Intermarket Analysis Throught Macro and Technical Methods

Here you’ll find: Intermarket Futures for:

- A full intermarket analysis (equities, bonds, currencies, and commodities) based on the second-nearest futures contract—Sept 2025—and a read on the message it’s sending.

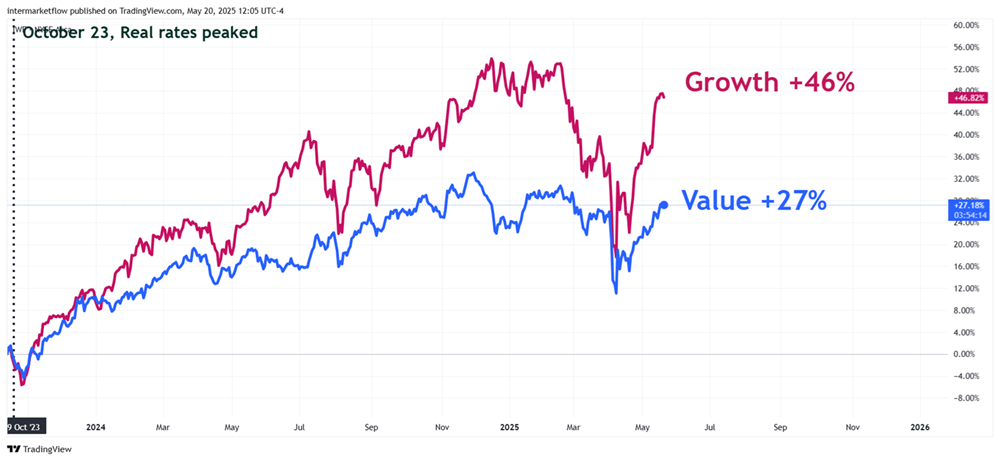

- A breakdown of equities into small, big, value, and growth categories.

- The identification of the weakest link in the chain.

- Two full setups for the Explorer tier.

- Three other ETFs in a separate category, with a market structure breakdown—Frontliner tier.

Back to intermarket futures basics—this time using the second front-month contracts (September 2025).

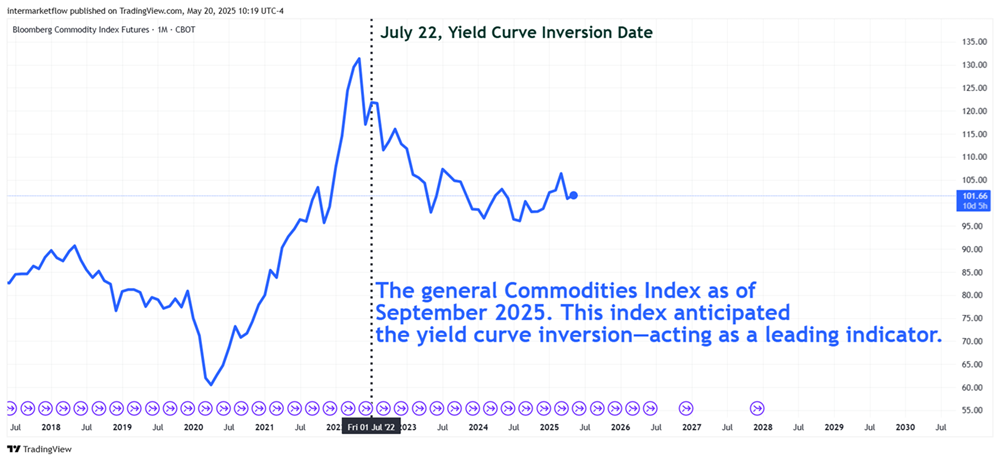

1. Intermarket Futures: General Commodities Index

Commodities are global, but grouping them into one index hides key details.

Here’s the breakdown:

– It includes all commodities.

– It peaked two months before the yield curve inverted (July 2022).

– Despite some record highs (e.g., gold), the overall trend is down.

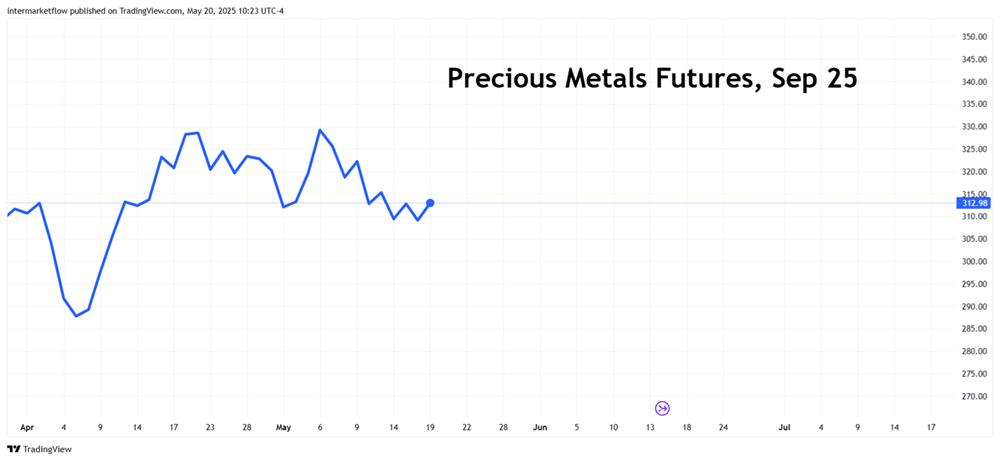

2.Intermarket Futures: Breaking down the Commodities Index

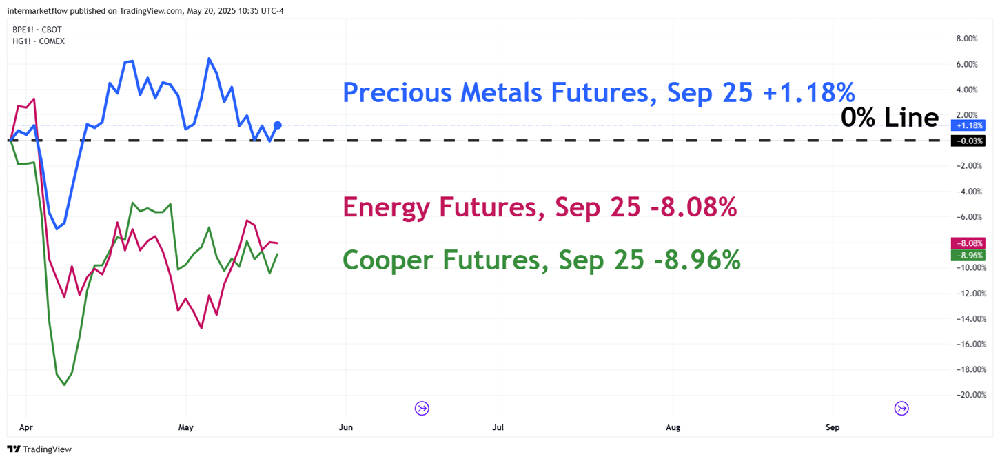

3. Intermarket Futures: Separating the wheat from the chaff

Current divergences are striking:

– Precious metals are at all-time highs.

– Industrial metals and energy are trending lower with negative returns.

This weakness suggests oversupply, falling demand, or both.

If the market expected stronger growth, the picture would be more balanced.

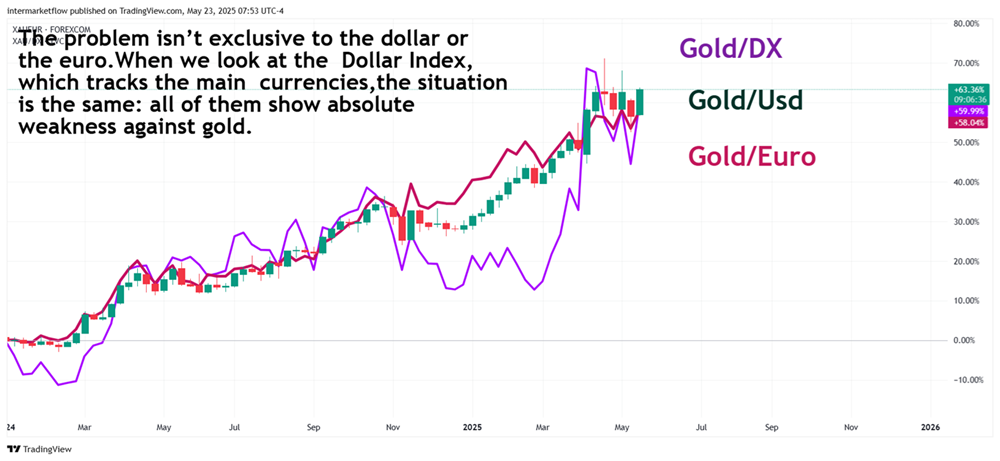

4. Intermarket Futures: Dollar – Euro – DX vs. Gold

- The dollar is devaluing against gold.

- The euro is devaluing against gold.

- The Dollar Index, which includes the world’s main currencies, is also losing value against gold.

Currency weakness isn’t just a dollar issue. It’s broad-based!

5. Intermarket Futures: Stocks

The divergence in Sept 2025 futures is clear—it’s not if, but when.

Fewer buyers, no sellers. One round of profit-taking could trigger the drop.

6. Intermarket Futures: 2-Year Treasury Notes

The market is shifting to the short end of the curve—and we can see it clearly in the volume. One way to reduce uncertainty is to shorten the horizon!

7. Intermarket Futures: 30-Year Treasury Notes Yield

The market is fleeing the long end:

- Why? Uncertainty.

- Short-term bonds are rising. Why? Safe haven.

- Gold is soaring. Why? Safe haven.

The market’s perception of risk is crystal clear.

Intermarket Snapshot – September 2025

– Industrial and energy commodities are down.

– Gold at all-time highs.

– Dollar weak, but so are other currencies.

– S&P 500 diverging sharply.

– Equities are out of sync with bonds, currencies, and commodities—unsustainable.

– Volume is rotating into short-term bonds.

Intermarket Futures: Stocks

In the previous article here, we saw that small caps are much more exposed than large caps.

Small Stocks: Growth vs.Value

In a slowdown, growth should lag value.

Relative Analysis Across Company Types: Small vs. Big Cap Ratio

P.S.

Want full access to the article?

Here’s how to go deeper:

Subscribe below for a 40-day free trial. No credit card required, and the subscription will auto-cancel after that period.

See you there,

Martin

Intermarket Flow

If you believe this is an error, please contact the administrator.