Executive Summary: Macroeconomics, rates and the Automotive Sector

- Weekly intermarket flows: which categories are seeing inflows and momentum, and which are not.

- The Fed, short-term rates, and the automotive industry.

- Auto sales in historical context.

- Auto purchase credit and its relationship with short-term rates.

- Five auto retailers and their relative performance versus the sector.

Macroeconomics, rates and the Automotive Sector

The different economic sectors have different sensitivities to interest rates across distinct maturities. As a result, there are sectors where the Federal Reserve’s interest-rate decisions have an immediate—or near-immediate—impact. The automotive sector is one of them. We took a deep dive into the data, and this is what we found.

Before diving into the macro picture, let’s first look at what happened across the different asset categories this week—a week that we already know is atypical given how thin markets currently are.

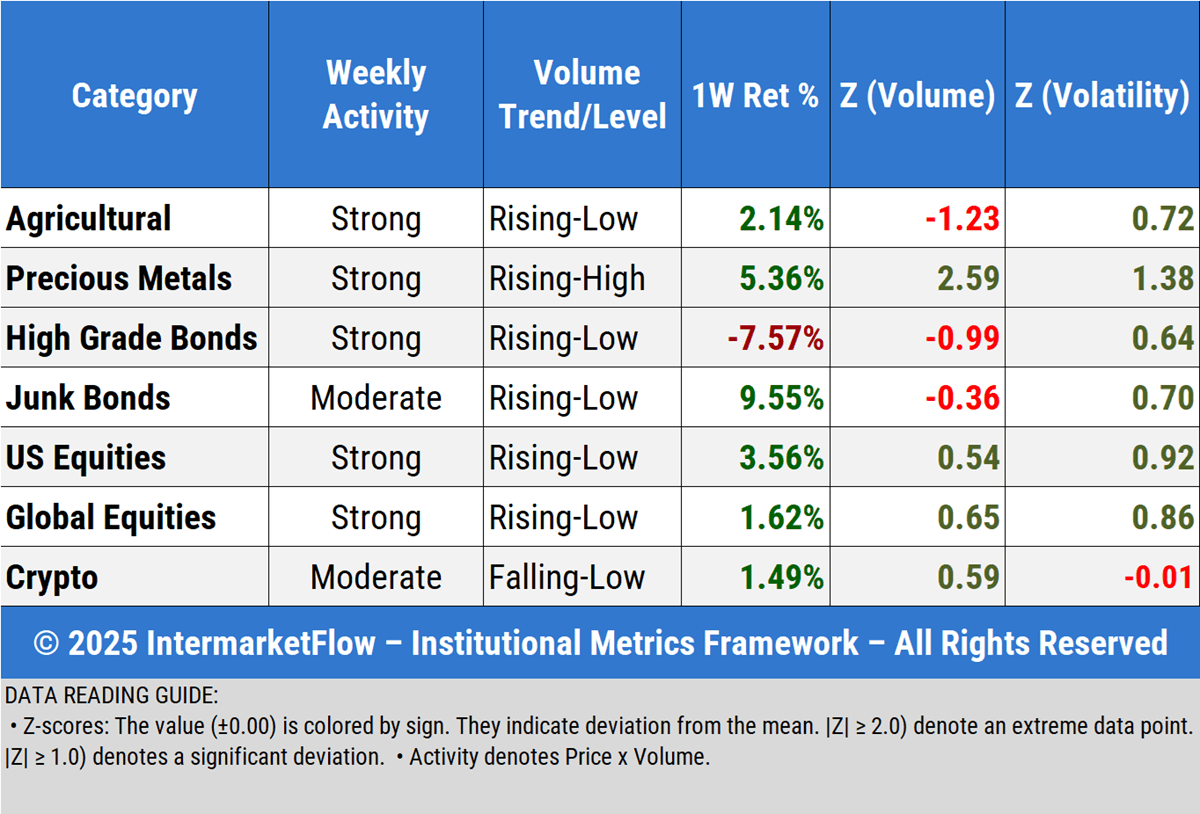

Capital flows: weekly variation relative to each category itself.

- Activity, returns, and volume remain concentrated in precious metals. That said, the level of volatility observed there is also sending an important signal.

- In the bond market, rotation is moving toward junk bonds, although volumes within the category are so low that it is difficult to assign significant weight to this move.

- Where we do see a more consistent flow is into equities. Both domestic and global equities are broadly receiving inflows and posted gains relative to last week.

This provides a statistically valid proxy that helps frame the weekly picture of where capital is coming from and where it is moving to at the category level.It is important to understand that these figures are relative to each category’s own movement versus the prior week, across all variables—returns, volume, and volatility.

Macroeconomics and the Automotive Sector

In a highly financialized economy, many business models exhibit a high sensitivity to interest rates, making rates the most relevant macroeconomic variable. Within that framework, the short-term policy rate set by the FOMC plays a central role.

This policy rate primarily impacts the short end of the yield curve, while its influence gradually fades as we move further out along the curve. As a result, different business models show differentiated exposures: some are more sensitive to short-term rates, while others are more exposed to long-term rates.

In the case of auto retail, the sector’s reliance on consumer financing makes short-term interest rates a key driver of its overall dynamics.

Macroeconomics, the Automotive sector, and their relationship with interest rates

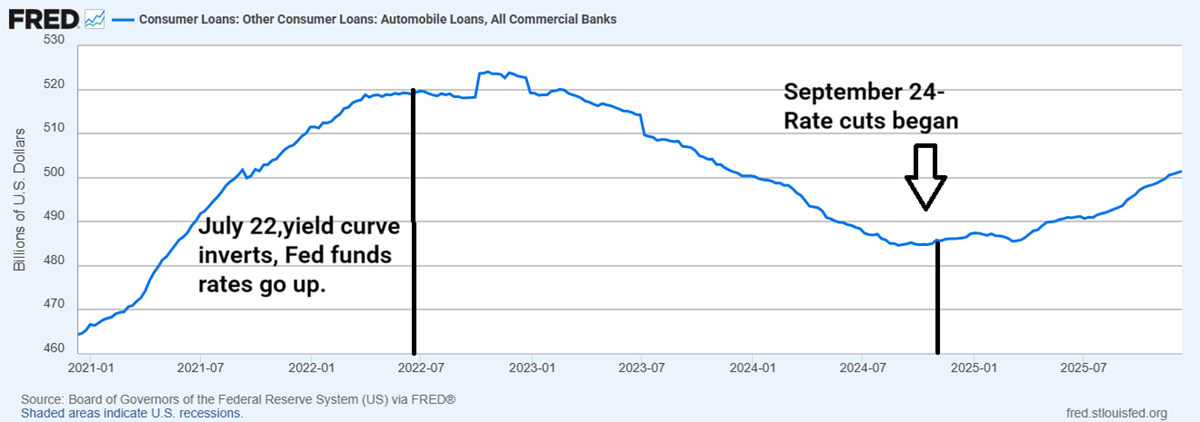

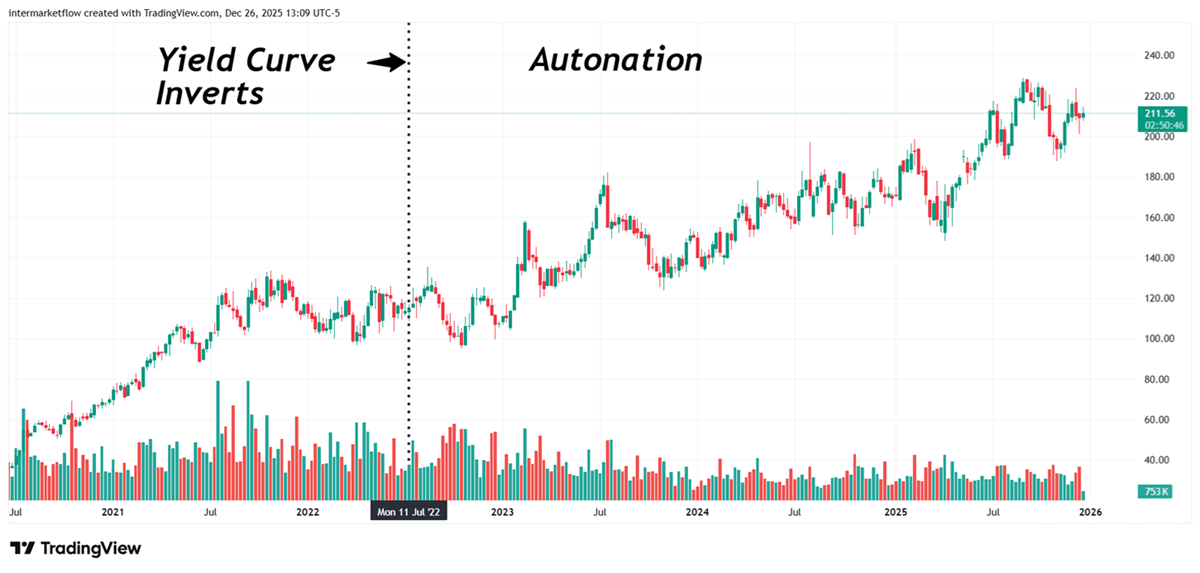

The Fed begins its rate-hiking cycle and, in July 2022, the yield curve inverts. At that same point, auto loan credit peaks and starts to contract. Symmetrically, in September 2024, when rate cuts begin, auto credit starts to expand again.

This dynamic provides a very clear analogy of what happens at the macroeconomic level: different business models display different sensitivities across the yield curve. Consumer credit is primarily exposed to short-term rates, while mortgages depend more heavily on long-term rates.

In the case of the automotive sector, the relationship between rates and sales is direct. Beyond the prevailing trend, monitoring the absolute level of auto sales is key to understanding the true state of the market and the consumer cycle.

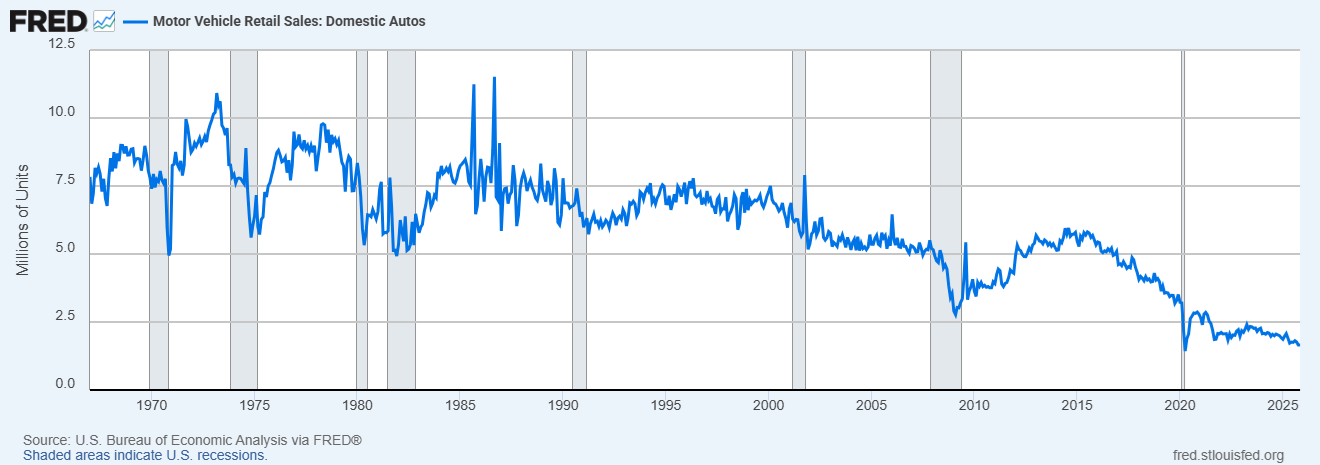

Auto sales are at historic lows.

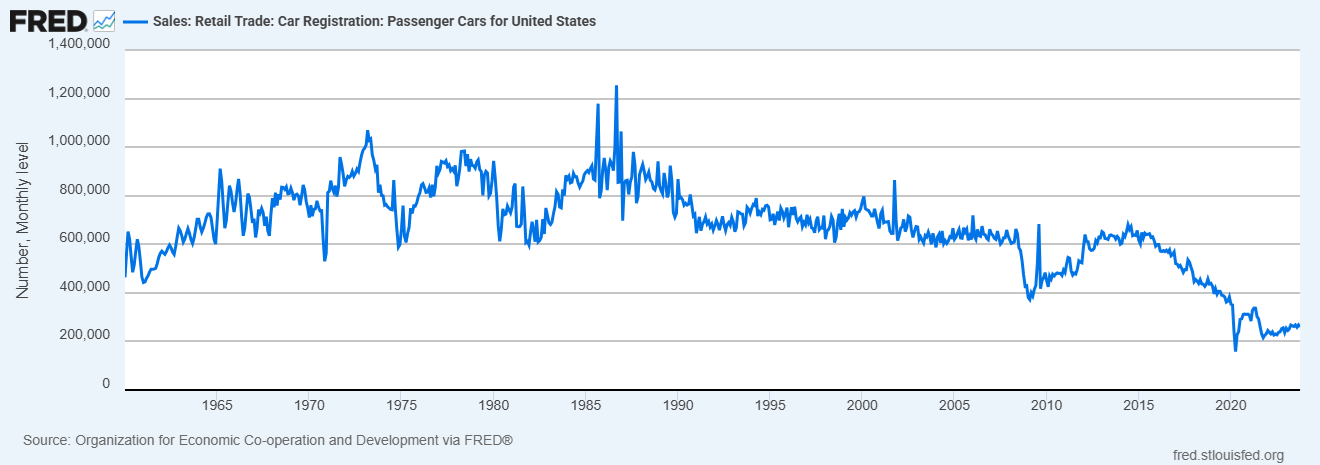

This level of market activity, in and of itself, defines the context in which companies are currently operating. We can confirm this by tracking passenger vehicle registrations, which clearly reflect the depressed state of the market.

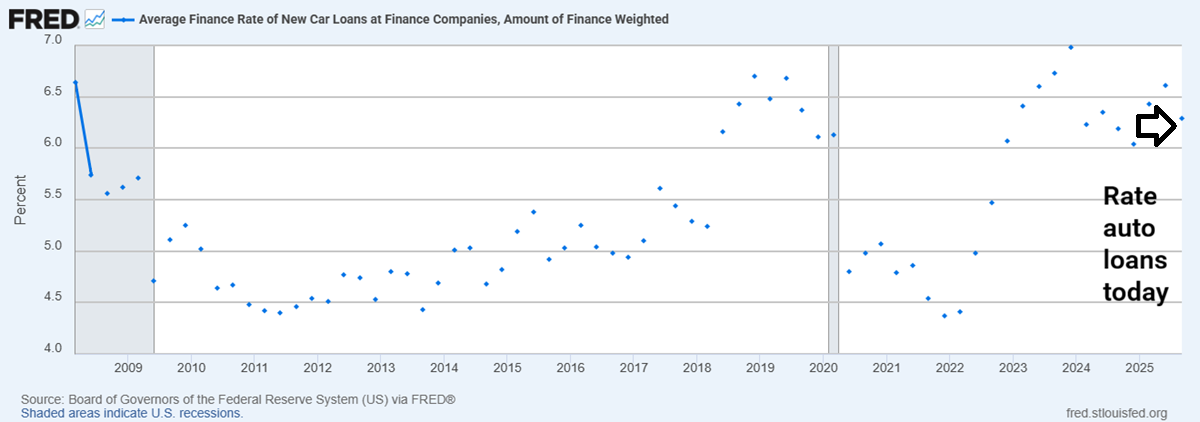

The Automotive Sector and Rates today

In a market heavily exposed to the credit system, with auto sales sitting at historic lows, auto loan rates are now higher than during the GFC. This alone provides a fairly clear picture of the environment local auto retailers are operating in.

It is important to highlight the source of this data: the Federal Reserve Bank of St. Louis.

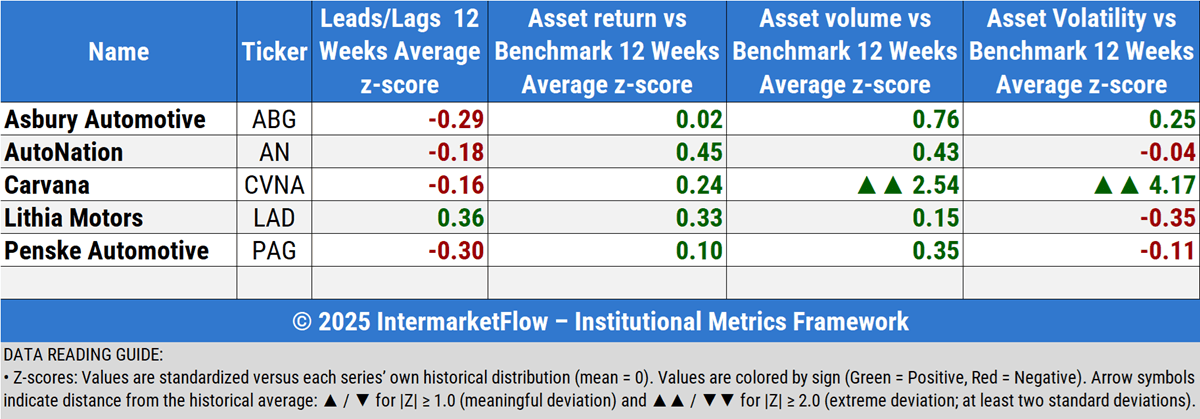

Automotive retail companies

Their performance over the past three months relative to the consumer discretionary sector (XLY).

On average, the five companies are posting slightly higher returns than the sector, with average volumes and volatility. Given this sector’s high sensitivity to short-term interest rates, this represents yet another disconnect between the market and the real economy.

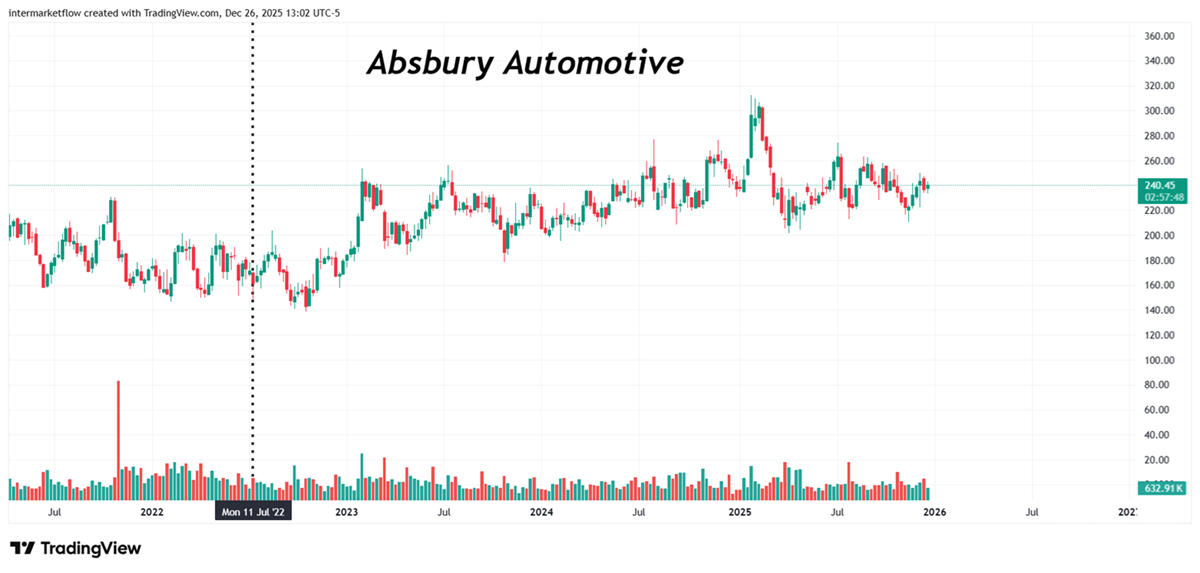

Some charts.

The situation repeats itself across multiple sectors. The market and the real economy are traveling on different paths. Naturally, this divergence has an endpoint, which will be defined as corporate results increasingly reflect the underlying real economy.

These companies—and a few others within the sector—will be the focus of our mid-week technical analysis.It is striking how valuations have continued to rise since the yield curve inverted. This is another sector—alongside construction and financials—where attention is warranted. When markets correct, these sectors are likely to be left particularly exposed.

Martin

If you believe this is an error, please contact the administrator.