Executive Summary

- The discretionary delusion and what the market is pricing in—and how that has created a setup where bad economic news still has plenty of room to move rate-cut odds and drive volatility.

- Retail inventories as leading indicators.

- Intermarket flows: where capital went.

- The gold–crude correlation.

- The Consumer Discretionary delusion—leading the economy as I write this.

- Three vehicles to trade this madness.

- Risk-taker positioning.

The discretionary delusion and the market’s stance. Three vehicles to track.

Year-end is here and markets start to tighten up. Portfolios close the books, traders go on vacation, and liquidity thins out. That’s a setup where key levels are more likely to break, with more manipulation, false breakouts, and stretched moves.

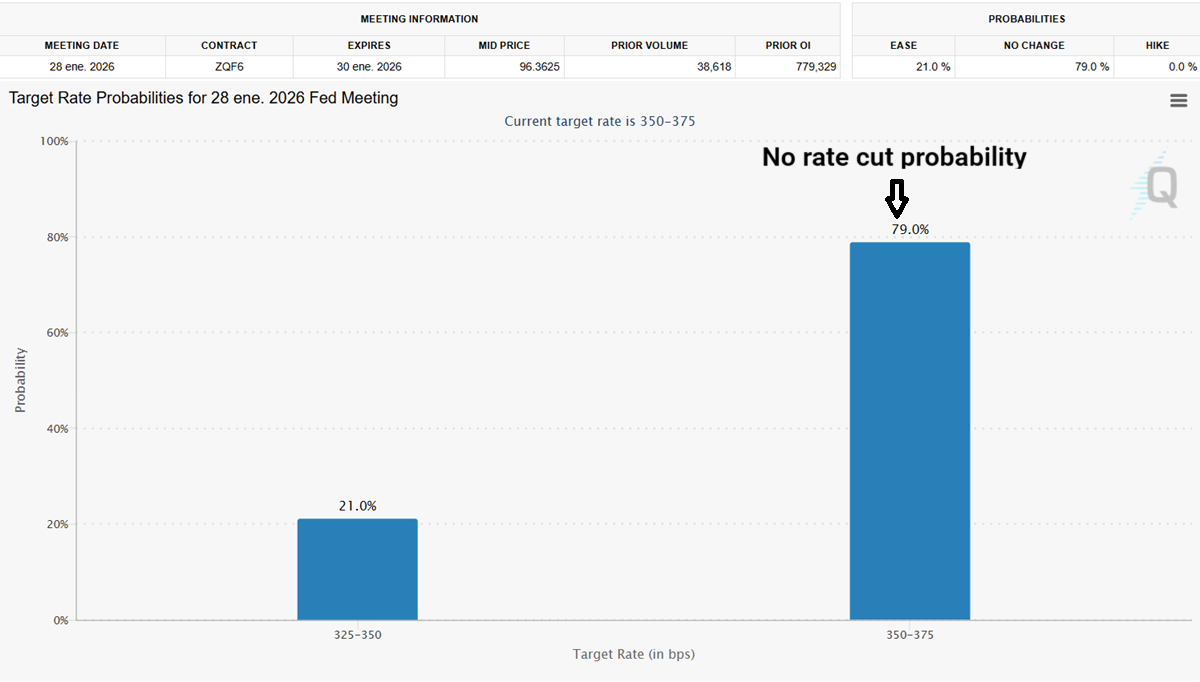

The market and rate probabilities and the environment we’re trading right now.

The market is not pricing in a cut for January 28. That creates an environment where bad macro news has plenty of room to push cut odds higher—and, by extension, lift equities. That’s the context we’re trading in today.

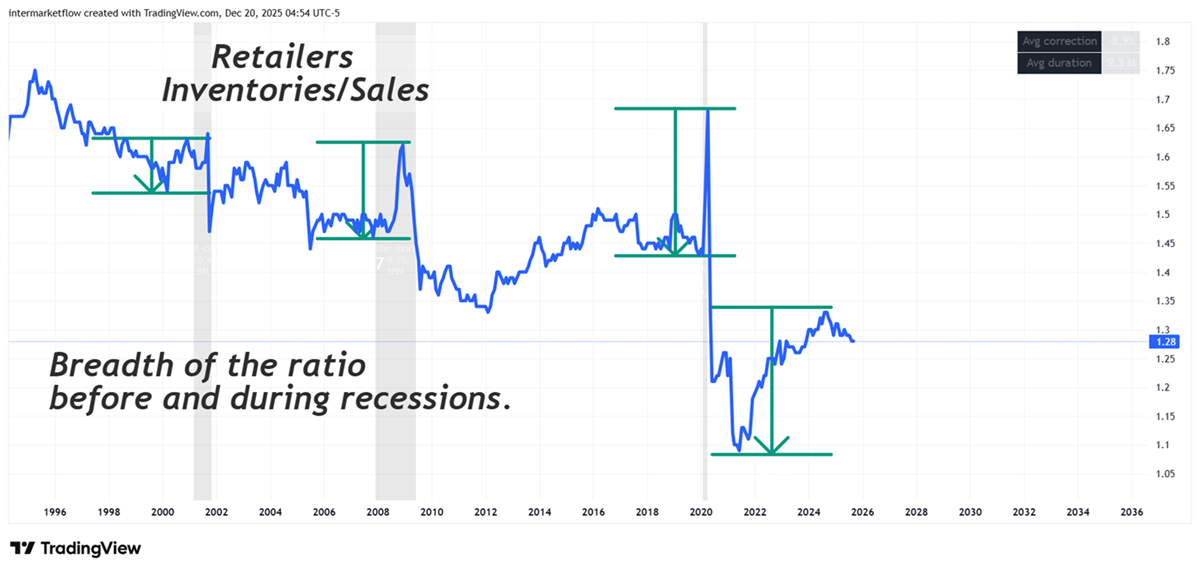

Retail sales and inventories

This week we got the retail sales report. For some reason, it flew under the radar. Below is the retailers’ inventory-to-sales ratio alongside recessions—a solid leading indicator for recession entry and exit points.

For context, sales were flat this month and are running at 3.5% YoY—basically zero real growth on a YoY basis and negative real growth for the month. Remember: all of these prints are reported in nominal terms.

In my book, that’s the definition of stagflation.

Stagflation and an intermarket snapshot.

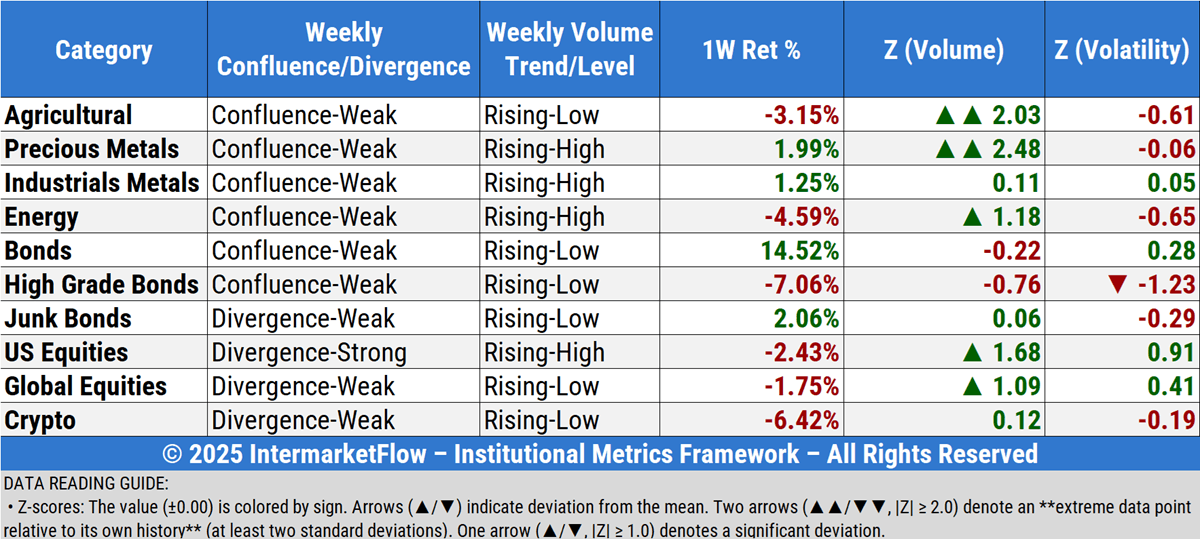

Weekly activity was dominated by a sharp outflow from Agricultural commodities. To a lesser extent, we saw a similar move in equities—both U.S. and international.

The one asset class that keeps attracting flows in a sustained way—at almost extreme levels versus its own history, and with virtually no volatility—is precious metals. By far the safest and most profitable allocation of the last six months. Of course, that sets off alarms. This is not normal.

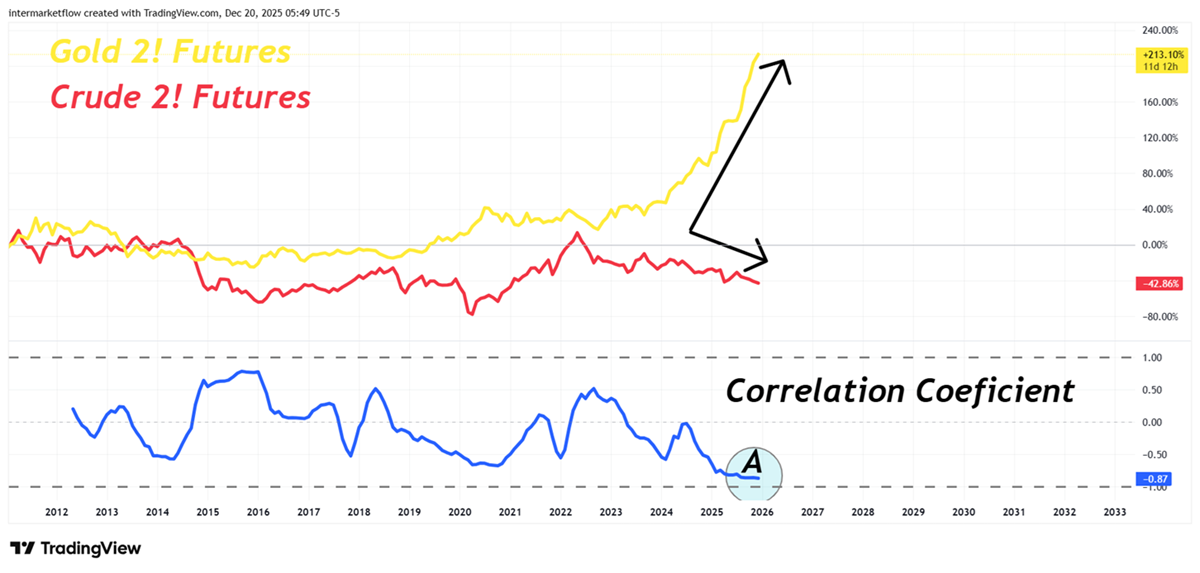

Gold and Oil.

In this case, we jump to the futures market—specifically the second front-month contract. Another setup that’s not normal, and one that reflects trends that go beyond the local picture and extend globally. There’s a lot of fear and uncertainty, and the market clearly isn’t pricing in a growth boom—at least in the near term.

Consumer Discretionary and its delusion

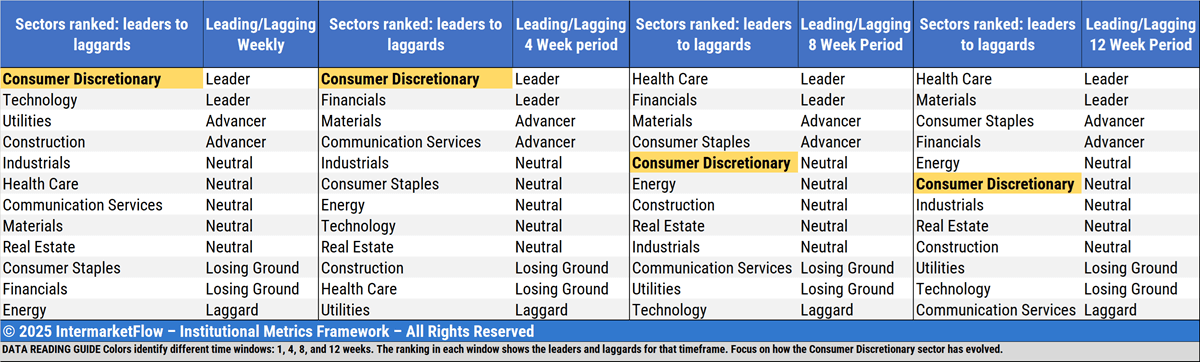

Let’s bring this down into tables so we can size it up properly.

From right to left: Consumer Discretionary over 12-, 8-, 4-, and 1-week windows versus the rest of the sectors. A steady staircase into leadership.

Remember: we just got a retail sales print with 0% nominal growth MoM—which means negative in real terms. So what is this insanity?

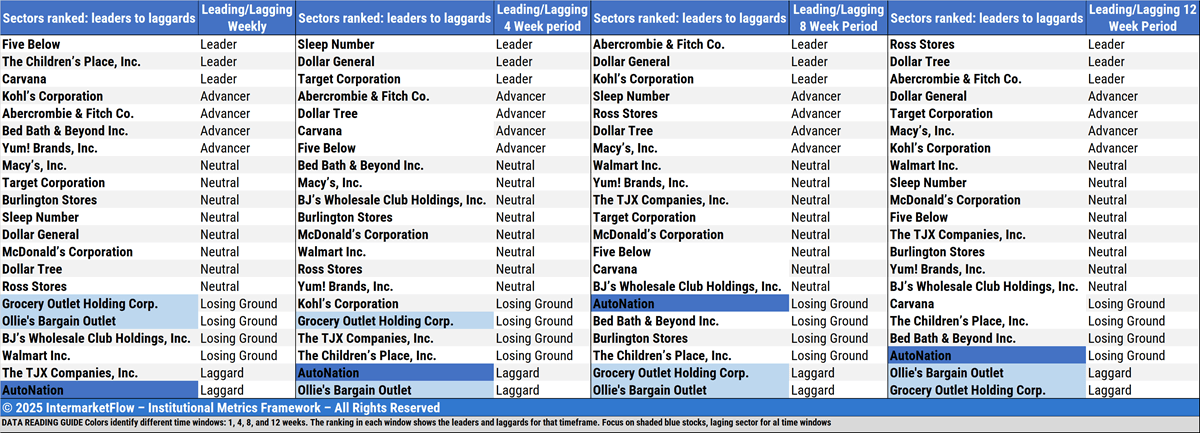

Consumer Discretionary and the lower-to-middle income segment

To filter out the wealthiest cohorts, we focus on companies whose primary target customer is this segment.

Consumer Discretionary

Again, from right to left: 12-, 8-, 4-, and 1-week windows. The companies are shaded in different degrees of blue. Some names are showing extreme weakness—inside a “leader” sector that I still don’t understand why it’s leading in the first place.

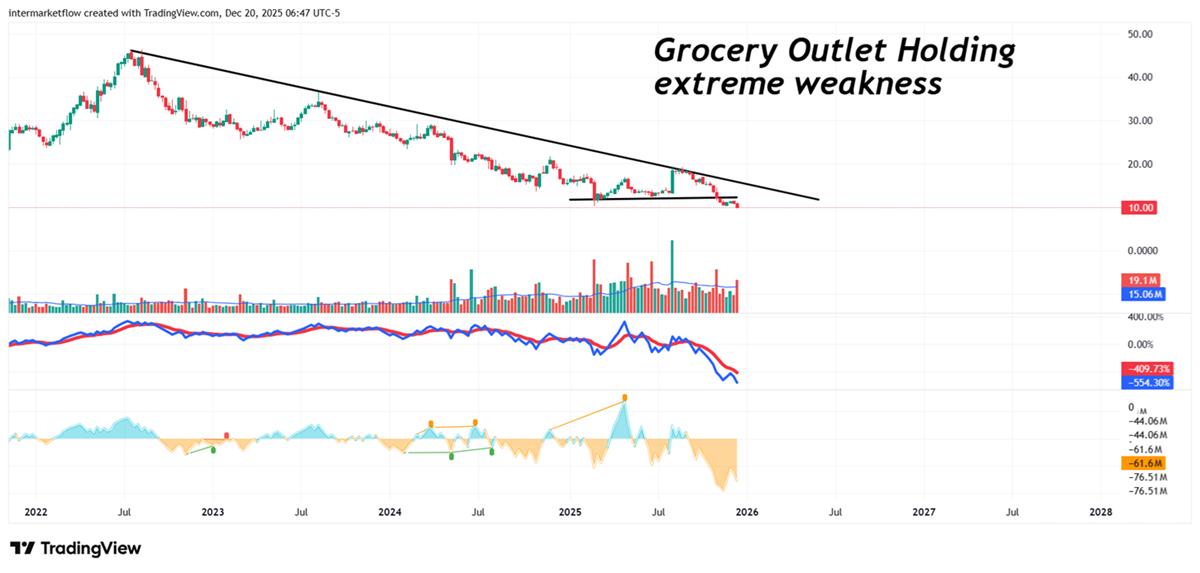

Somo charts under study

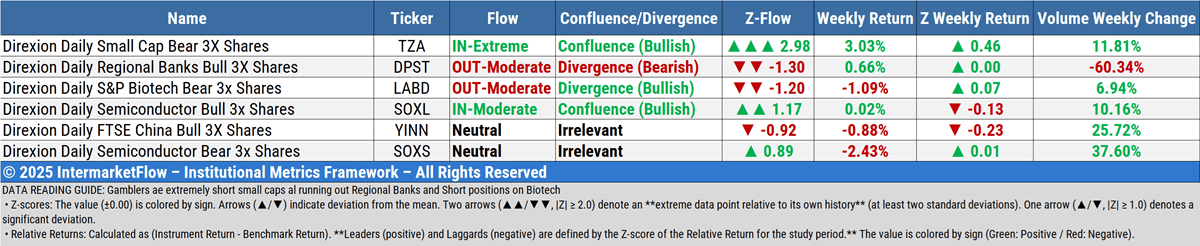

Risk-takers: what are these guys up to?

Extremely short small caps, running out of long positions on regional banks and shorts Bio. Getting bull in semiconductors.

We’re going deeper into the technical analysis on some of these names.

For the thousandth time: this is not a recommendation. It’s our work—and we share it for marketing purposes.

If you’re still not following us on X, I suggest you do. We post all kinds of updates—charts as they come up, and timely themes as they hit the market.

We’re heading into a very special week. I hope you can enjoy it with your loved ones—because at the end of the road, they’re the only thing that truly matters.

Martin

If you believe this is an error, please contact the administrator.