Executive Summary: Trading Emerging Markets — Brazil

- Monthly and weekly intermarket flows: clear capital receivers and expellers shaping the current macro landscape.

- Trading an emerging market: the additional variables that go beyond traditional valuation frameworks.

- Spot rates in reals and dollars: the resulting rate differential and its macro relevance.

- Opportunity in short-term bonds denominated in Brazilian reals: attractive carry under current conditions.

- FX risks and local indices.

- Trading Brazil: the broader setup and context for a trade with different durations and portfolio objectives.

- EWZ trading context: a concrete trade setup and scenario.

Trading Emerging Markets

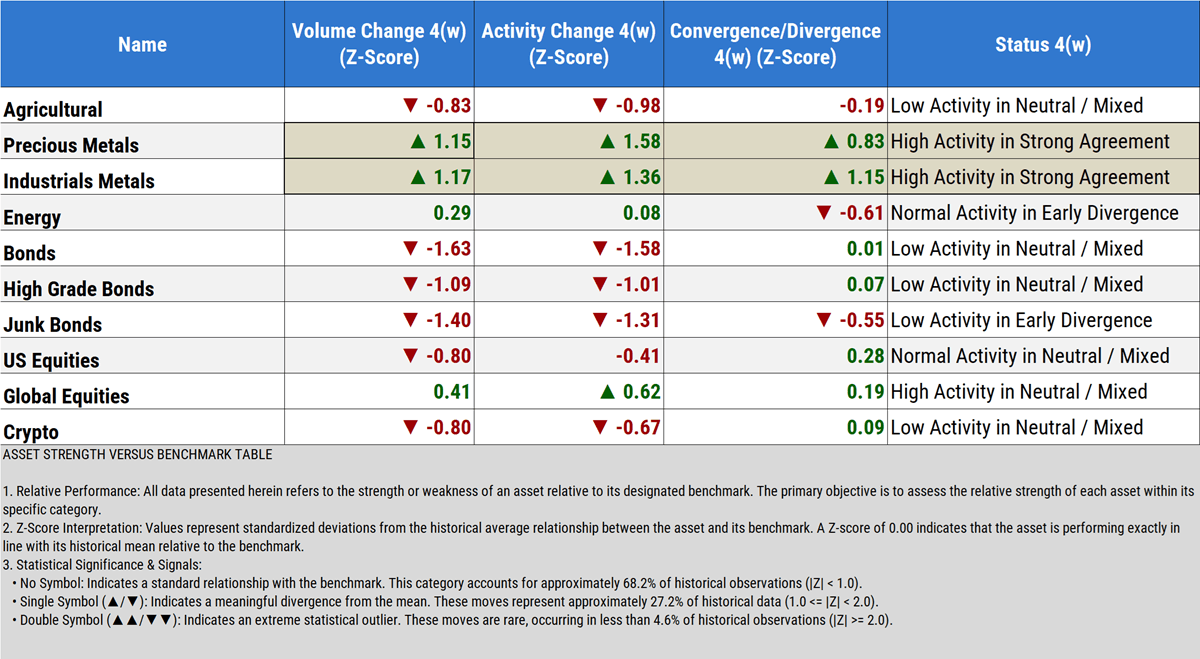

Trading Emerging Markets gives a tremendous diversification tool. As we move into 2026, capital is gradually finding its direction and reallocating once again. If we look at intermarket flows over the past month—as discussed in the previous article—the receivers and expellers are clear. Capital is exiting all types of bonds, regardless of maturity, credit quality or country of issuance and flowing into commodities, particularly precious and industrial metals.

Intermarket flows Monthly Time frame

Intermarket flows weekly Time frame

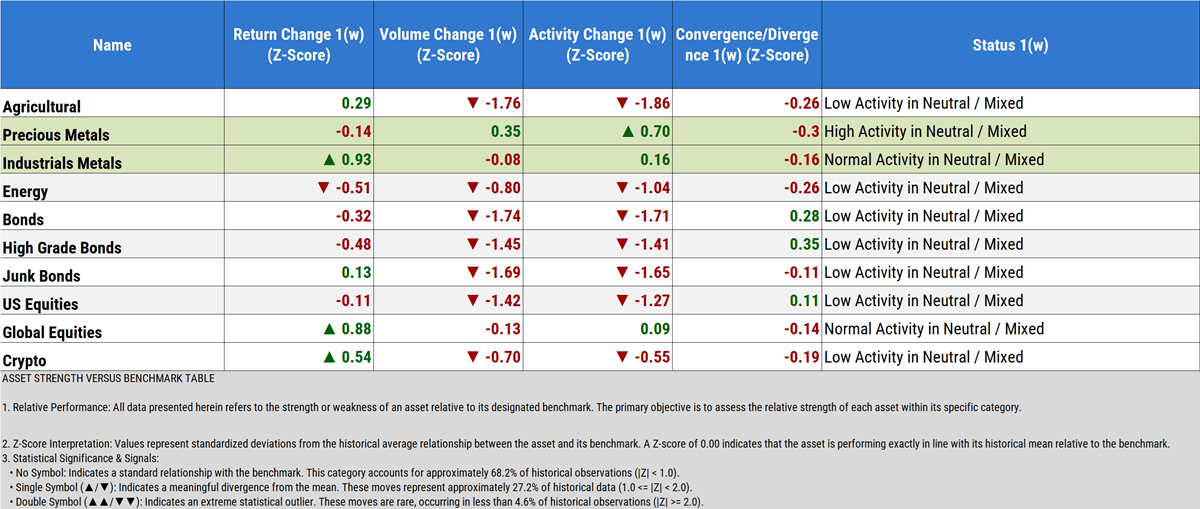

So far, nothing new. Let’s narrow the frame to a one-week view to see what has happened since the start of the year.

Weekly analysis does not carry the same weight as the monthly view, but it keeps returns and volume at similar levels. Precious metals are the only segment showing high activity relative to their average—weekly, in this case. In short, capital is flowing in and repositioning.

Risks of Trading Emerging Markets and Commodities

There are multiple ways to trade a commodity, depending on risk tolerance and time horizon. What matters is understanding all the variables that ultimately drive the profitability of this type of trade.As we saw with the yen carry trade, outcomes are defined by several factors.

Specifically:

- FX risk

- Interest rate risk

- Country-specific systemic risk

- Commodity price risk itself

- Instrument-specific risk (bond, equity, option, etc.)

An inherent risk of holding a portfolio

The nominal risks in our portfolio—currency, interest rates, asset prices, and even country risk—are always present. They may be smaller and more measurable than in emerging markets, but they are real. Even sitting in cash in a dollar-based account, earning interest, still involves FX and inflation risk.

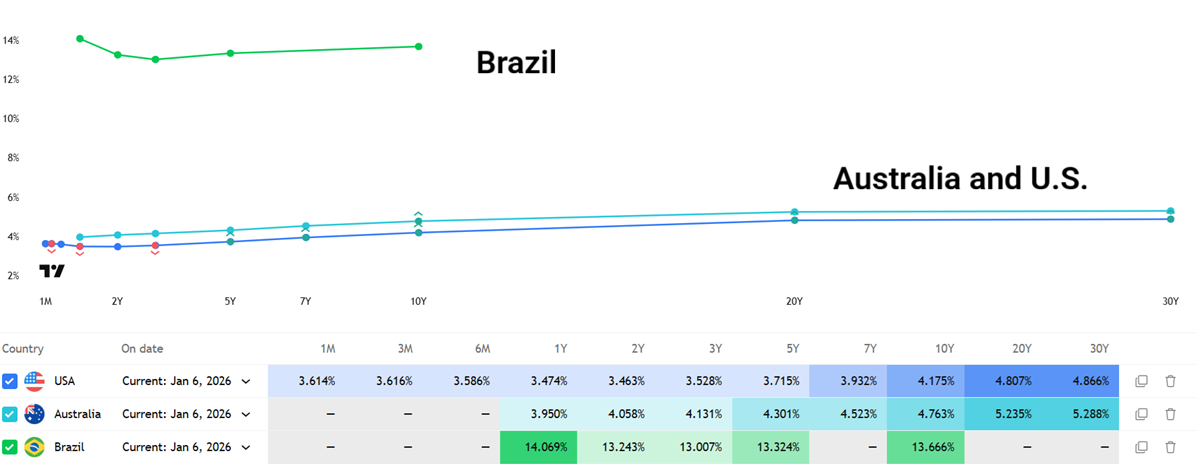

The Yield Curve and Commodity Countries

Brazil’s yield curve is shorter because it lacks a deep long-term debt market, a trait shared by most emerging economies. Limited confidence in fiscal policy, exchange-rate management, the legal framework, and the political system constrains long-term liquidity.

Risks of Trading Emerging Markets: Yield Curves and FX

Today’s spot policy rates (local currency vs. USD):

- Brazil Selic: ~15.00% for debt denominated in Brazilian reals—an attractive opportunity given current dollar conditions and the chart below. A short-term bond in Brazilian reals offers exceptional carry. While it does not replicate the dollar-based FX dynamics of the yen, even in a scenario where the real appreciates against the dollar, the rate differential remains substantial. Better than that, it gives you time to react.

- Fed Funds: ~3.50%–3.75% for debt denominated in U.S. dollars.

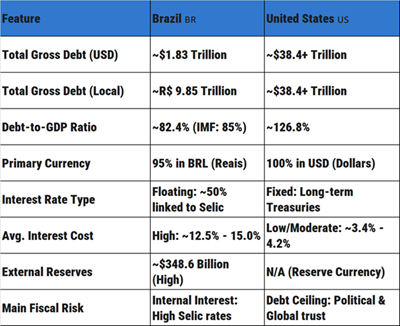

In the article’s appendix, a table outlines Brazil’s debt profile and compares it with that of the United States

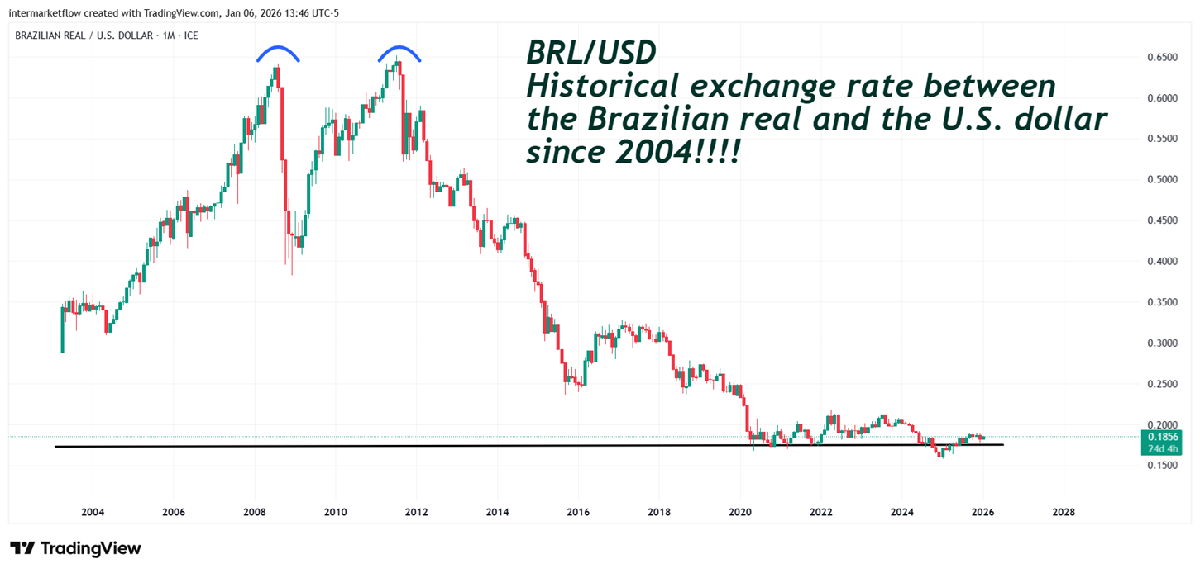

Trading Emerging Markets: FX risk

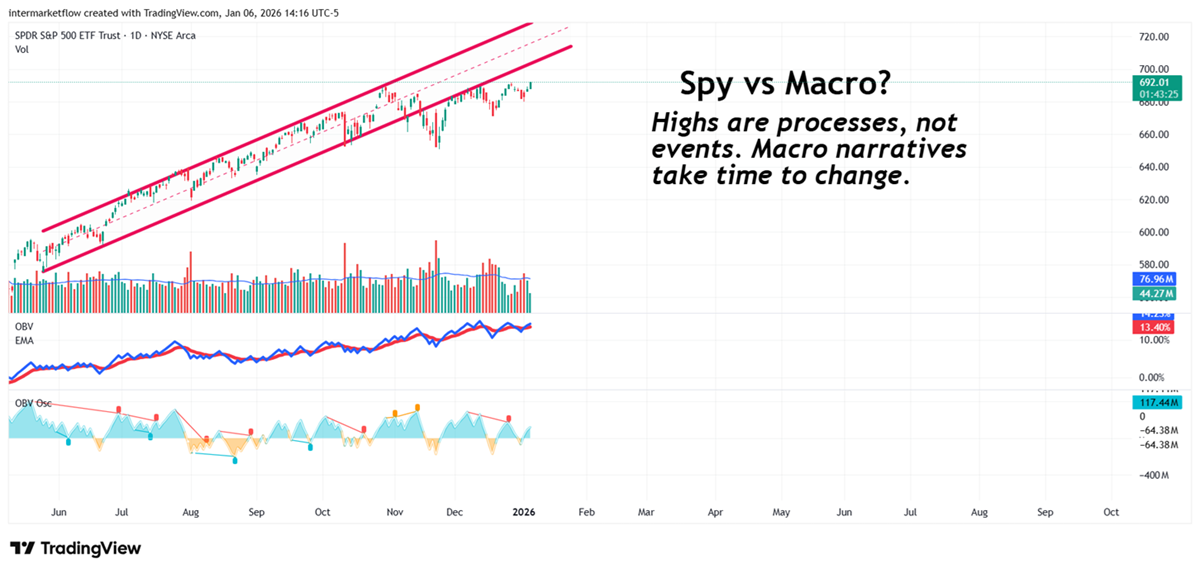

Levels are never a good reason to enter a trade—at least for me. Still, when we look back to 2004 and see historically low levels alongside capital inflows into commodities, it’s a scenario I’m comfortable with, especially when approached as a holder position and a portfolio diversification anchor.

Trading Emerging Markets: Local indexes

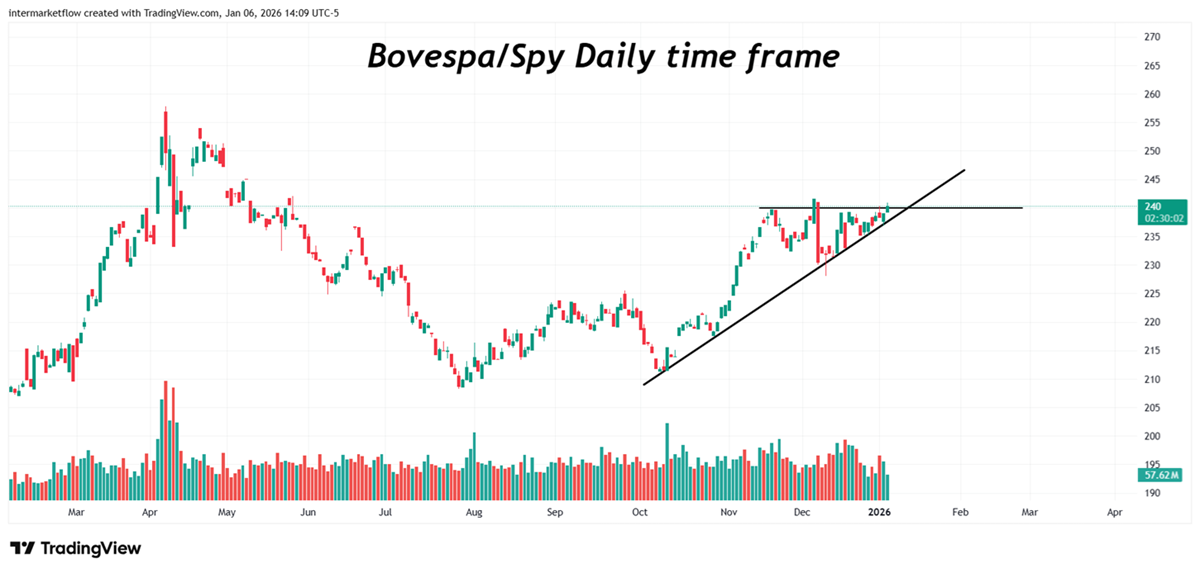

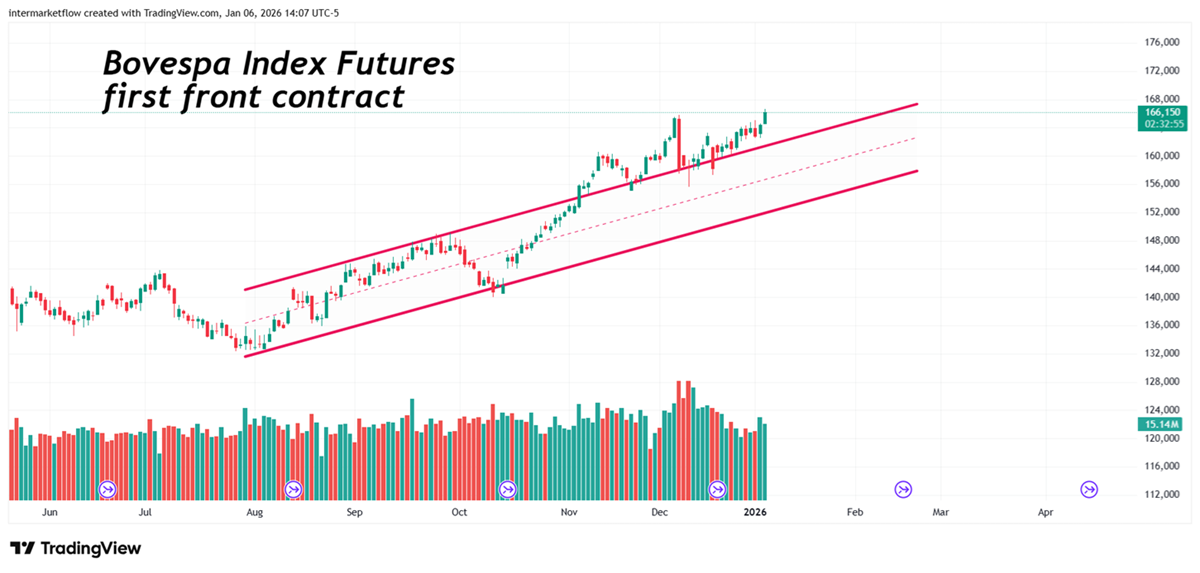

Bovespa is Brazil’s main stock market index and this particular ratio becomes especially relevant when combined with the following two charts.

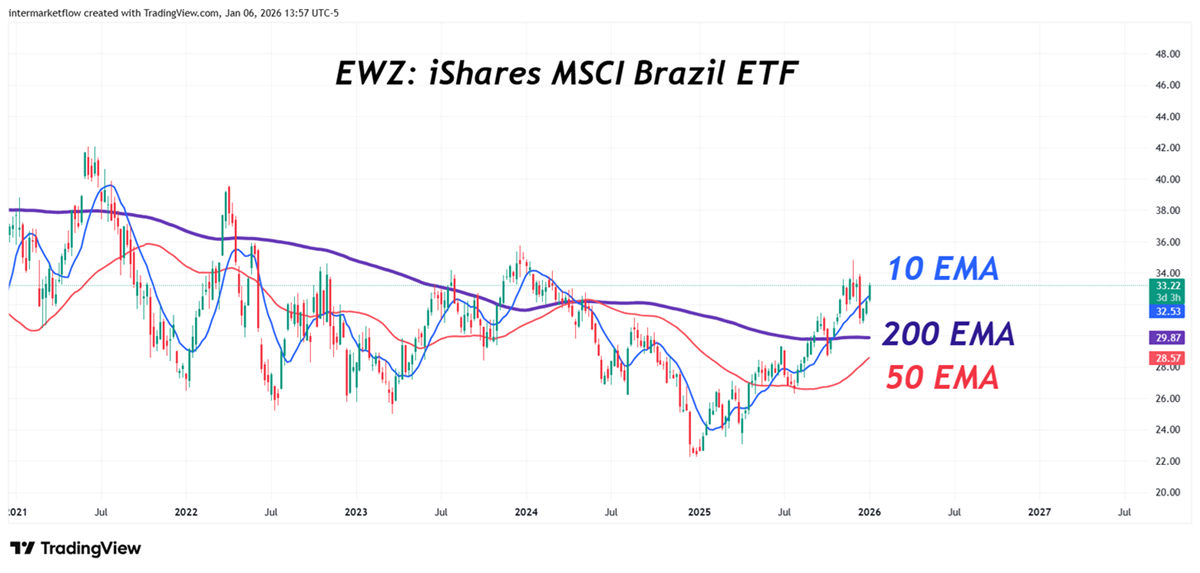

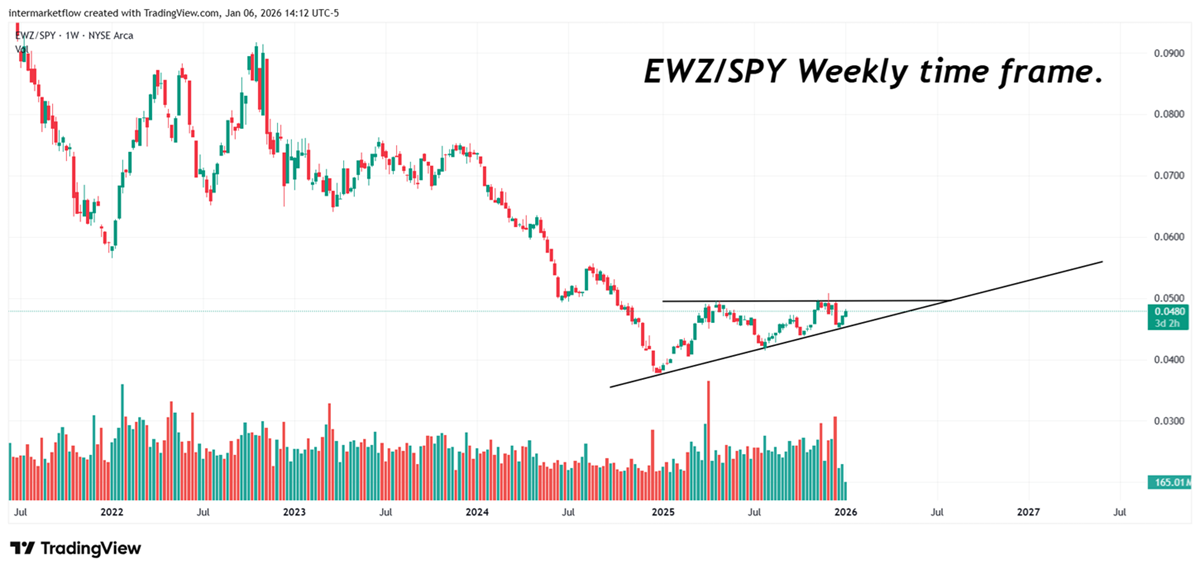

Trading Emerging Markets: The vehicle, EWZ ETF (iShares MSCI Brazil ETF)

Foot note: A perfect golden cross is forming. What makes it perfect ain’t the cross per se, its de amplitude between moving averages preceding it. If you notice this was not the case in previous episodes.

EWZ represents Brazil’s equity market, not the Brazilian economy as a whole—a critical distinction. It is a proxy for “exporter and financial Brazil,” closely tied to commodities, the dollar, and global flows rather than domestic consumption. This risk is related to Brazil risk, but it is not the same—and it is far from negligible.

Trading Emerging Markets Commodities economies: Copper, leading industrial commodity

Conclusions

Trading an emerging market requires additional layers of analysis beyond traditional valuation. It’s not about whether a local stock, index, or option is under- or overvalued—the game is more complex. That complexity, however, is precisely what gives these markets strong diversification power across currencies, assets, economies, interest rates, and commodities.

Appendix: Brazilian debt profile

Brazilian debt, unlike most emerging markets, has extraordinary characteristics, just in case someone is thinking about a short end bond. Here are some of them.

See you soon.

Martin

If you believe this is an error, please contact the administrator.