#97 Intermarket Signals: Capital Flight from US Beta to Global Alpha

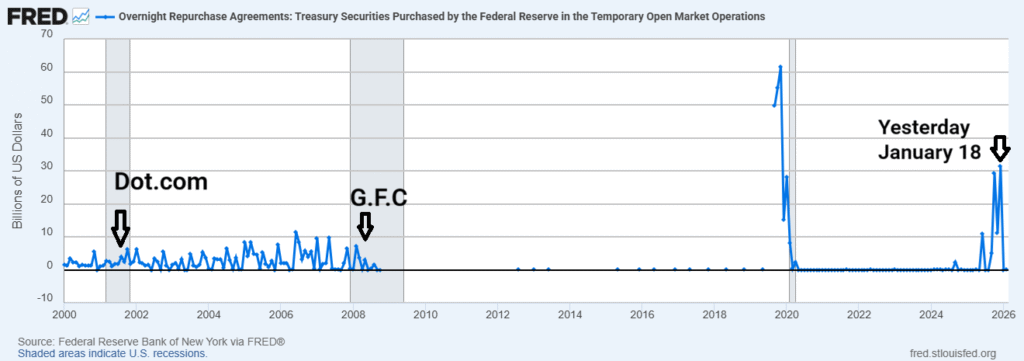

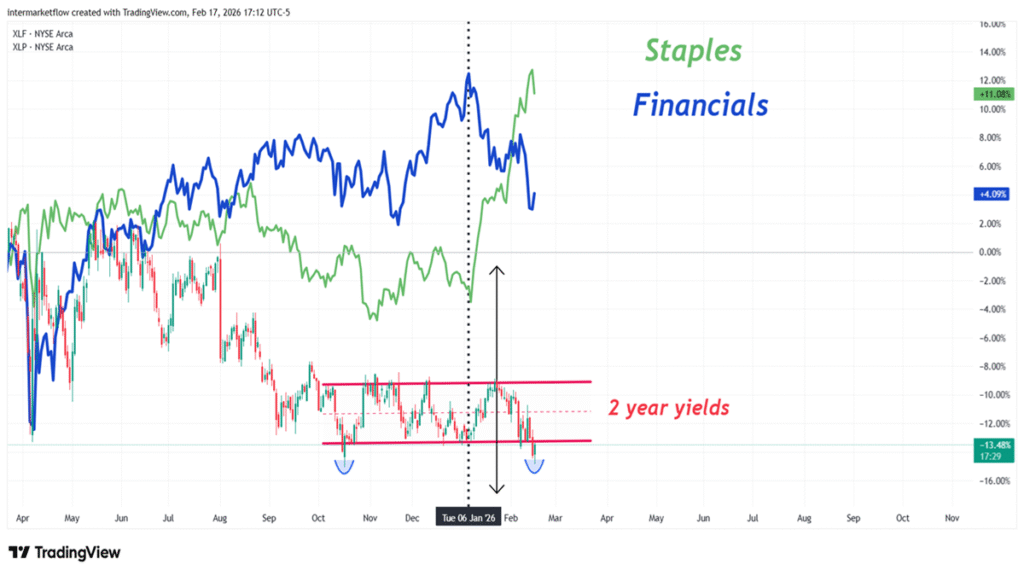

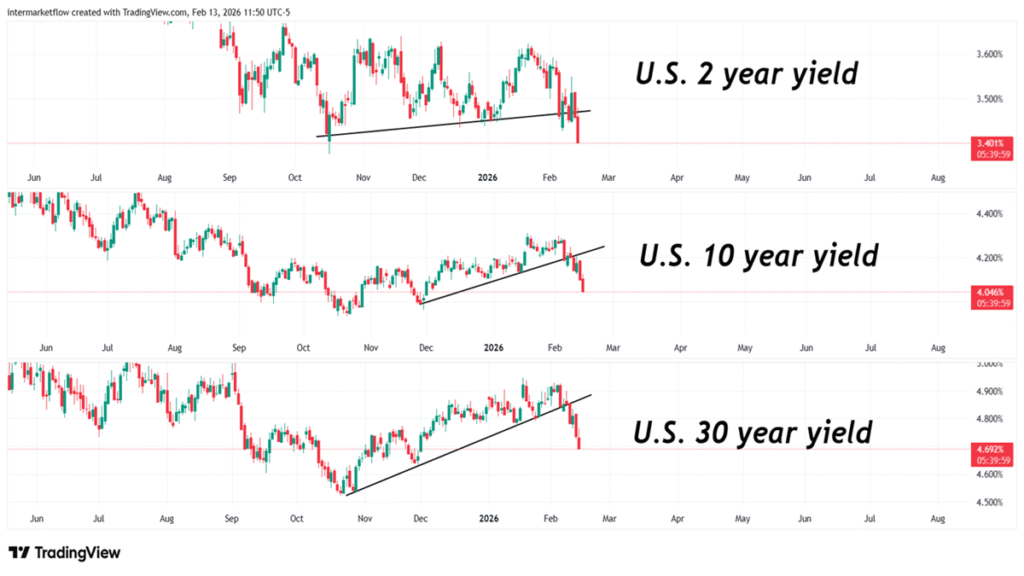

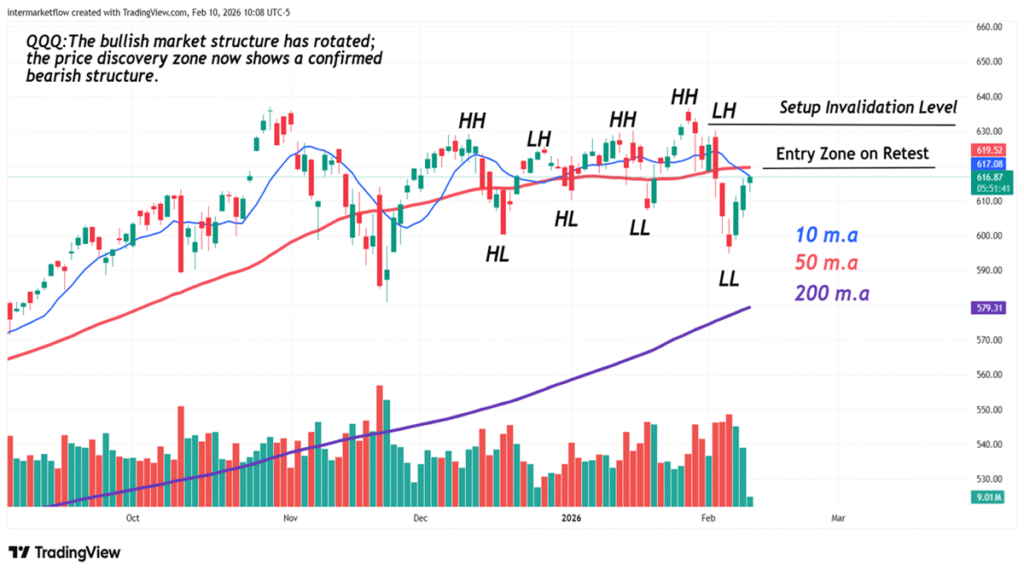

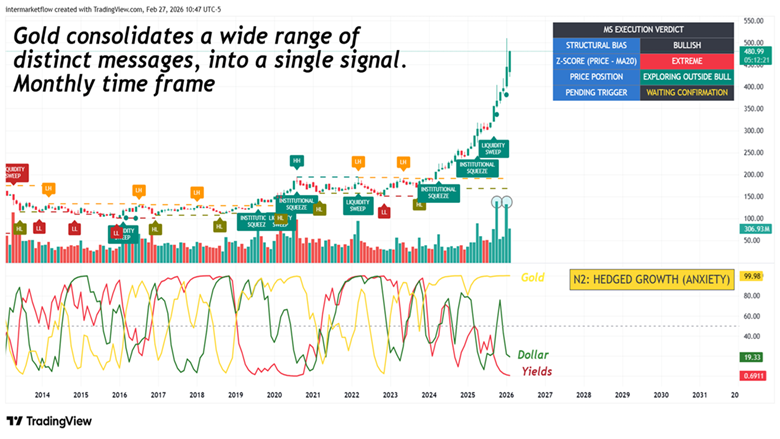

Intermarket Signals point to a structural capital flight from US beta. While Fed liquidity masks a cyclical collapse and creates a bull trap in the S&P 500, smart money is aggressively repositioning into Swiss Franc safety, Korean semiconductor alpha, and Brazilian real yield. Read the full Sunday Verdict to map