large-cap stocks.

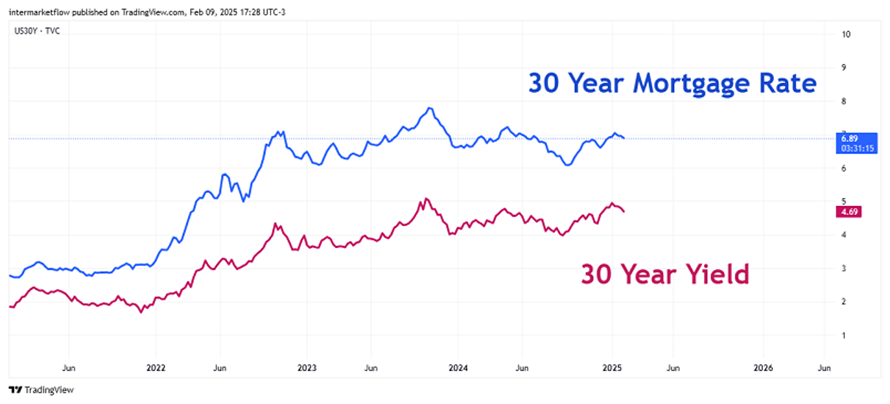

#51 Reading the bond market and analyzing interest rate components

Reading the Bond Market: Breaking Down the Components of Nominal Rates to Understand Bond Market Dynamics and Decipher Its Signals

#48 Overshooting, Economic Fluctuations and trading opportunities.

How do you trade in this kind of environment? What we’re seeing now falls under what we know as herd behavior. And contrary to what many believe, this type of behavior follows identifiable patterns—and can be highly profitable. These are the rules of the game now. We know how the opposing team plays—now it’s just […]

#46 Interest rates: The heart of the financial system.

Understanding the directional effects they create is essential for making sense of the markets. We can think of global capital as a fixed amount of capital—what changes are the stops where it temporarily settles. Nothing in the markets moves in isolation; everything is interconnected through interest rates. Components of an interest rate: ꭆ(n)= ꭇeal ꭇate(n) […]