#56 Global equities—time to open our minds. Trading has become a global game.

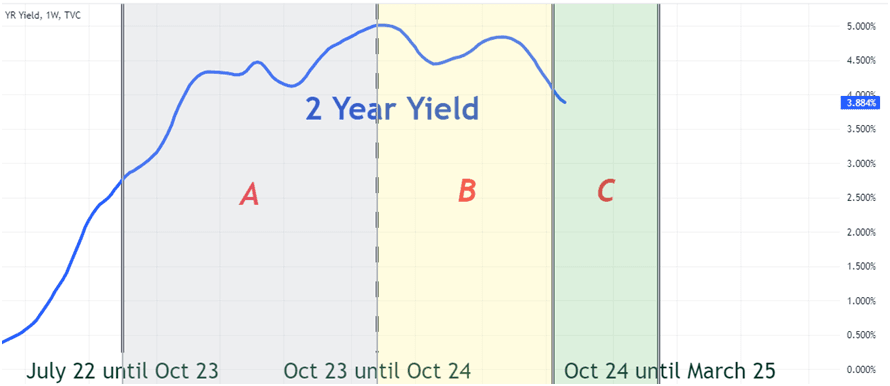

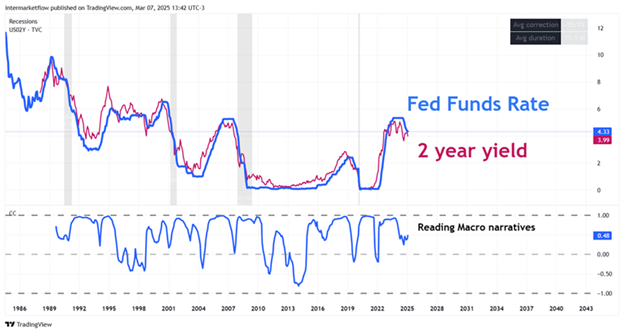

U.S. markets are facing high uncertainty. They’ve just gone through the deepest and longest yield curve inversion in history. With valuations stretched and prices at all-time highs, it’s time to open your mind and consider other options.

#55 Episode 2- Decoding the Yield Curve Messages

This is the second step to strengthen your understanding of the yield curve—decoding the messages it sends and the effects it has on the real economy.

#54 Episode 1- Yield Curve: Basic Concepts Behind Its Formation

This is your first step toward understanding the yield curve from scratch.

Simple, clear, and concise. Enjoy it.

#53 Intermarket futures update and the strong signals it’s sending

We analyze the current state of intermarket analysis. We identify which asset class is out of sync with the rest, as well as the individual assets that offer the most compelling trading opportunities.

#52 Micro and Small Caps: valuations across and within sectors

In this article, we analyze the capital rotation into defensive sectors of the economy, while also examining intra-sector valuations between small-cap and large-cap stocks.

#51 Reading the bond market and analyzing interest rate components

Reading the Bond Market: Breaking Down the Components of Nominal Rates to Understand Bond Market Dynamics and Decipher Its Signals

#50 Macro, the Market, the F.E.D. and the Political Class

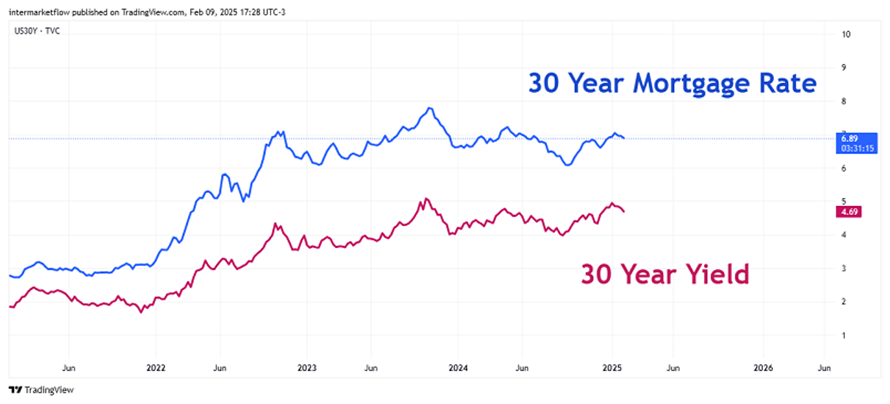

How different macro narratives are shaped through the interaction between these three players A macro view of the real estate market Affordability is at historic lows. It’s getting harder to buy a home, which suggests inventory may rise even further. Timing and projections for the sector Production forecasts in the housing market already show an […]

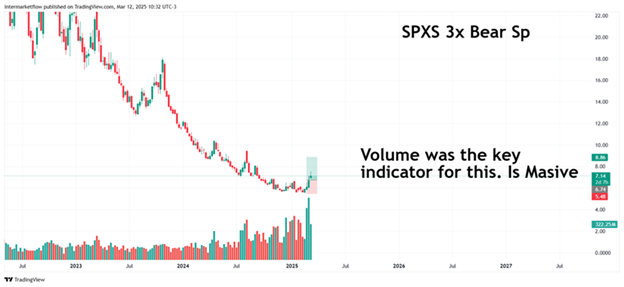

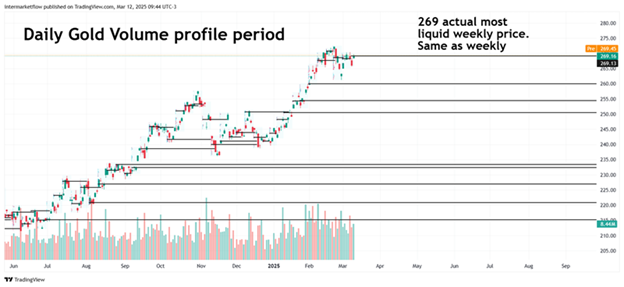

#49 A volume-based system to trade macro narratives

A deep dive into the different ways volume can be read We’re in a market where macro reports have taken a back seat— daily news is driving prices. It’s a time for weekly and daily trading, and in this context, it’s technical analysis that guides us. We already know we’re in a volatile price environment, […]

#48 Overshooting, Economic Fluctuations and trading opportunities.

How do you trade in this kind of environment? What we’re seeing now falls under what we know as herd behavior. And contrary to what many believe, this type of behavior follows identifiable patterns—and can be highly profitable. These are the rules of the game now. We know how the opposing team plays—now it’s just […]

#47 Before we begin—here you´ll find:

The State of the American Consumer and Why a Correction Is Imminent. #47 Current expectations of the American consumer—and the trades they’re generating, at a systemic level. We’ve already looked at this from the perspective of real and disposable income—over six months ago here. Now, let’s examine it through the lens of current consumer expectations. […]