Context and Follow-Up: QQQ & IWM — From Sunday to Today

For today’s analysis, we revisit the four key conclusions from Sunday, with QQQ and IWM at the center of the framework:

- Correlation Inversion:Over the past month, QQQ and IWM have inverted their relationship with rates.

- Focus on the 2-Year: The 2-year segment (US02Y) remains the most active part of the curve, showing the largest marginal changes.

- Flows to Cash: The Cash is King category has continued to attract capital steadily for the past month, reinforcing the defensive bias impacting QQQ and IWM.

With these premises in mind, the charts below present the technical analysis of these variables and an operative setup for QQQ.

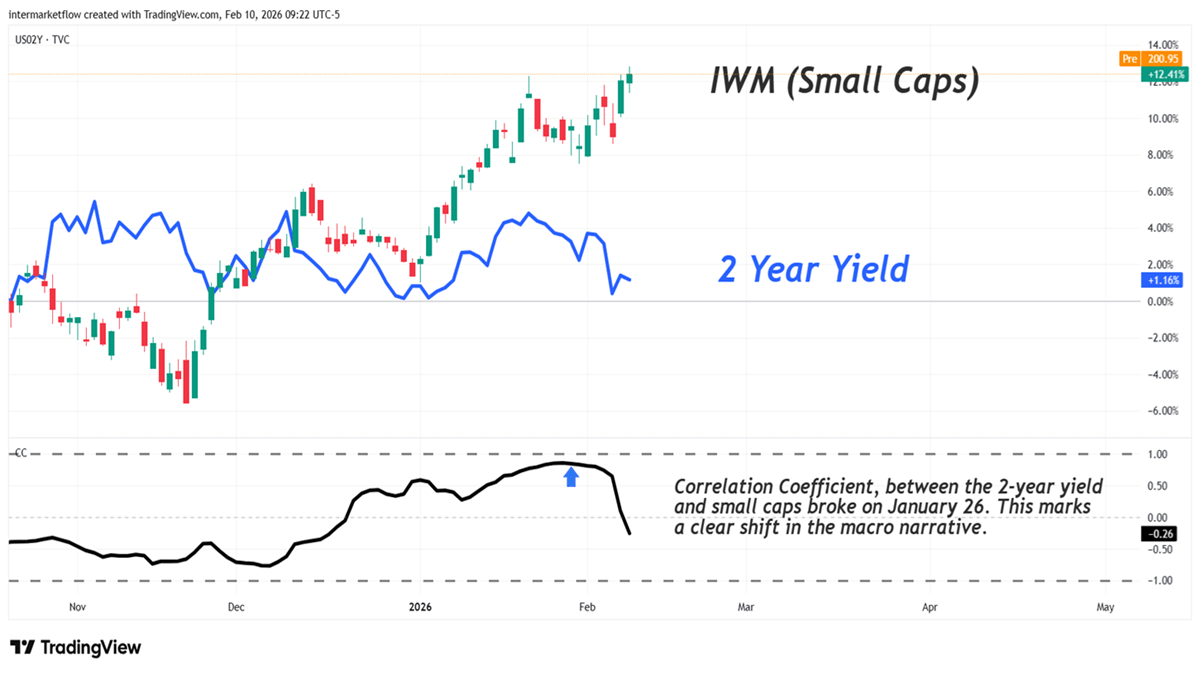

IWM and the 2-Year Yield (US02Y) correlation

After the correlation break that began on January 26, IWM is attempting to hold above its prior peak without the flow support that previously came from the 2-year segment. This marginal advance—now disconnected from rate dynamics—sets up a potential double-top scenario at critical levels.

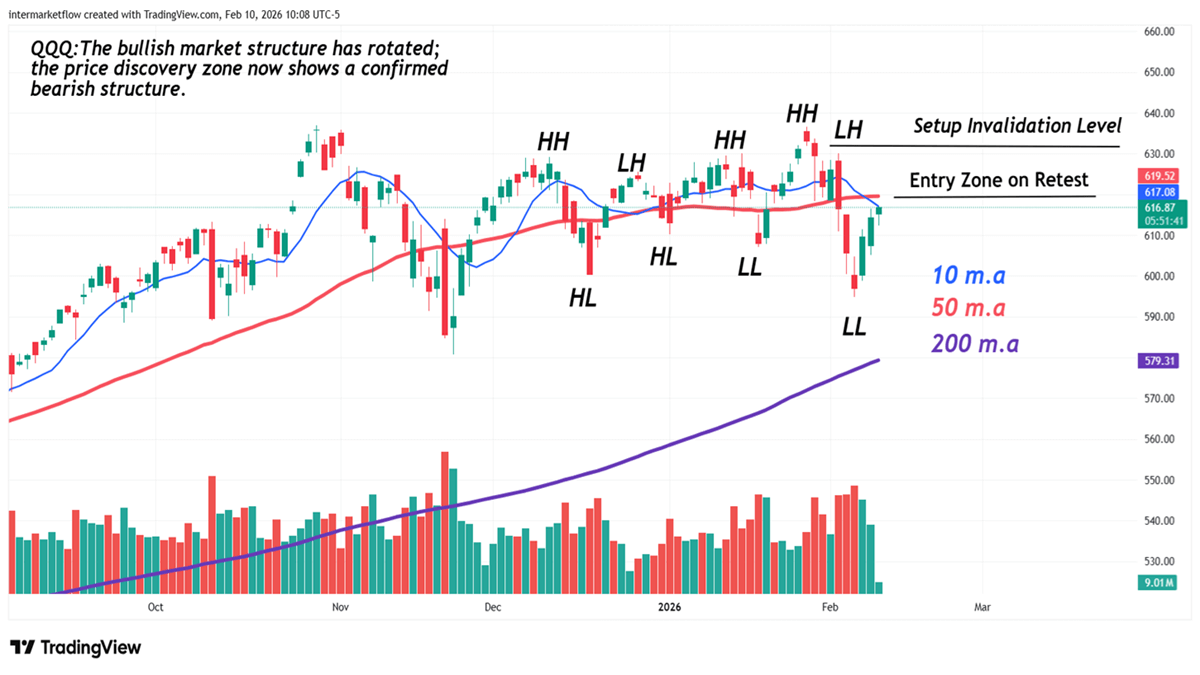

QQQ: Bearish Continuation Structure (Daily)

- Confirmed Bull Market Structure Break: The chart shows a clear transition from HH to LL, invalidating the prior bullish sequence.The subsequent price discovery phase already shows a confirmed bearish structure.

- Moving Averages Cross: Visual confirmation of the MA10 crossing below the MA50, now acting as dynamic resistance.

- Entry Setup: Marked zones for bearish trend continuation trade.

- Invalidation Zone: Very clear invalidation zone: above the last LH, which would break the current structure.

- Target: MA200.

Final entry price and stop define the risk/reward, with a moving target at the 200-day average. Position sizing should be adjusted to the stop required by the trade.

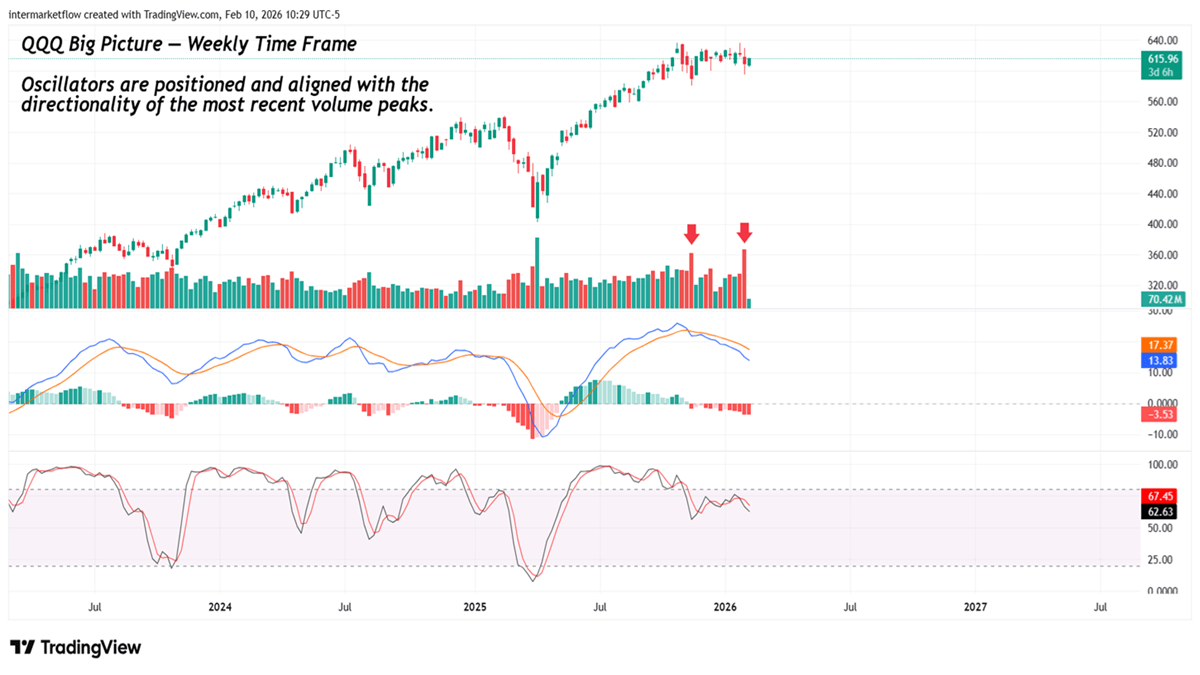

QQQ big picture (Weekly)

This chart is not meant to validate a direction—that was already defined by the Intermarket, Macro, Intramarket, and Statistical analysis we shared in Sunday’s report (read here). The mid week report has a real, operable approach where we simply observe the technical materialization of that scenario.

Outflow Evidence: Rising volume on bearish weekly candles is the physical proof of distribution that our intramarket analysis had already anticipated.

Oscillators in Regime: Indicator positioning on this timeframe confirms that price has entered the expected bearish expansion zone, with no signs of absorption.

Conclusion: Current price action is the logical consequence of the underlying variables. The Big Picture shows that the weekly structure has aligned with the risk diagnosis we laid out at the start of the week.

Catalysts on the Horizon

With the weekly structure confirmed and bearish price discovery underway, focus now shifts to fundamental catalysts.

- Macro Reports (Tomorrow): The morning data release will act as the potential trigger for the resolution of the structure we’ve outlined.

- Scenario: Given the current technical configuration, any morning volatility is interpreted as the fuel required to complete the expansion toward our liquidity targets.

- Management: Direction is set. Tomorrow, we will simply observe whether the market uses the macro report to accelerate the execution of the technical verdict already issued by QQQ.

See you on Sunday, god willing

Martin

If you believe this is an error, please contact the administrator.