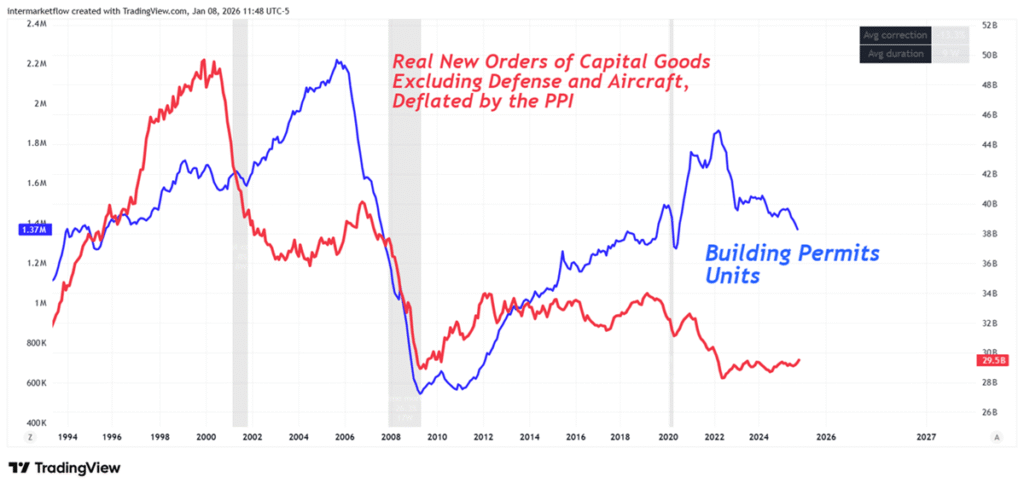

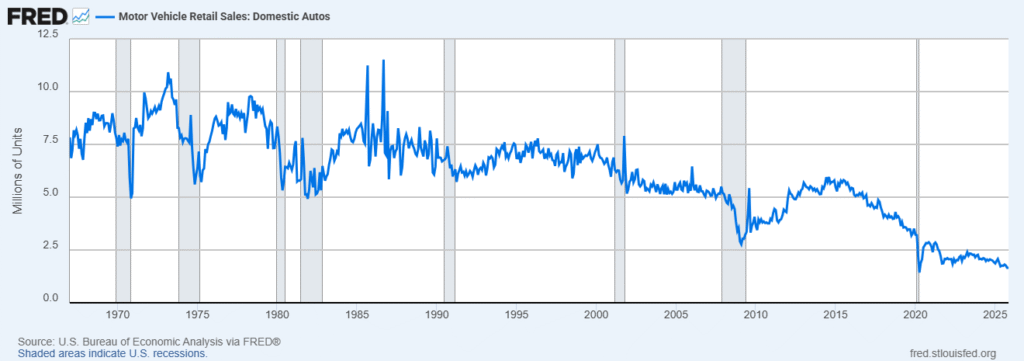

#89 New Orders: Nominal Strength, Real Weakness

New orders can be misleading. We analyze the nominal trap through building permits and intermarket, intramarket and speculative capital flows.

New orders can be misleading. We analyze the nominal trap through building permits and intermarket, intramarket and speculative capital flows.

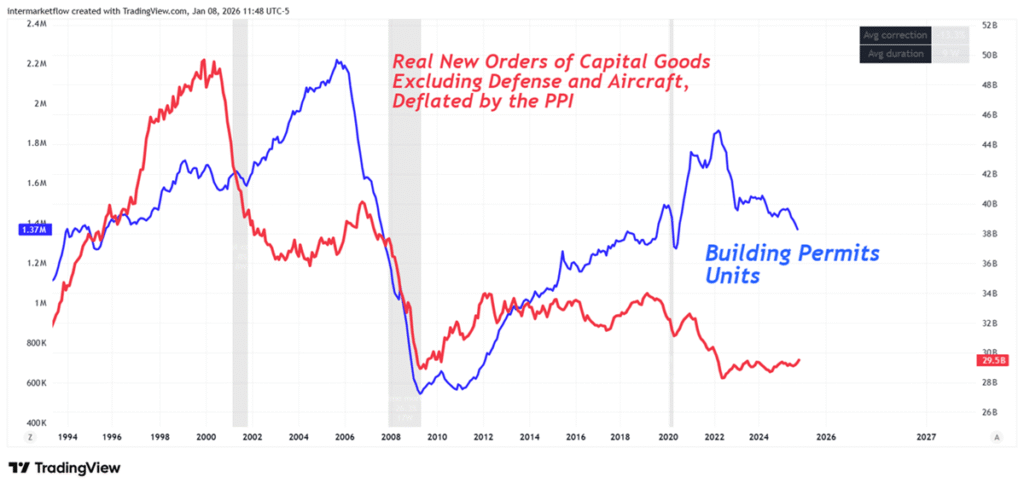

An intermarket analysis of Brazil and emerging markets, exploring yield curves, FX risk, carry dynamics, commodities flows, and their role as long-term portfolio diversifiers in a shifting global macro environment.

Intermarket Flows: We analyze capital outflow and inflow hubs, seek risk-efficient operating environments, and examine currencies and commodity-intensive economies.

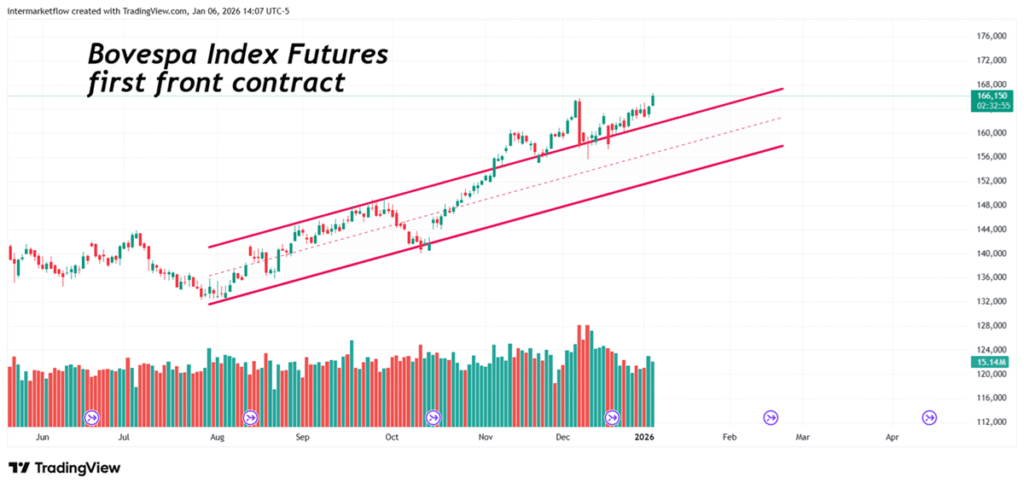

We analyze the evolution of auto credit and vehicle sales, and how short-term interest rates directly impact demand. We place today’s sales levels in historical context and examine five vehicles within the auto retail sector.

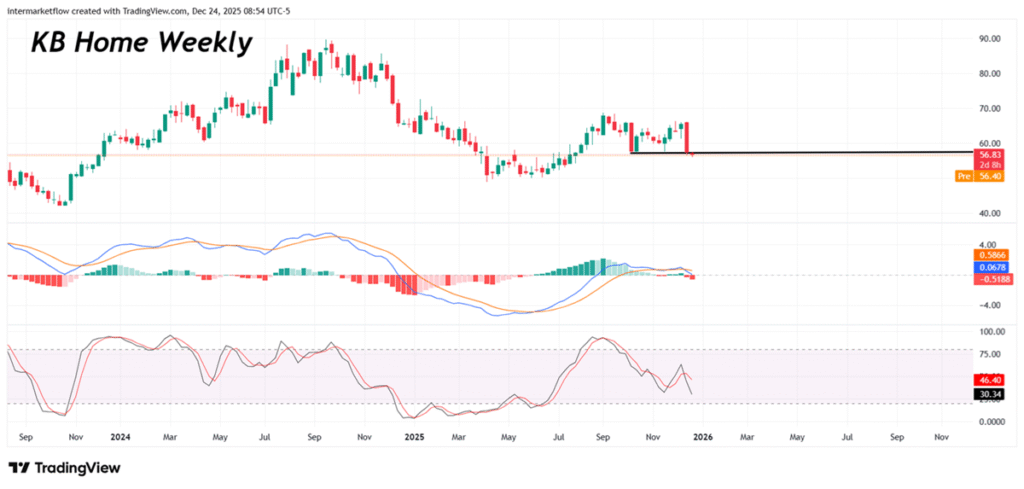

The real economy and the context we are trading today.The VIX: a historical perspective on current levels, with a specific comparison to the Dot-com and GFC recessions.The real economy and divergent reactions within the financial and homebuilding sectors.

Intermarket flows: the same winners remain in control.Intra-market analysis: segmentation to

We break down retail sales and why Consumer Discretionary is completely detached from reality. We picked three vehicles to go deeper, while tracking how risk-takers positioned themselves this week.